Ch19 - 2015 - Cal State LA

Chapter 19

Corporations: Distributions

Not in Complete Liquidation

Comprehensive Volume

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

The Big Picture

(slide 1 of 3)

•

Lime Corporation, an ice cream manufacturer, has had a very profitable year.

–

To share its profits with its two shareholders, it distributes the following:

• Cash of $200,000 to Orange Corporation, and

•

Real estate worth $300,000 (adjusted basis of $20,000) to Gustavo.

– The real estate is subject to a mortgage of $100,000, which

Gustavo assumes.

•

The distribution is made on December 31,

Lime’s year-end.

The Big Picture

(slide 2 of 3)

•

Lime Corporation has had both good and bad years in the past.

–

More often than not, however, it has lost money.

– Despite this year’s banner profits, the GAAPbased balance sheet for Lime indicates a year-end deficit in retained earnings.

•

Consequently, the distribution of cash and land is treated as a liquidating distribution for financial reporting purposes, resulting in a reduction of Lime’s paid-in capital account.

The Big Picture

(slide 3 of 3)

•

The tax consequences of the distributions to the corporation and its shareholders depend on a variety of factors.

– Identify these factors.

•

Explain the tax effects of the distributions to both Lime Corporation and its 2 shareholders.

•

Read the chapter and formulate your response.

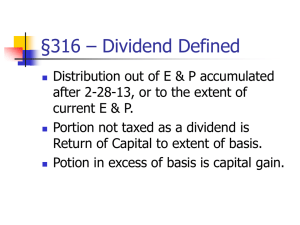

Taxable Dividends

•

Distributions from corporate earnings and profits (E & P)

–

Treated as a dividend distribution

• Taxed as ordinary income or as preferentially taxed dividend income

•

Distributions in excess of E & P

– Nontaxable to extent of shareholder’s basis (i.e., a return of capital)

•

Excess distribution over basis is capital gain

Earnings & Profits

(slide 1 of 2)

•

No definition of E & P in Code

•

Similar to Retained Earnings (financial reporting), but often not the same

Earnings & Profits

(slide 2 of 2)

•

E & P represents:

–

Upper limit on amount of dividend income recognized on corporate distributions

–

Corporation's economic ability to pay dividend without impairing capital

Calculating Earnings & Profits

(slide 1 of 4)

•

Calculation generally begins with taxable income, plus or minus certain adjustments

–

Add previously excluded income items and certain deductions to taxable income including:

• Muni bond interest

• Excluded life insurance proceeds

• Federal income tax refunds

•

Dividends received deduction

•

Domestic production activities deduction

Calculating Earnings & Profits

(slide 2 of 4)

• Calculation generally begins with taxable income, plus or minus certain adjustments (cont’d)

– Subtract certain nondeductible items:

•

Nondeductible portion of meal and entertainment expenses

• Related-party losses

• Expenses incurred to produce tax-exempt income

• Federal income taxes paid

•

Key employee life insurance premiums (net of increase in cash surrender value)

• Fines, penalties, and lobbying expenses

Calculating Earnings & Profits

(slide 3 of 4)

•

Certain E & P adjustments shift effect of transaction from the year of inclusion in or deduction from taxable income to year of economic effect, such as:

–

Charitable contribution carryovers

–

NOL carryovers

– Capital loss carryovers

•

Gains and losses from property transactions

–

Generally affect E & P only to extent recognized for tax purposes

– Thus, gains and losses deferred under the like-kind exchange provision and deferred involuntary conversion gains do not affect E & P until recognized

Calculating Earnings & Profits

(slide 4 of 4)

•

Other adjustments

–

Accounting methods for E & P are generally more conservative than for taxable income, for example:

•

Installment method is not permitted

•

Alternative depreciation system required

• §

179 expense must be deducted over 5 years

• Percentage of completion must be used (no completed contract method)

Examples of E & P Adjustments

(slide 1 of 2)

Examples of E & P Adjustments

(slide 2 of 2)

Current vs Accumulated E & P

(slide 1 of 3)

