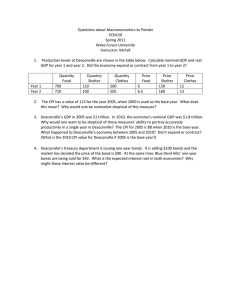

Answers to Practice Exam 2

advertisement

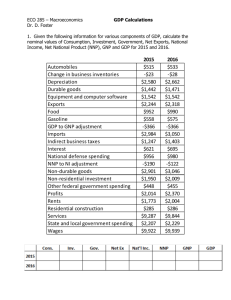

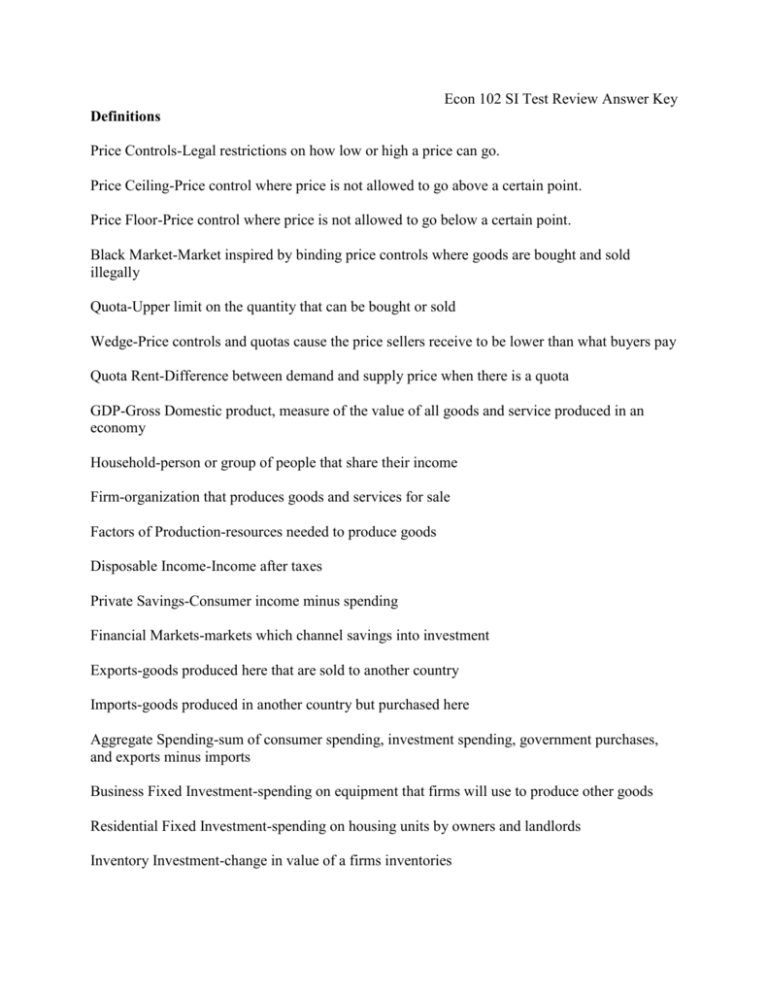

Econ 102 SI Test Review Answer Key Definitions Price Controls-Legal restrictions on how low or high a price can go. Price Ceiling-Price control where price is not allowed to go above a certain point. Price Floor-Price control where price is not allowed to go below a certain point. Black Market-Market inspired by binding price controls where goods are bought and sold illegally Quota-Upper limit on the quantity that can be bought or sold Wedge-Price controls and quotas cause the price sellers receive to be lower than what buyers pay Quota Rent-Difference between demand and supply price when there is a quota GDP-Gross Domestic product, measure of the value of all goods and service produced in an economy Household-person or group of people that share their income Firm-organization that produces goods and services for sale Factors of Production-resources needed to produce goods Disposable Income-Income after taxes Private Savings-Consumer income minus spending Financial Markets-markets which channel savings into investment Exports-goods produced here that are sold to another country Imports-goods produced in another country but purchased here Aggregate Spending-sum of consumer spending, investment spending, government purchases, and exports minus imports Business Fixed Investment-spending on equipment that firms will use to produce other goods Residential Fixed Investment-spending on housing units by owners and landlords Inventory Investment-change in value of a firms inventories Capital-the factor of production that investment is concerned with Substitutes- If a pair of goods are substitutes, then a rise in the price of one good will lead to a rise in demand for the other good Complements-If a pair of goods are complements, then a rise in price of one good will lead to a decrease in demand for another good. Short Answer What effect do price controls have on a market? Are they generally considered by Economists to have a positive effect on the efficiency of the economy? Explain. Will create a wedge between supply and demand, creating inefficiency. Explain the fairness vs. efficiency debate. It is more fair if everyone has an opportunity to purchase a good at a lower price, but more efficient if those who value it most are able to purchase it when desired. What do the national accounts do? Keep track of the flow of funds to different parts of the economy What is the significance of disposable income? It signifies consumption, which is by far the largest part of our economy and affects GDP the most. What is the difference between stocks and flows? A stock is a quantity measured at a point in time, whereas a flow is measured per unit of time Circle which of the following are included in GDP 1. 2. 3. 4. 5. 6. 7. 8. Domestically produced final goods and services Inputs Used goods New construction of structures Intermediate goods and services Changes to inventories Financial assets such as stocks and bonds Foreign produced goods and services Explain the difference between real and nominal GDP, and why one is more useful than the other. Nominal GDP is measured using a given year’s price and quanitity, whereas real GDP is measured using a base years price with another years quantity. Real GDP can be compared to other years to measure growth. What measure is used to show price changes? What is the formula for this measure? Consumer Price Index. 100 * Cost of basket in time period/cost of basket in base period What is the difference between a decrease in supply and a decrease in the quantity supplied? A decrease in supply means the supply curve shifts, whereas a decrease in the quantity supplied is just a move along the supply curve. What can cause a change in supply or demand? Any change that is not a price change. Calculate numerical answers to the following problems Graph and show numerically the equilibrium for the following supply and demand curves. D=50-2P S=5P What is the minimum that a price floor could be in this economy and still be binding? Consider the following quantities and prices in this one good economy. Year 1909 1910 1911 Price 20 25 35 Quantity 50 45 55 Calculate nominal GDP for every year. Then calculate real GDP using 1909 as the base year. What information does this tell you about the economy? Suppose a given basket of goods that is commonly purchased among consumers cost about $65 in 2009, and if you were to purchase it today it would cost you about 85$. Calculate the CPI and the inflation using 2009 as your base year. 100*85/65=130.77=CPI Which means it is a 30.77 inflation rate