new structure

advertisement

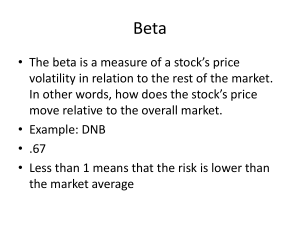

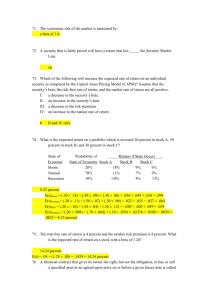

What the company is that proposing to invest in Anglo American plc (AAL) is a worldwide mining and exploration company operating in every continent. The Company's portfolio of mining assets and natural resources, include platinum and diamonds, of which they are market leaders. as well as owning a series of share stakes in other mining and industrial businesses, namely Kumba iron Ore and Anglo Platinum which together account for more than half of the Anglo's £40.2bn market cap. We aim to analyse the case for attaining substantial equity in AAL, individually or as part of a portfolio and assess the inherent risks and returns for the investor. Ratios – ALL about EARNINGS link on FB. current ratio (capability of paying long term obligations) 1.5 to 1.8. net margin up 11.8%. total debt to equity was 54.8% now 2010 39.3% return on equity = 12% (A steadily increasing ROE is a hint that management is giving shareholders more for their money, which is represented by shareholders' equity. Simply put, ROE indicates know how well management is employing the investors' capital invested in the company. It turns out, however, that a company cannot grow earnings faster than its current ROE without raising additional cash. That is, a firm that now has a 15% ROE cannot increase its earnings faster than 15% annually without borrowing funds or selling more shares. But raising funds comes at a cost: servicing additional debt cuts into net income and selling more shares shrinks earnings per share by increasing the total number of shares outstanding. So ROE is, in effect, a speed limit on a firm's growth rate, which is why money managers rely on it to gauge growth potential. In fact, many specify 15% as their minimum acceptable ROE when evaluating investment candidates.) P/E ratio was 21 in 2009, 9.5 in 2010 (Theoretically, a stock's P/E tells us how much investors are willing to pay per dollar of earnings. For this reason it's also called the "multiple" of a stock. In other words, a P/E ratio of 20 suggests that investors in the stock are willing to pay $20 for every $1 of earnings that the company generates. the P/E is more than a measure of a company's past performance. It also takes into account market expectations for a company's growth. Remember, stock prices reflect what investors think a company will be worth. Future growth is already accounted for in the stock price. As a result, a better way of interpreting the P/E ratio is as a reflection of the market's optimism concerning a company's growth prospects. If a company has a P/E higher than the market or industry average, this means that the market is expecting big things over the next few months or years. A company with a high P/E ratio will eventually have to live up to the high rating by substantially increasing its earnings, or the stock price will need to drop. A good example is Microsoft. Several years ago, when it was growing by leaps and bounds, and its P/E ratio was over 100. Today, Microsoft is one of the largest companies in the world, so its revenues and earnings can't maintain the same growth as before. As a result, its P/E had dropped to 43 by June 2002. This reduction in the P/E ratio is a common occurrence as high-growth startupssolidify their reputations and turn into blue chips) Pros to invest in them using theories – what is the pros of investing in ANGLO? Anglo’s portfolio is highly diverse. This allows Anglo portfolio to absorb any economic shocks. Similarly, Anglo’s operations are also highly diverse. They currently operate in every continent. This allows Anglo to benefit from different economies and raw materials. Anglo is currently listed in the UK, South Africa, Switzerland, Botswana and Nambia. This allows Anglo to take advantage of certain tax advantages because no capital gains tax applies. It also allows for shares to trade across multiple time zones and currencies, which gives the potential for more liquidity. The final advantage of this is brand awareness. Cons to investing in them using theories and downfall in theories – why don’t? The mining sector is considered to be a highly volatile market, so although it has the potential to earn high returns, there is a higher level of perceived risk. The mining sector was considered as a poor market in 2011 and some predict 2012 will be a struggle for the mining sector1. There could be a number of ethical