Statement of Cash Flows

advertisement

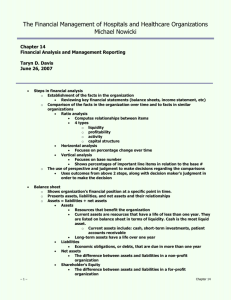

Finance Chris Truax System Director, Business Development OhioHealth Finance • 20 Questions and reflects 10% of the Exam – – – – – – – – – Financial Mgmt and Financial Analysis Principles Operating Budget Principles Capital Budgeting Principles Reimbursement Methodologies and Ramifications Fundamental Productivity Measures Financial Controls and Auditing Principles Capitol Funding Sources Revenue Generation Asset Mgmt, including Facilities equipment, etc. Financial Accounting • The three basic financial statements: – Balance Sheet – Income statement (statement of revenue and expenses – Statement of cash flows 3 Financial Accounting • Balance Sheet • Presents the financial position of the organization at a point in time – usually at the end of the fiscal year • Values assigned to the assets are accounting values and do not necessarily reflect market values. • Prepared in accordance with GAAP • Major components: – Historical cost convention – Accrual – “going concern” 4 Financial Accounting • Historical cost convention – Asset values are typically based on the value assigned at the time of purchase (price paid) • Accrual – Focuses on a matching of the revenues earned and the expenses incurred to provide those services, not when the cash flow actually occurs • “Going concern” – Reflects the fact that the values assigned to the assets are based on the premise that the organization will continue to perform the same type of mission (i.e.,. Health services in the case of a hospital) 5 Financial Accounting • Basic structure of the balance sheet – Present assets in order of liquidity and liabilities in order of payment – Values of the assets must be equal to the claims of the capital supplier 6 Financial Accounting TOTAL ASSETS = including: Current Assets Assets Limited as to Use Tangible Assets Intangible Assets TOTAL DEBT AND EQUITY including: Current Liabilities Long-Term Liabilities Equity/Net Worth/Funds Balance 7 Balance Sheet: Assets (in thousands) 2010 2009 Current Assets: Cash $12,102 $6,486 Marketable securities 10,000 5,000 Net patient accounts receivable 28,509 25,927 3,695 2,302 $54,306 $39,715 $48,059 $25,837 Land $2,954 $2,035 Buildings and equipment 85,595 77,208 $88,549 $79,243 36,099 29,694 $52,450 $49,549 $154,815 $115,101 Inventories Total current assets Long-term investments Property and Equipment: Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets 8 Balance Sheet: Liabilities and Equity (in thousands) 2010 2009 $4,334 $3,345 Accounts payable 5,022 6,933 Accrued expenses 6,069 5,037 15,425 15,315 85,322 53,578 Total liabilities 100,747 68,893 Net assets (Equity) $54,068 $46,208 $154,815 $115,101 Current Liabilities: Notes payable Total current liabilities Long-term debt Total liabilities and equity 9 Financial Accounting • The Income Statement (statement of revenues and expenses) reports the revenues and expenses of the organization over a period of time. • The bottom line of the income statement is captured in the equity section of the balance sheet. 10 Financial Accounting • Income statements are usually prepared in accordance with GAAP, which requires the use of the accrual basis of accounting for recognition of revenues and expenses. • Revenues and expenses reported include the value of services provided regardless of whether cash has been received – Cash expenses such as salaries – Noncash expenses such as: • Depreciation • Amortization • Bad debt expense 11 Financial Accounting • Noncash expenses reflect accounting allocations of 1)previous capital investment decisions and 2) the amount of revenues that have been billed but will probably not be collected in full. 12 Financial Accounting • Charity Care • Not shown as an expense or deduction under the revised accounting rules. • Charity Care, Other Deductions from Revenue (allowance accounts and discounts) are now shown in the footnotes of the financial statements. 