Mr. Maurer Name: AP Economics Chapter 13 Quiz Review 1. In the

advertisement

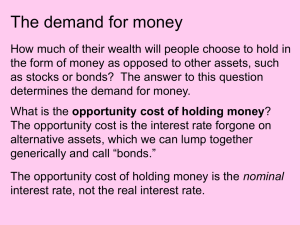

Mr. Maurer AP Economics Name: _______________________ Chapter 13 Quiz Review 1. In the money market, what is the equilibrium interest rate (how would you define it)? It’s the interest rate at which the total demand for money equals the supply of money. 2. The transactions demand for money (Dt) is dependent upon nominal GDP. What two components of nominal GDP could shift the Dt curve? That is, a change in either one of two factors associated with nominal GDP could shift the money demand curve. What are those two factors? Real GDP (output) and the Price level 4. A change in what variable will cause a change in the quantity of money demanded (not a shift of the Dm curve, but a movement along it). The nominal interest rate 5. Interest Rate 6% 5 4 3 Asset Demand (billions of dollars) 25 50 75 100 a. Suppose the velocity of money is 4, the supply of money is $250 billion, and the asset demand for money (Da) is shown in the table above. If nominal GDP is $800 billion, what will be the equilibrium interest rate? 5% (Dt = $200 Billion. Supply = $250 Billion. So Da must equal $50 Billion, which it does at an interest rate of 5%, according to the table. b. If nominal GDP doesn’t change, an increase in the money supply to $300 billion will cause the new equilibrium interest rate to be what? 3%, for the same reasons stated above. c. If instead, nominal GDP increased to $1000 billion, and the money supply increased to $275 billion, what would be the equilibrium interest rate? 6% (Dt = $250 Billion, Supply of money = $275 Billion, so Da must equal $25 Billion, which it does at 6%) 6. What is the most important function of the Federal Reserve? Controlling the money supply. 7. How are the following pairs related (directly, indirectly, or unrelated) a. Bond prices and interest rates _____indirectly____________________ b. The interest rate and the opportunity cost of holding money __directly (the interest rate is the opportunity cost of holding money). Understand why.__________________ c. Total demand for money and interest rates Trick question. If the total demand for money goes up, the interest rate will go up. If the interest rate goes up, total demand for money does not change, only the quantity of money demanded will change. It will go down. d. The supply of money and the interest rate. This one is more complicated. Explain the relationship between the two. The two are indirectly related. If the money supply increases, the interest rate will decrease. However, the money supply is not affected by the interest rate – it is the independent variable. The interest rate is the dependent variable because it is, in part, determined by the money supply. 8. If you are comparing the price of new houses, you are using which function of money? A unit of account – you are determining the value of goods and services in terms of dollars. 9. If you write a check to pay the mortgage on your house, you are using which function of money? A medium of exchange – you are using money to pay a debt. 10. How are the asset demand for money and interest rates related? They are indirectly or inversely related. This is explained in #8 c. It is the asset demand for money (or, more precisely, the quantity of money demanded as an asset) that is determined by the interest rate. That is what affects the total quantity of money demanded at each interest rate. 11. Why aren’t savings accounts included in M1? They are not a medium of exchange – you can’t directly spend money in your savings account. You have to transfer it to checking or withdraw it as cash first. When you do either of those, it becomes part of the M1 money supply. 12. What will happen to interest rates and the quantity of money if the total demand for money increases, all other things unchanged (ceteris paribus)? Hint: Draw a graph. Interest rate: Increases Quantity of money: Does not change. The supply of money is set by the Federal Reserve, so it is a vertical (perfectly inelastic) line on the money market graph. The quantity of money cannot change unless the Federal Reserve changes it. 13. How much intrinsic value does fiat money have? Zilch. 14. What is “the opportunity cost of holding money?” Explain. It is the interest rate. By holding money you are forgoing the interest payment you could be getting by buying a bond or some other financial investment. 15. If you moved $5000 from your checking account to your savings account, what would be the effect on both the M1 money supply and the M2 money supply? M1 would decrease by $5000. M2 would not change. The $5000 in your checking account was already being counted in M2 and is still being counted when the money is moved to your savings account. 16. If you moved $5000 from your savings account to your checking account, what would be the effect on both the M1 money supply and the M2 money supply? M1 would increase by $5000. The money was not in M1 when it was in savings, but now it is. M2 would not change. It was in M2 before and it’s still in M2. 17. If you withdraw $10,000 in cash from your checking account, what would be the effect on the M1 money supply and the M2 money supply? Neither of them would change. The money was counted in both M1 and M2 when it was in your checking account, and it is still counted in both now that you hold it in cash. 18. If the price index increases from 1.00 to 1.5, what will be the change (in percentage terms) in the value of money? Show your calculation. 1/1.5 = .67. The value of money decreased by 33% (It used to be 1). Chapter 13 Quiz Review Part 2 – FRQs 1. Assume that real output increases while the price index remains constant. a. Draw a correctly labeled graph of the money market (2 pts.) and show the impact of this expanded output on the following. i. The demand for money (1 pt.) ii. The nominal interest rate (1 pt.) b. What will happen to bond prices as a result of the change in interest rates in (a)(ii) (1 pt.) Bond prices will decrease. 2. A decline in the stock market causes investors to sell their stocks and hold more money as an asset. (a) Using a correctly labeled graph of the money market, show how the nominal interest rate will be affected. (2 pts) (b) Given the interest rate change in part (a), what will happen to bond prices in the short run? (1 pt.) Bond prices will decrease. (c) Given the interest rate change in part (a), what will happen to the price level in the short run? Explain. (2 pts.) The price level will decrease. Higher interest rates will cause a decrease in investment spending, shifting aggregate demand to the left.