Personal Management

advertisement

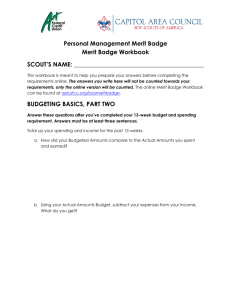

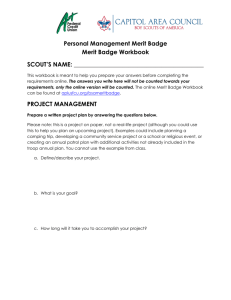

Personal Management Troop 395 Fall 2011 Brandon Fentress Ranse Stokes Requirement 1* Do the following: A. Choose an item that your family might want to purchase that is considered a major expense. B. Write a plan that tells how your family would save money for the purchase identified in requirement 1a. 1. Discuss the plan with your merit badge counselor 2. Discuss the plan with your family 3. Discuss how other family needs must be considered in this plan. C. Develop a written shopping strategy for the purchase identified in requirement 1a 1. Determine the quality of the item or service (using consumer publications or rating systems). 2. Comparison shop for the item. Find out where you can buy the item for the best price. (Provide prices from at least two different price sources.) Call around; study ads. Look for a sale or discount coupon. Consider alternatives. Can you buy the item used? Should you wait for a sale? Requirement 2* Do the following: A. Prepare a budget reflecting your expected income (allowance, gifts, wages), expenses, and savings. Track your actual income, expenses, and savings for 13 consecutive weeks. (You may use the forms provided in this pamphlet, devise your own, or use a computer generated version.) When complete, present the results to your merit badge counselor. B. Compare expected income with expected expenses. 1. If expenses exceed income, determine steps to balance your budget. 2. If income exceeds expenses, state how you would use the excess money (new goal, savings). Requirement 3 (in Class) Discuss with your merit badge counselor FIVE of the following concepts: A. The emotions you feel when you receive money. B. Your understanding of how the amount of money you have with you affects your spending habits. C. Your thoughts when you buy something new and your thoughts about the same item three months later. Explain the concept of buyer's remorse. D. How hunger affects you when shopping for food items (snacks, groceries). E. Your experience of an item you have purchased after seeing or hearing advertisements for it. Did the item work as well as advertised? F. Your understanding of what happens when you put money into a savings account. G. Charitable giving. Explain its purpose and your thoughts about it. H. What you can do to better manage your money. Requirement 4 (in Class) Explain the following to your merit badge counselor: A. The differences between saving and investing, including reasons for using one over the other. B. The concepts of return on investment and risk. C. The concepts of simple interest and compound interest and how these affected the results of your investment exercise. Requirement 4A Saving – “A Scout is Thrifty” • Income not spent • • Putting money into something for hope of profit • Purchase of financial instruments (stocks or mutual funds) to gain positive returns in the form of interest, dividends or appreciation. • Investment comes with varying degrees of risk of loss of all or part of your money • Must try to determine if the risk is worth the investment (sometimes this is hard!) Money in a bank, safe, cookie jar.. • Reducing expenditures (refinancing your mortgage, eliminating soft drinks to save money) • Associated with lower or “no” risk • Protected by the Federal government if in a bank. • Investing Saving (increased in net worth) vs. Savings (one part of your assets) Requirement 4B Return on Investment (ROI) • Rate of profit • Rate of return • The ratio of money gained or lost on the investment relative to the amount of money invested • A percentage value • Can be negative or positive (hopefully always positive!) (e.g., +50% or -20% ) Risk • Usually associated with return. In general, the more risk you take, the more return you can expect – but the converse is also true, meaning that the less risk you take, the lower amount of return you can expect. • Sometimes you can manage risk by not “putting all of your eggs in one basket”…this is known as diversification. • The concept of risk tolerance is important when considering where to invest. Requirement 4C Simple Interest • What is interest? A fee paid on borrowed assets, the price paid for borrowed money. • The “rent” of money • Simple interest is the interest earned on the deposit amount, or principal. • $100 into an account that earns 6 percent interest annually, that investment would be worth $106 at the end of the year. Compound Interest • Compound interest pays interest on the principal, but also pays interest on the interest earned. • See example in MB pamphlet for $100 invested over 10 years at 10% compounded interest, but, to take advantage of this – you must reinvest the interest in order to grow your principle and utilize the advantage of compounding to get to $159.39! Requirement 5* Select five publicly traded stocks from the business section of the newspaper. Explain to your merit badge counselor the importance of the following information for each stock: A. Current price B. How much the price changed from the previous day C. The 52-week high and the 52-week low prices Which Business Model wins? $1,000 invested