13 Income Statement: Revenues (in thousands) 2010 2009 Revenues Net patient service revenue Other revenue Total revenues $169,013 $140,896 7,079 5,704 $176,092 $146,600 14 Income Statement: Expenses (in thousands) 2010 2009 $126,223 $102,334 Supplies 20,568 18,673 Insurance 4,518 3,710 Lease 3,189 2,603 Depreciation 6,405 5,798 Provision for bad debts 2,000 1,800 Interest 5,329 3,476 $168,232 $138,394 $7,860 $8,206 Expenses: Salaries and benefits Total expenses Net Income 15 Financial Accounting • Statement of Cash Flows uses information from balance sheet and income statements to develop a cash flow statement that explains changes in cash flows resulting from three activities: – Operating – Investing – Financing • This statement is usually prepared in accordance with GAAP. 16 Financial Accounting Statement of Cash Flows • Converts net income based on the accrual basis of accounting to a cash basis by adding noncash expenses back to the reported net income • Identifies cash flows from providing services, investing activities and financial activities 17 Financial Accounting Ratio Analysis • Primary financial tool used to assess the financial condition of an organization • Categories of ratios are: – Liquidity: ability to meet short-term obligations – Operating: use of assets and management performance – Debt: long-term survivability – Profit: management performance and ability to meet long-term obligations 18 Ratio Analysis • Liquidity ratios indicate an organization’s ability to meet short-term financial obligations. – Current ratio – Collection period (days in AR) – Days cash-on-hand, all sources – Days cash-on-hand, short-term sources – Average payment period 19 Ratio Analysis • Profitability ratios indicate an organization’s ability to survive and grow by measuring the relationship of revenues to expenses. – Operating margin – Total margin – Return on net assets 20 Ratio Analysis • Asset efficiency ratios indicate an organization’s ability to be efficient by measuring the relationship between revenue and assets [note: total revenue includes net non-operating gains]. – Total asset turnover – Age of plant – Fixed asset turnover – Current asset turnover – Inventory turnover 21 Ratio Analysis • Capital structure ratios indicate that organization’s long-term liquidity by measuring a variety of relationships to capital. – Net asset financing – Long-term debt to net assets – Debt service coverage – Cash flow-to-debt 22 Operating Indicators • Measure financial performance related to operations. – Average length-of-stay (LOS) – Occupancy rate – Outpatient revenue as a percentage of total patient revenue – FTE’s per occupied bed – Salary per FTE – Compensation costs per discharge 23 Financial Accounting • Ratio Analysis for Managed Care Organizations – focus on two major categories of expense and how they relate to the premium dollar Medical Claims Expense Ratio = Total Medical Claims Expense Premium Revenue Administrative Expense Ratio = Non-health Service Expenses Total Operating Revenue 24 Management Accounting • Management Accounting’s primary focus is the determination of the cost of a particular decision. • “Cost” is ambiguous and its meaning depends on the type of decision being made. 25 Cost Classifications • In the long-run, all costs are variable, and hence these cost classifications hold only in the short-run, say, for one year. • Also, no costs are fixed throughout an indefinite range of volumes. Thus, the concept of cost classifications according to volume must be applied within some relevant range of patient volume. 26 Management Accounting Key Calculations for Total Cost Decisions Total Cost = Total Fixed Cost + Total Variable Costs Per-unit costs are averages Per unit costs = TFC/Q + TVC/Q (Q = Services provided) It is important to stress that whenever you have fixed costs, you can not determine per-unit costs without specifying a volume of output. 27 Management Accounting Contribution Margin Approach • The relationship between fixed and variable costs and profit can also be expressed in terms of the contribution margin approach: • Contribution Margin = Price after Discounts – Variable Cost Per Unit CM = P – VCU 28 Management Accounting • Relationship between CM and the Income Statement $20 -8 $12 Average revenue per patient visit after discount Average variable cost per patient visit Contribution margin (CM) per patient visit Total Fixed Costs (TFC) = $240,000 BEQ (Break Even Quantity) = TFC/CM = $240,000/12 Total revenue (20,000 x $20) Total variable costs (20,000 x $8) Total contribution margin (20,000 x $12) Total fixed costs Excess of revenue over expenses = = = = = $400,000 $160,000 $240,000 $240,000 $ 0 29 Management Accounting Contribution Margin approach is used determine: • Break-even points/profit • Quantity • Prices • Cost categories 30 Financial Management Sources of Capital • Equity (or fund balance) Contributed capital Retained earnings • Debt Short-term (trade credit) Long-term (notes, bonds, leasing) 31 Financial Management Risk of Debt • As the amount of debt increases, the risk to the lender increases and higher interest rates follow • To maintain a stable risk profile in the capital structure, then, increased use of debt requires that additional equity also be obtained to keep the relative amounts of each source within