•

Current E & P

–

Taxable income as adjusted

Current vs. Accumulated E & P

(slide 2 of 3)

•

Accumulated E & P

– Total of all prior years’ current E & P (since

February 28, 1913) reduced by distributions from

E & P

Current vs. Accumulated E & P

(slide 3 of 3)

•

Distinguishing between current and accumulated E & P is important

–

Taxability of corporate distributions depends on how current and accumulated E & P are allocated to each distribution made during year

Allocating E & P to Distributions

(slide 1 of 4)

•

If positive balance in both current and accumulated E & P

–

Distributions are deemed made first from current E

& P, then accumulated E & P

–

If distributions exceed current E & P, must allocate current and accumulated E & P to each distribution

• Allocate current E & P pro rata (using dollar amounts) to each distribution

•

Apply accumulated E & P in chronological order

Allocating E & P to Distributions

(slide 2 of 4)

•

When the tax years of the corporation and its shareholders are not the same

–

May be impossible to determine the amount of current E & P on a timely basis

–

Allocation rules presume that current E & P is sufficient to cover every distribution made during the year until the parties can show otherwise

Allocating E & P to Distributions

(slide 3 of 4)

•

If current E & P is positive and accumulated E

& P has a deficit

–

Accumulated E & P IS NOT netted against current

E & P

• Distribution is deemed to be taxable dividend to extent of positive current E & P balance

The Big Picture – Example 10

Positive Current E & P,

Deficit In Accumulated E & P

• Return to the facts of The Big Picture on p. 19-1.

•

Lime Corp. had a deficit in GAAP-based retained earnings at the start of the year and banner profits during the year.

– Assume that this translates into an $800,000 deficit in accumulated

E & P at the start of the year and current E & P of $600,000.

• In this case, current E & P would exceed the total cash and property distributed to the shareholders.

– The distributions are treated as taxable dividends.

– They are deemed to be paid from current E & P even though Lime still has a deficit in accumulated E & P at the end of the year.

Allocating E & P to Distributions

(slide 4 of 4)

•

If accumulated E & P is positive and current

E&P is a deficit, net both at date of distribution

–

If balance is zero or a deficit, distribution is a return of capital

–

If balance is positive, distribution is a dividend to the extent of the balance

– Any current E & P is allocated ratably during the year unless the parties can show otherwise

Cash Distribution Example

A $20,000 cash distribution is made at year end in each independent situation:

1 2 3* .

Accumulated E & P, beginning of year

Current E & P

Dividend:

100,000

50,000

20,000

(100,000)

50,000

20,000

15,000

(10,000)

5,000

*Since there is a current deficit, current and accumulated

E & P are netted before determining treatment of distribution.

Qualified Dividends

(slide 1 of 3)

• For individual taxpayers, qualified dividends are subject to a max 20% tax rate

– Qualified dividends are exempt from tax for taxpayers in the 10% or 15% rate brackets

– The 20% rate applies to taxpayers in the 39.6% tax bracket

–

The lower rates on dividend income apply to both the regular income tax and the alternative minimum tax

•

Corporations treat dividends as ordinary income and are permitted a dividends received deduction

Qualified Dividends

(slide 2 of 3)

• To qualify for lower rates, dividends must be:

–

Paid by domestic or certain qualified foreign corps

• Qualified foreign corps include those traded on a U.S. stock exchange or any corp. located in a country that:

–

Has a comprehensive income tax treaty with the U.S.

–

Has an information-sharing agreement with the U.S. and

–

Is approved by the Treasury

– Paid on stock held > 60 days during the 121-day period beginning 60 days before the ex-dividend date

– Dividends paid to shareholders who hold both long and short positions in the stock do not qualify

Qualified Dividends

(slide 3 of 3)

• Qualified dividends are not considered investment income for purposes of determining the investment interest expense deduction

– An election is available to treat qualified dividends as ordinary income (taxed at regular rates) and include them in investment interest income

–

Thus, taxpayers subject to an investment interest expense limitation must compare relative benefits of low tax on qualifying dividends vs. increased amount of deductible investment interest expense

Property Dividends

(slide 1 of 4)