issues attached to the mining sector Finally Anglo is currently in a legal battle due to poor health and safety issues in South Africa. This is still on going and although it’s in its early stages, this could affect the company.2 Facts about past performance and financials using excel from last year. Link in with mining sector info for 2011 and mikes quote that 2012 will be similar. Beta Stocks that have a beta greater than 1 have greater price volatility than the overall market and are more risky. Stocks with a beta of less than 1 have less price volatility than the market and are less risky. For example, if the market with a beta of 1 is expected to return 8%, a stock with a beta of 1.5 should return 12%. If you don’t see that level of return, then the stock is not a good investment possibility. Stocks with a beta below 1 may be a safer investment (at least by this one measure) and you should expect a lower return. Beta looks backward and history is not always an accurate predictor of the future. Beta also doesn’t account for changes that are in the works, such as new lines of business or industry shifts. Beta suggests a stock’s price volatility relative to the whole market, but that volatility can be upward as well as downward movement. In a sustained advancing market, a stock that is outperforming the whole market would have a beta greater than 1. 1 http://www.telegraph.co.uk/finance/newsbysector/industry/mining/8961366/Mining-sectorpredictions-for-2012.html 2 http://www.bbc.co.uk/news/world-africa-14992024 Investors can find the best use of the beta ratio in short-term decision-making, where price volatility is important. If you are planning to buy and sell within a short period, beta is a good measure of risk. However, as a single predictor of risk for a long-term investor, the beta has too many flaws. Careful consideration of a company’s fundamentals will give you a much better picture of the potential long-term risk Reasonably high, need to know if returns match beta. That the important bit. Great risk is greater return. Compare with gilt – pros and cons of gilts Pro A UK gilt is known as the safest forms of UK investment, therefore it is regarded as low risk. Gilts provide a fixed income, usually twice a year “Anyone who wants a lower risk investment or a fixed income should consider investing in bonds”3 The gilt market is regarded as highly liquid. This means gilts can be bought and sold relatively quickly. Although gilts provide a low level of risk, returns are minimal. The general concept is that if the risk of a share/currency/commodity is high, the investor would demand a higher return to compensate4 Although the government has never defaulted on its debts, in times of increasing uncertainty, such as the current macro-economic events happening within the Euro with which the UK is heavily invested, it is still a possibility. Con Cons to investing in just one company Increased risk. As if that share was to fail, the investor would face a significant loss as within a portfolio the losses of one share can be supported by the gains of another. Returns may not be maximised as not taking advantage of prosperous sectors Fincancials about investing in 3 share portfolio and also international markets. (quotes for 1.bigger portoflios to reduce risk better 2. hence trust), 3. Utility as an anchor as everyone needs it. Low betas. 1. 2. Because investment trusts own shares in a variety of different companies, buying shares in the trust will effectively give you a diversified portfolio. This spreads your risk, as you are not reliant on the success of just one or two companies.5 3 http://www.thisismoney.co.uk/money/investing/article-1583921/Bonds-and-gilts.html http://blog.financialcoachshow.com/wp-content/uploads/2009/09/mpttextbook.pdf (intro) 5 http://www.fandc.com/new/it/default.aspx?id=86331 4 3. Many utilities stocks have a beta of less than 1 – investopedia The Utility sector was the best performing sector in the S&P in 2011, returning almost 15% for investors. http://seekingalpha.com/article/321903-defensive-dividend-portfolio-picksfor-2012-part-1-utilities Beta seems to be a great way to measure the risk of any stock. If you look a young, technology stocks, they will always carry high betas. Many utilities on the other hand, carry betas below 1. http://stocks.about.com/od/evaluatingstocks/a/beta120904.htm Why we chose the companies – QE – differen SE – commod/RE trade off – china utility anchor. What would we do?