board-established units 32 Financial Management Weighted Average Cost of Capital Model (WACC) • Method to measure the costs of various services of capital and the impact of the capital structure • The relative amount of debt and equity in the capital structure and the cost of each source in the marketplace are used to determine the weighted cost 33 Financial Management Evaluation Techniques • Economic evaluation techniques (adjusted for the time value of money) – Net Present Value – Internal Rate of Return • Accounting evaluation techniques (not adjusted for the time value of money) – Accounting Rate of Return – Pay Back 34 Financial Management Net Present Value (NPV) The different between the discounted cash inflows and discounted cash outflows over the life of the investment Internal Rate of Return (IRR) The discount rate, r, which, when used to discount a series of cash inflows and outflows, makes the NPV of those cash flows equal to zero. 35 Financial Management Accounting Rate of Return The average increase in income reported on the financial statement divided by the total or average investment Pay Back The amount of time it takes to recover the cash outflows of the investment from the cash inflows 36 Finance Ready for some test questions? 37 Finance Test Questions Which of the following is a unit measure commonly used to determine physicians’ clinical productivity? – – – – RVU CMS IPO CPU Finance Test Questions Which of the following third-party reimbursement methods provides the largest financial incentive for the provider to reduce cost? – – – – Charge-based Cost-based Prospective payment Per diem Finance Test Questions Statements and earnings, financial positions, changes in financial position and retained earnings are required to be submitted yearly by all: – – – – Publically owned healthcare organizations Privately owned healthcare organizations Government owned healthcare organizations Faith-based owned healthcare organizations Finance Test Questions Which of the following is an Example of a capital expenditure? – Land that is purchased for resale – Surgical equipment with a useful life of six months – A building with a useful life of 20 years – Medical supplies used for patient care Finance Test Questions If the amount of charity care increased from one reporting period to the next, which of the following would occur? – Provision for bad debts would increase – Unrestricted net assets would increase – Unrestricted net assets would neither, increase or decrease – Unrestricted net assets would decrease Finance Test Questions Which would be a reasonable basis on which to allocate administrative overhead costs? – Salaries – Amount of supplies used – Hours worked – Square footage Finance Test Questions The effective cost of debt is roughly the same for both not-for-profit and investor-owned organizations because: – Both types of organizations can issue tax-exempt debt – The interest rate is the same on both tax-exempt and regular debt – Neither type of organization can issue tax-exempt debt – The tax deductibility of interest for investor-owned firms offsets the lower coupon rate on tax-exempt debt. Finance Test Questions Which of the following statements best describes the statistics budget? – It combines volume and expense rates to forecast costs – It is a profit forecast for the coming year – It combines volume and reimbursement data to forecast revenues – It provides input date for other budgets Finance Test Questions Which of the following is an Example of an asset? – Accounts payable – Accrued employee benefits – Property, plant, and equipment – Unrealized gain Finance Test Questions • Which statement about short-term debt reduces liquidity? – Increased use of short-term debt reduces liquidity – Short-term debt provides certainty about interest costs over time – The interest rates for short-term debt are typically higher than interest rates for longterm debt – An organization that relies on short-term debt replaces the need for working capital Finance Test Questions • Cost accounting is an important tool which enables the CFO to: a.Meet Joint Commission fiscal requirements b.Ensure supplies are competitively purchased c.Determine the actual cost of providing patient care d.Improve revenue cycle returns Finance Test Questions • What does a liquidity ratio measure? a.A firm’s ability to meet its current obligations in a timely manner b.Size of dividends to be paid to shareholders c.The percent of total funds provided by creditors d.Days in accounts receivable Finance Test Questions • The real value of financial statements lies in the fact they can be used to help: a.Predict the