•

Effect on shareholder:

–

Amount distributed equals FMV of property

• Taxable as dividend to extent of E & P

• Excess is treated as return of capital to extent of basis in stock

• Any remaining amount is capital gain

Property Dividends

(slide 2 of 4)

• Effect on shareholder (cont’d):

–

Reduce amount distributed by liabilities assumed by shareholder

–

Basis of distributed property = fair market value

Property Dividends

(slide 3 of 4)

•

Effect on corporation:

–

Corp. is treated as if it sold the property for fair market value

•

Corp. recognizes gain, but not loss

–

If distributed property is subject to a liability in excess of basis

•

Fair market value is treated as not being less than the amount of the liability

Property Dividends

(slide 4 of 4)

• Effect on corporation’s E & P:

–

Increases E & P for excess of FMV over basis of property distributed (i.e., gain recognized)

–

Reduces E & P by FMV of property distributed (or basis, if greater) less liabilities on the property

–

Distributions of cash or property cannot generate or add to a deficit in E & P

•

Deficits in E & P can arise only through corporate losses

The Big Picture – Example 13

Property Dividends - Effect on the Shareholder

• Return to the facts of The Big Picture on p. 19-1.

•

Lime Corporation distributed property to Gustavo, one of its shareholders.

– Fair market value $300,000.

–

Adjusted basis $20,000.

– Subject to a $100,000 mortgage, which Gustavo assumed.

•

As a result, Gustavo has a taxable dividend of

$200,000

–

$300,000 (fair market value) – $100,000 (liability).

– The basis of the property to Gustavo is $300,000.

The Big Picture – Example 16

Property Dividends - Effect on the Corporation

• Return to the facts of The Big Picture on p. 19-1.

•

Lime Corporation distributed property to Gustavo, one of its shareholders.

– Fair market value of $300,000

–

Adjusted basis of $20,000

•

As a result, Lime recognizes a $280,000 gain on the distribution.

Property Distribution Example

Property is distributed (corporation’s basis = $20,000) in each of the following independent situations. Assume

Current and Accumulated E & P are both $100,000 in each case:

1 2 3 .

Fair market value of distributed property

Liability on property

Gain(loss) recognized

E&P increased by gain

E & P decrease on dist.

60,000

-0-

40,000

40,000

10,000

-0-

-0-

-0-

40,000

15,000

20,000

20,000

60,000 20,000 25,000

Constructive Dividend

(slide 1 of 2)

•

Any economic benefit conveyed to a shareholder may be treated as a dividend for tax purposes, even though not formally declared

–

Need not be pro rata

Constructive Dividend

(slide 2 of 2)

•

Usually arises with closely held corporations

•

Payment may be in lieu of actual dividend and is presumed to take form for tax avoidance purposes

•

Benefit conveyed is recharacterized as a dividend for all tax purposes

–

Corporate shareholders are entitled to the dividends received deduction

– Other shareholders receive preferential tax rates

Examples of Constructive Dividends

(slide 1 of 3)

•

Shareholder use of corporate property at reduced cost or no cost (e.g., company car to non-employee shareholder)

•

Bargain sale of property to shareholder (e.g., sale for $1,000 of property worth $10,000)

•

Bargain rental of corporate property

Examples of Constructive Dividends

(slide 2 of 3)

•

Payments on behalf of shareholder (e.g., corporation makes payments to satisfy obligation of shareholder)

•

Unreasonable compensation

Examples of Constructive Dividends

(slide 3 of 3)

•

Below market interest rate loans to shareholders

•

High rate interest on loans from shareholder to corporation

Avoiding Unreasonable Compensation

•

Documentation of the following attributes will help support payments made to an employeeshareholder:

– Employee’s qualifications

–

Comparison of salaries with dividends made in past

–

Comparable salaries for similar positions in same industry

– Nature and scope of employee’s work

–

Size and complexity of business

– Corporation’s salary policy for other employees

Stock Dividends

(slide 1 of 2)

•

Excluded from income if pro rata distribution of stock, or stock rights, paid on common stock

–

Five exceptions to nontaxable treatment deal with various disproportionate distribution situations