buys 16.67 shares @ $60 each Your investment would have grown to a current value of $4,167…..an increase of 316% !!! $1,000 invested buys 3,333 shares @ 0.30 cents each Your investment would have shrunk to a current value of $200…decrease of -80% !!! Requirement 6 (in Class) Pretend you have $1,000 to save, invest, and help prepare yourself for the future. Explain to your merit badge counselor the advantages or disadvantages of saving or investing in each of the following: A. Common stocks B. Mutual funds C. Life insurance D. A certificate of deposit (CD) E. A savings account or U.S. savings bond Common Stocks – 6A • A form of ownership in a company (usually comes with voting rights) • Can pay dividends and provide capital appreciation • Has the most risk of the investments on our list. Mutual Funds – 6B • A professionally managed investment that pools money from many investors and typically invests in stocks, bonds, short-term money instruments, other mutual funds, etc. • The fund’s manager buys and sells the fund’s investments in line with the fund’s investment objective. Fund objectives can be geographical, industry specific, strategic for growth, income or preservation, or tax preferred, etc… • Mutual funds can have added investment expenses, so it is important to choose wisely. • Mutual funds are generally less risky than individula stocks due to a diversification of their investments. • Mutual funds are relatively liquid assets, which means you can withdraw your money easily – and it is easy to add money to your original investment. Life Insurance – 6C • A contract between the policy owner and the insurer, where the insurer agrees to pay a designated person (the beneficiary) a set amount of money upon the death of the insured. In return, the insured individual pays an annual amount, known as the premium, to the insurance company. • Term insurance is essential to have during a persons working years, as it provides the family protection from lost income and coverage of debts if one dies. It is not an investment, but does provide “piece of mind”. • Whole life insurance can be considered an investment, but generally, there are better choices for investment that offer better flexibility. Certificate of Deposit – 6D • CD’s are insured deposits that pay a fixed interest rate over a specific period of time. Rates are currently very low. • Longer periods of time are usually associated with relatively higher rates of return. • CD’s are not liquid assets and there are usually penalties for early withdrawal if you need your money. • CD’s are very conservative way to preserve your money, but they are not good investments at this time. Savings Account vs. US Savings Bond – 6E Savings Account • • • Accounts maintained by retail financial institutions (e.g., State Employee’s Credit Union) that pay interest but cannot be used directly as money (for example, by writing a check) These accounts allow depositors a way to save money. They are highly regulated in the US and may come with additional restrictions and penalty fees imposed by the individual banks themselves US Savings Bond • US Treasury security is government debt • Considered safe investments because they are backed by the federal government • Series EE (pay for half of face amount and interest is variable) and Series I (pay full face value plus variable interest announced every 6 years) further described in the MB pamphlet Requirement 7 (in Class) Explain to your merit badge counselor the following: A. What a loan is, what interest is, and how the annual percentage rate (APR) measures the true cost of a loan. B. The different ways to borrow money. C. The differences between a charge card, debit card, and credit card. What are the costs and pitfalls of using these financial tools? Explain why it is unwise to make only the minimum payment on your credit card. D. Credit reports and how personal responsibility can affect your credit report. E. Ways to eliminate debt Loan and Interest - 7A Loan • Interest and APR An agreement between a lender and a borrower where the borrower must pay back the principal and (usually, unless it’s your parents!) interest. • Simple interest rate is not the whole story • Annual percentage rate (APR) – takes into account fees and other costs over a year period • Usually over a fixed amount of time • Charges based on: amount you borrow, fees charged by lender, interest rate, time for repayment • Extra fees add up quickly and will increase the cost of the loan • Penalties for late/missed payments • • Affects your credit rating and ability to obtain further loans Take care when comparing loans: lower payments could be longer to pay off a loan • Best to shop to investigate fees and time periods • Try to get a loan where you can pay it off early without penalty fees Loan Amortization schedule for borrowing $100k at 6% over 30 years Payment Amount Principal Interest Balance 1 $599.55 $99.55 $500.00 $99,900.45 2 $599.55 $100.05 $499.50 $99,800.40 3 $599.55 $100.55 $499.00 $99,699.85 4 $599.55 $101.05 $498.50 $99,598.80 5 $599.55 $101.56 $497.99 $99,497.24 6 $599.55 $102.06 $497.49 $99,395.18 7 $599.55 $102.57 $496.98 $99,292.61 8 $599.55 $103.09 $496.46 $99,189.52 9 $599.55 $103.60 $495.95 $99,085.92 10 $599.55 $104.12 $495.43 $98,981.79 350 $599.55 $567.54 $32.01 $5,833.87 351 $599.55 $570.38 $29.17 $5,263.49 352 $599.55 $573.23 $26.32 $4,690.26 353 $599.55 $576.10 $23.45 $4,114.16 354 $599.55 $578.98 $20.57 $3,535.18 355 $599.55 $581.87 $17.68 $2,953.31 356 $599.55 $584.78 $14.77 $2,368.52 357 $599.55 $587.71 $11.84 $1,780.81 358 $599.55 $590.65 $8.90 $1,190.17 359 $599.55 $593.60 $5.95 $596.57 360 $599.55 $596.57 $2.98 $0.00 Totals $215,838.19 $100,000.00 $115,838.19 Different Ways to Borrow Money – 7B • Parents/relatives (may not charge interest) • Banks (for things too expensive to buy like cars and houses) – will charge interest, usually lower total charges/fees/interest the quicker you pay it back • Charge and Credit Cards (will charge varying amounts of interest and interest adds up quickly if only the minimum monthly charge is paid) Charge Card vs. Credit Card – 7C Charge Card Credit Card • A plastic card that provides an alternative to paying cash when making purchases • A plastic card that provides an alternative to paying cash when making purchases • An agreement that the debt incurred on the charge card will be paid in full by the due date (usually every 30 days) or be subject to severe late fees and restrictions on charge use. • An agreement that the debt incurred on the credit card does not need to be paid in full and no late fee is charged so long as the minimum payment is made at specified intervals (e.g., monthly) • Credit cards come with a credit limit that cannot be exceeded • Some places may not accept certain types of credit cards • May not have a credit limit • Some places may not take certain charge cards How Credit Cards Can Affect You – 7D • Because debt is part of life in the US, companies track credit records for everyone • Can demonstrate good buying and loan repayment behavior to future lenders and employers – a Scout is thrifty! • Poor choices can get you into serious debt and will accompany you for many years • You may be refused future credit • You may lose your house or car (see news about local house foreclosures or just walk around your neighborhood) Ways to Eliminate/Reduce Debt – 7E • Stop buying things you don’t need • Pay cash for purchases • Cut up credit cards if you can’t stop from using them • Reduce the number of credit cards that you have • Make a budget to track income and expenses • Try to earn extra money to help pay off debts Why is Minimum Payment Unwise? – 7C • If the loan (debt amount) is not paid off at the end of the month, a finance charge will be added to the balance • The longer it takes to pay off the balance, the more the loan costs you. • Interest can be expensive! Many cards charge 18% a year or more. The longer it takes to pay off the balance, the more expensive the items you bought become. Requirement 8* Demonstrate to your merit badge counselor your understanding of time management by doing the following: A. Write a "to do" list of tasks or activities, such as homework assignments, chores, and personal projects, that must be done in the coming week. List these in order of importance to you. B. Make a seven-day calendar or schedule. Put in your set activities, such as school classes, sports practices or games, jobs or chores, and/or Scout or church or club meetings, then plan when you will do all the tasks from your "to do" list between your set activities. C. Follow the one-week schedule you planned. Keep a daily diary or journal during each of the seven days of this week's activities, writing down when you completed each of the tasks on your "to do" list compared to when you scheduled them. D. Review your "to do" list, one-week schedule, and diary/journal to understand when your schedule worked and when it did not work. With your merit badge counselor, discuss and understand what you learned from this requirement and what you might do differently the next time. Requirement 9* Prepare a written project plan demonstrating the steps below, including the desired outcome. This is a project on paper, not a real-life project. Examples could include planning a camping trip, developing a community service project or a school or religious event, or creating an annual patrol plan with additional activities not already included in the troop annual plan. Discuss your completed project plan with your merit badge counselor. A. Define the project. What is your goal? B. Develop a timeline for your project that shows the steps you must take from beginning to completion. C. Describe your project. D. Develop a list of resources. Identify how these resources will help you achieve your goal. E. If necessary, develop a budget for your project. Requirement 10* Do the following: A. Choose a career you might want to enter after high school or college graduation. B. Research the limitations of your anticipated career and discuss with your merit badge counselor what you have learned about qualifications such as education, skills, and experience. Types of Careers • • • • • • • • Banker Loan Officer / Underwriter Financial Planner Investment Advisor Financial Analyst Time Management Expert (e.g., Personal Productivity Expert) Teacher/Professor of Economics Certified Public Accountant