firm’s future financial condition b.Compute total margin versus periodic gain c. Relate the industry average to net profit/loss over time d.Understand that a large portion of a hospitals net income may come from non-operating gains Finance Test Questions • Facing struggles such as declining profit margins, nonprofit healthcare organizations have become more dependent on what source for financing capital needs? a.Philanthropy b.Bond financing c.Capital leases d.Operational leases Finance Test Questions • You work for a county organization that has decided to issue bonds to fund a new building. What type of bond would be sold on behalf of your organization? a.Mortgage bond b.Corporate bond c.Capital bond d.Municipal bond Finance Test Questions • On a balance sheet, what does the difference between total current assets and total current liabilities indicate? a.Cash on hand b.Net working capital c.Liquid assets d.Equity Finance Test Questions • Budgets for new capital expenditures include requests for: a.Infrastructure b.Wage adjustments c.New employee insurance plans d.New gain share agreement with staff physician Finance Test Questions • The Capital Asset Pricing Model (CAPM), an equilibrium model, describes the relationship between which of the following? a.Market risk and required rate of return b.Expected rate of return and actual rate of return c. Price and market risk d.Expected rate of return and required rate of return Finance Test Questions • Which of the following is not considered part of the labor budget? a.Staff Salaries b.Hourly wages c.Employee benefits d.Contract staff expenses Finance Test Questions • What in the revenue cycle process is a major impediment to prompt payment? a.Payment receipt and posting b.Claims submission c.Poor financial counseling d.Claim denial Finance Test Questions • When evaluating capital budget performance, what is the best indicator of operating leverage? a.Debt to capitalization ratio b.Expense ratio c.Average age of plant d.Depreciation ratio Finance Test Questions • An analysis of proposed capital investment typically includes all of the following except: a.Cost of capital b.Cash flow projections c.Liquidity ratio d.Risk assessment Finance Test Questions • Revenue cycle billing management typically includes what broad activities? a. Billing and collections for inpatient, outpatient and surgical services b. Claims processing, denial management and claims payment c. Processing accounts payable, denial management and billing for outpatient services d. Activities before services are rendered, activities that occur simultaneously with the services and activities after services are rendered Finance Test Questions • Under the regulations of the IRS, a tax exempt entity: a.Must provide a private benefit to those institutions operating or affiliated with the entity b.Must limit the benefit to any private individual c. Must provide a public benefit to the community d.Can minimize penalties if it limits private benefits to less than 50% Finance Test Questions • Bundled pricing (paying a single fee for all services) for such services as total hip replacement or coronary artery bypass surgery affects physician-hospital relationships by: a. Reducing the need to devote administrative effort to measuring outcomes and performance indicators b. Putting the physician and hospital at each other’s throat fighting over distribution of the fee c. Promoting efforts to collaborate and integrate efforts to provide more efficient care d. Guaranteeing that only top quality physicians will be allowed to participate in such programs Finance Test Questions • Which of the following is an Example of direct costs? a.Utility bills b.Parking operations c.Debt service d.Drug prescriptions Finance Test Questions • What are the three basic categories of quantitative performance measures used in conventional accounting systems? a.Market share, customer satisfaction, and quality b.Demand, sales, and cost c.Demand, cost, and output/productivity d.Services rendered, market share, and access Finance Test Questions • Under capitated payment system, the risk sharing arrangements involve which parties? a.Insurers and patients b.Physicians and purchasers c.Hospitals and patients d.Hospitals and insurers Finance Test Questions • Which concept of profitability analysis listed below is correct? a.Internal Rate of Return (IRR) measures a project’s percentage of cash flow b.Net Present Value (NPV) is a profitability measure that uses discounted cash flow c. Modified Internal Rate of Return (MIRR) is a less accurate measure than a project’s actual rate of return d.Profitability Return Rate (PRR) provides the most accurate measure Finance Test Questions • Which of the following must be included when determining a capital project’s incremental cash flow? a.Opportunity costs b.Cash inflows c.Inflation d.Internal rate of return Finance Test Questions • The primary purpose of generally accepted account principles (GAAP) in healthcare settings is to: a. Provide regulators with increased access to high quality financial statements of organizations within their jurisdiction b. Ensure that financial information that is reported to outsiders is consistent across businesses and presented in a manner that facilitates interpretation and judgments c. Allow interested individuals a rapid means of collecting financial data about hospitals and managed care organizations d. Facilitate the training of accountants and other finance professionals in the fundamentals of hospital and health services accounting Finance Test Questions • The Statement of Cash Flows is typically organized into three sections: Cash Flow From Operations; Cash Flow From Investing Activities; and Cash Flow From: a.Bad Debt Recovery b.Regulatory Recapture c.Financing Activities d.Donations & Foundation Support Finance Test Questions • Which of the following combines data from a balance sheet and an income statement to create a single number that facilitates easy interpretation? a.Financial ratio analysis b.Acid test ratio c.Operating margin ratio d.Cash flow analysis Finance Test Questions • If a CEO wanted to look at a “snapshot” of the financial condition of the healthcare organization, he/she would review which of the following? a.Income Statement b.Balance Sheet c.Retained Earnings Statement d.Investment Portfolio Finance Test Questions • Where should charity care be shown in a healthcare organization’s financial statement? a.In the balance sheet b.In the statement of operations c.In the statement of changes in net assets d.In the notes to the financial statements Finance Test Questions • Which financial statement is updated daily to reflect changes in assets or composition of financing? a.The flash report b.The balance sheet c.The statement of operations d.The statement of cash flows Finance Test Questions • Controlling the costs of accounts receivable is heavily affected by: a.The time or length of the payment cycle b.The dollar amount of credit granted to individuals c.The total dollar amount of receivables carried on the books d.Working capital management Finance Test Questions • One of the techniques most frequently used in industry to aid management in interpreting a firm’s balance sheet is computation of the acid-test ratio, which is the ratio of: a.Current assets to current liabilities b.Total assets to total liabilities c. Cash to short-term department d.Cash, marketable securities, and accounts receivable to current liabilities Finance Test Questions • Memorial Hospital offers a screening test as a public service for a $0.50 per test. Variable costs per unit are $0.32. Fixed costs are $43,200 per month for the department performing the test. It is the only test done by this special department. The break-even point in tests is: a.240,000 tests b.172,000 tests c. 135,000 tests d.86,400 tests Finance Test Questions • The asset turnover ratio is useful in measuring managerial performance because it indicates the: a.Amount of resources required to generate a dollar of revenue b.Profitability per dollar of revenue c.Effectiveness of capital structure decisions d.Effective use of current assets Finance Test Questions Which of the following is the depreciation method that best recognizes changes in the general purchasing power of the dollar and/or changes in the replacement cost of specific assets? A. B. C. D. Declining-balance depreciation. Straight-line depreciation Price-level depreciation. Sum of the years’ digits depreciation. Finance Test Questions When third-party policies and programs impede the healthcare facility’s fiscal capacity to renovate and model its plant as routinely scheduled, the healthcare facility, to protect itself, should first: A. Delay capital improvements until funds are available. B. Reduce the level of operating services. C. Limit the number of admissions from the selected third-party payments sources. D. Resort to the regulatory agency to obtain a waiver. Finance Test Questions Under generally accepted accounting standards, bad debts are reported as a/an: A. B. C. D. Operating expense Deduction from net revenue Contractual allowance Deduction from gross revenue Finance Study up! Get additional resources if needed. Understand your financial ratios, and how they relate to each other. 81