•

Effect on E & P

–

If nontaxable, E & P is not reduced

–

If taxable, treat as any other taxable property distribution

Stock Dividends

(slide 2 of 2)

• Basis of stock received

–

If nontaxable

• If shares received are identical to shares previously owned, basis =

(cost of old shares/total number of shares)

•

If shares received are not identical, allocate basis of old stock between old and new shares based on relative fair market value

• Holding period includes holding period of formerly held stock

– If taxable, basis of new shares received is fair market value

• Holding period starts on date of receipt

Stock Rights

(slide 1 of 2)

•

Tax treatment of stock rights is same as for stock dividends

–

If stock rights are taxable

•

Income recognized = fair market value of stock rights received

• Basis = fair market value of stock rights

•

If exercised, holding period begins on date rights are exercised

•

Basis of new stock = basis of rights plus any other consideration given

Stock Rights

(slide 2 of 2)

•

If stock rights are nontaxable

–

If value of rights received < 15% of value of old stock, basis in rights = 0

•

Election is available which allows allocation of some of basis of formerly held stock to rights

–

If value of rights is 15% or more of value of old stock, and rights are exercised or sold, must allocate some of basis in formerly held stock to rights

Effect of Redemption

(slide 1 of 3)

•

If qualified as a redemption:

–

Shareholder reports gain or loss on surrender of stock

•

Gain taxed at favorable capital gains rates

(0%/15%/20%)

•

Shareholder reduces gain by basis in stock redeemed

•

Capital gains may be offset by capital losses, if available

Effect of Redemption

(slide 2 of 3)

•

If transaction has appearance of a dividend, redemption will not be qualified:

–

For example, if shareholder owns 100% and corporation buys ½ of stock for $X, shareholder still owns 100%

Effect of Redemption

(slide 3 of 3)

•

If not qualified as a redemption:

–

Shareholder reports dividend income

• Individual shareholders may be taxed at 0%/15%/20% rates

• But, redemption proceeds may not be offset by basis in stock surrendered

• Cannot be offset by capital losses

– Corporate shareholders may prefer dividend treatment because of the dividends received deduction

The Big Picture – Example 26

Sale of Stock

• Return to the facts of The Big Picture on p. 19-1.

•

Assume Gustavo sells some of his shares of

Lime Corp. stock ($80,000 stock basis) to a third party for $1.2 million.

– If the transaction is treated as a sale or exchange

(return of the owner’s investment), Gustavo has a long-term capital gain of $1,120,000

•

$1.2 million (amount realized) – $80,000 (stock basis).

The Big Picture – Example 27

Redemption Treated as D

ividend

Distribution

(slide 1 of 2)

•

Return to the facts of The Big Picture on p. 19-1 and the previous example.

•

Assume that Lime Corp. redeems some of its shares from Gustavo ($80,000 stock basis) for

$1.2 million.

–

If the transaction is treated as a sale or exchange

(return of the owner’s investment), Gustavo has a long-term capital gain of $1,120,000

•

$1.2 million (amount realized) – $80,000 (stock basis).

The Big Picture – Example 27

Redemption Treated as D

ividend

Distribution

(slide 2 of 2)

•

Return to the facts of The Big Picture on p. 19-1 and the previous example.

•

Assume that Lime Corp. redeems some of its shares from Gustavo ($80,000 stock basis) for

$1.2 million.

–

If treated as a dividend distribution (return from the owner’s investment), Gustavo has $1.2 million of dividend income (assuming adequate E & P).

