Using Credit Wisely

advertisement

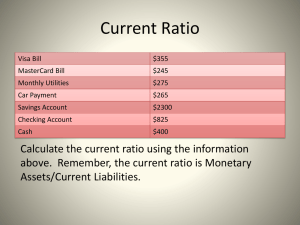

Using Credit Wisely: Identifying Issues & Setting Limits Prepared by: Sissy R Osteen, Ph.D., CFP® If you Answered “Yes” to: 1-2 questions: You may be developing financial problems. 3-5 questions: You are on the edge of Financial disaster. 5-10 questions: You are in over your head. Your Financial Situation Income Debt Expenses Determining Income Income Source Salary Tips Soc. Sec. Retirement Child Support TANF Student Loans Tax Refunds Other Weekly Bi-Weekly Month Yearly Total Determining Expenses Housing Food Clothing Transportation Childcare Medical School Expenses Entertainment Personal Items Reserve Savings* Miscellaneous Occasional Expenses Past 12 Months Home Repairs $ School Expenses Car Maintenance Car Insurance Medical Expenses Clothing Gifts Vacations Property Taxes Total $ Reserve Account Having some means Financial Freedom Having none means Catching Up and More Debt Defining Your Debt Lender Car Loan Credit Cards Bills Loans Monthly Payment Balance Is there a Debt Problem? Income minus Expenses = Amount Available for Paying Debts. - = Sometimes looks like this - = Or this - = Debt/Income Ratio Monthly Debt Monthly Income Debt/Income Ratio 15% or Less Usually Not a Problem 15-20% Plan Carefully 20-35% Cut Back! Over 35% Seek Help! What To Do If You Need Help Stop using your credit cards. If you have money, contact your creditors and ask for lowered payments. If you have been threatened with legal action, contact a lawyer. Questions