Transactions Treated as Redemptions

(slide 1 of 3)

•

The following types of distributions may be treated as a redemption of stock rather than as a dividend:

– Distributions not essentially equivalent to a dividend (subjective test)

–

Disproportionate distributions (mechanical rules)

Transactions Treated as Redemptions

(slide 2 of 3)

– Distributions in termination of shareholder’s interest (mechanical rules)

–

Partial liquidations of a corporation where shareholder is not a corporation, and either

•

(1) Distribution is not essentially equivalent to a dividend, or

•

(2) An active business is terminated

•

(May be subjective (1) or mechanical (2))

Transactions Treated as Redemptions

(slide 3 of 3)

– Distributions to pay death taxes (limitation on amount of allowed distribution is mechanical test)

•

Stock attribution rules must be applied, so distribution which appears to meet requirements may not qualify

Stock Attribution

(slide 1 of 3)

•

Qualified stock redemption must result in substantial reduction in shareholder’s ownership

– Stock ownership by certain related parties is attributed back to shareholder whose stock is redeemed

Stock Attribution

(slide 2 of 3)

Stock Attribution

(slide 3 of 3)

•

Family attribution rules can be waived for redemptions in complete termination of shareholder’s interest

•

Stock attribution rules do not apply to partial liquidations or redemptions to pay death taxes

The Big Picture – Example 31

Stock Attribution Rules

•

Return to the facts of The Big Picture on p. 19-1.

•

Assume instead that Gustavo owns only 30% of the stock in Lime Corp.

– 20% is owned by his two children.

•

For purposes of the stock attribution rules,

Gustavo is treated as owning 50% of the stock in Lime Corp.

–

He owns 30% directly and, because of the family attribution rules, 20% indirectly through his children.

Not Essentially Equivalent

Redemptions

(slide 1 of 3)

•

Redemption qualifies for sale or exchange treatment if “not essentially equivalent to a dividend”

– Subjective test

–

Provision was added to deal specifically with redemptions of preferred stock

•

Shareholders often have no control over when preferred shares redeemed

•

Also applies to common stock redemptions

Not Essentially Equivalent

Redemptions

(slide 2 of 3)

•

To qualify, redemption must result in a meaningful reduction in shareholder’s interest in redeeming corp.

• Stock attribution rules apply

•

Indicators of a meaningful reduction include:

– A decrease in the redeeming shareholder’s voting control

–

Reduction in rights of redeeming shareholders to

•

Share in corporate earnings, or

• Receive corporate assets upon liquidation

Not Essentially Equivalent

Redemptions

(slide 3 of 3)

•

If redemption fails to satisfy any of the qualifying stock redemption rules

–

Treated as ordinary dividend

–

Basis in stock redeemed attaches to remaining stock owned (directly or constructively)

Qualifying Disproportionate

Redemption

(slide 1 of 4)

•

Redemption qualifies as disproportionate redemption if:

–

Shareholder owns less than 80% of the interest owned prior to redemption

–

Shareholder owns less than 50% of the total combined voting power in the corporation after the redemption

Qualifying Disproportionate

Redemption

(slide 2 of 4)

Qualifying Disproportionate

Redemption

(slide 3 of 4)

Qualifying Disproportionate

Redemption

(slide 4 of 4)

•

Shareholder has 46 2/3% ownership represented by 35 voting shares (60-25) of 75

(100-25) outstanding voting shares

•

Redemption is qualified disproportionate redemption because:

–

Shareholder owns < 80% of the 60% owned prior to redemption (80%

×

60% = 48%), and

–

Shareholder owns < 50% of total combined voting power of corporation

Complete Termination Redemptions

•

Termination of entire interest generally qualifies for sale or exchange treatment

–

Often will not qualify as disproportionate redemption due to stock attribution rules

–

Family attribution rules will not apply if:

•

Former shareholder has no interest (other than as creditor) for at least 10 years

•

Agree to notify IRS of any disallowed interest within

10 year period

Redemptions in Partial Liquidation

(slide 1 of 3)

•

Noncorporate shareholder gets sale or exchange treatment for partial liquidation including:

– Distribution not essentially equivalent to a dividend

–

Under a safe-harbor rule, distribution pursuant to termination of an active business

Redemptions in Partial Liquidation

(slide 2 of 3)

•

To qualify, distribution must be made within taxable year plan is adopted or the succeeding taxable year

•

Not essentially equivalent test looks at effect on corporation

–

Requires genuine contraction of the business of the corporation

•

Difficult to apply due to lack of objective tests

•

Advanced ruling from IRS should be obtained

Redemptions in Partial Liquidation

(slide 3 of 3)

•

Under the safe-harbor rule, to meet the complete termination of a business test, the corporation must:

–

Have two or more active trades or businesses that have been in existence for at least five years

• Distribution must consist of the assets of a qualified trade or business or the proceeds from the sale of such assets

–

Terminate one trade or business and continue a remaining trade or business

Redemptions to Pay Death Taxes

(slide 1 of 2)

•

Allows sale or exchange treatment if value of stock exceeds 35% of value of adjusted gross estate

– Stock of 2 or more corps may be treated as stock of single corp for 35% test if 20% or more of each corp was owned by decedent

–

Special treatment limited to sum of:

•

Death Taxes

•

Funeral and administration expenses

Redemptions to Pay Death Taxes

(slide 2 of 2)

•

Basis of stock is stepped up to fair market value on date of death (or alternate valuation date)

– When redemption price equals stepped-up basis, no tax consequences to estate

Effect of Redemption on Corporation

(slide 1 of 2)

•

Gain or loss recognition

–

If property other than cash used for redemption

• Corporation recognizes gain on distribution of appreciated property

• Loss is not recognized

– Corporation should sell property, recognize loss, and use proceeds from sale for redemption

Effect of Redemption on Corporation

(slide 2 of 2)

•

Effect on Earnings and Profits

–

E & P is reduced in a qualified stock redemption by an amount not in excess of the ratable share of

E & P attributable to stock redeemed

•

Corporate expenditures incurred in a stock redemption are not deductible

– e.g., accounting, brokerage, legal and loan fees

Refocus On The Big Picture

(slide 1 of 4)

• A number of factors affect the tax treatment of Lime

Corporation’s distributions.

•

The amount of current and accumulated E & P (which differ from retained earnings) partially determines the tax effect on the shareholders.

–

Given that Lime Corporation has had a highly profitable year, it is likely that there is sufficient current E & P to cover the distributions.

• If so, they are dividends to the shareholders rather than a return of capital.

•

Orange Corporation receives $200,000 of dividend income that is mostly offset by the dividends received deduction.

–

The amount of the offsetting deduction depends on the ownership percentage that Orange has in Lime.

–

In this situation, Orange would likely qualify for a dividends received deduction of $160,000 ($200,000 X 80%).

Refocus On The Big Picture

(slide 2 of 4)

• Gustavo has $200,000 of dividend income (i.e.,

$300,000 value of the land less the $100,000 mortgage).

– Assuming that Lime is a domestic corporation and that

Gustavo has held his stock for the entire year, the land is a qualified dividend .

•

As a result, the dividend is either tax-free (if Gustavo has a marginal rate of 10% or 15%) or subject to a 15% (or 20%) tax rate

(depending on Gustavo’s marginal tax rate).

– Gustavo’s basis in the land is its fair market value at distribution, or $300,000.

Refocus On The Big Picture

(slide 3 of 4)

• From Lime Corporation’s perspective, the distribution of appreciated property creates a deemed gain of $280,000.

– $300,000 fair market value of the land less its $20,000 adjusted basis.

– While the gain increases Lime’s E & P, the distributions to the shareholders reduce it by $200,000 for the cash and

$200,000 for the land ($300,000 fair market value reduced by the $100,000 mortgage).

Refocus On The Big Picture

(slide 4 of 4)

What If?

• What if current E & P is less than the cash and land distributed to the shareholders?

•

Current E & P is applied pro rata to the cash and the land.

– Since the amounts received by the two shareholders are equal

($200,000 each), the current E & P applied is taxed as a dividend

– To the extent that the distributions are not covered by current E & P, accumulated E & P is then applied in a pro rata fashion.

•

However, Lime probably has a deficit in accumulated E & P.

• As a result, the remaining amounts distributed to the two shareholders are:

– First a tax-free recovery of stock basis, and

– Any excess is taxed as a sale of the stock (probably classified as capital gain).

If you have any comments or suggestions concerning this

PowerPoint Presentation for South-Western Federal

Taxation, please contact:

Dr. Donald R. Trippeer, CPA trippedr@oneonta.edu

SUNY Oneonta

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

75