I t

advertisement

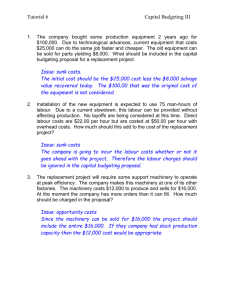

International Capital Budgeting (Eun and Resnick chapter 18) 18-1 Review of Domestic Capital Budgeting Identify the size and timing of all relevant cash flows on a time line. Identify the riskiness of the cash flows to determine the appropriate discount rate. Find NPV by discounting the cash flows at the appropriate discount rate. Compare the value of competing cash flow streams at the same point in time. 18-2 Review of Domestic Capital Budgeting The basic net present value equation is T CFt TVT NPV C0 t T (1 K ) t 1 (1 K ) Where: CFt = expected incremental after-tax cash flow in year t TVT = expected after-tax terminal value including return of net working capital C0 = initial investment at inception K = weighted average cost of capital T = economic life of the project in years The NPV rule is to accept a project if NPV 0 18-3 Review of Domestic Capital Budgeting For our purposes it is necessary to expand the NPV equation. CFt = (Rt – OCt – Dt – It)(1 – ) + Dt + It (1 – ) Rt is incremental revenue OCt is incremental operating cash flow It is incremental interest expense is the marginal tax rate Dt is incremental depreciation 18-4 Review of Domestic Capital Budgeting We can use CFt = (OCFt)(1 – ) + Dt to restate the NPV equation, T NPV = S (1 + K) + t=1 CFt t TVT (1 + K)T – C0 as: T NPV = S t=1 (OCFt)(1 – ) + Dt (1 + K)t + TVT (1 + K)T – C0 18-5 The Adjusted Present Value Model T NPV = S t=1 (OCFt)(1 – ) (1 + K)t T + Dt S (1 + K) t=1 t + TVT (1 + K)T – C0 can be converted to adjusted present value (APV) T S APV = t=1 (OCFt)(1 – ) (1 + Ku)t + Dt (1 + i)t + It (1 + i)t + TVT (1 + Ku) – C 0 T by appealing to Modigliani and Miller’s results. 18-6 The Adjusted Present Value Model T S APV = t=1 (OCFt)(1 – ) (1 + Ku )t + Dt (1 + i)t + It (1 + i)t + TVT (1 + Ku )T – C0 The APV model is a value additivity approach to capital budgeting. Each cash flow that is a source of value to the firm is considered individually. Note that with the APV model, each cash flow is discounted at a rate that is appropriate to the riskiness of the cash flow. 18-7 International Capital Budgeting from the Parent Firm’s Perspective T S APV = t=1 (OCFt)(1 – ) (1 + Ku )t + Dt (1 + i)t + It (1 + i)t + TVT (1 + Ku )T – C0 The APV model is useful for a domestic firm analyzing a domestic capital expenditure or for a foreign subsidiary of an MNC analyzing a proposed capital expenditure from the subsidiary’s viewpoint. The APV model is NOT useful for an MNC in analyzing foreign capital expenditure from the parent firm’s perspective. 18-8 International Capital Budgeting from the Parent Firm’s Perspective Donald Lessard developed an APV model for MNCs analyzing a foreign capital expenditure. The model recognizes many of the particulars peculiar to foreign direct investment. T St OCFt (1 τ ) T St τDt St τI t APV t t t ( 1 K ) ( 1 i ) ( 1 i ) t 1 t 1 t 1 ud d d T T St LPt ST TVT S0C0 S 0 RF0 S0CL0 T t (1 K ud ) ( 1 i ) t 1 d 18-9 APV Model of Capital Budgeting from the Parent Firm’s Perspective T APV = S t=1 + StOCFt(1 – ) )t (1 + Kud St TVT T + St Dt T S t It S (1 + i ) +S (1 + i ) t=1 d t t=1 – S0C0 + S0RF0 + S0CL0 T d t S T St LPt t (1 + Kud) t = 1 (1 + id) The marginal corporate tax OCFt represents only the The operatingthe cashvalue flows of must beDenotes The operating cash flows must the present value (in S RF represents rate, , is the larger of the 0 0 of operating cash portion translated back into the parent the parent’s be discounted at the of any currency) parent’s or foreign accumulated restricted flows available for remittance firm’s currency at thefunds spot rate unlevered domestic rate concessionary loans, CL0, subsidiary’s. (in the amount of RF ) that are expected to prevail 0 in each that can be legally remitted toperiod. and loan payments, LPt , freed up by the project. the parent firm. discounted at i . d 18-10 Capital Budgeting from the Parent Firm’s Perspective One recipe for international decision makers: – – Estimate future cash flows in foreign currency. Convert to the home currency at the predicted exchange rate. • Use PPP, IRP, et cetera for the predictions. – Calculate NPV using the home currency cost of capital. 18-11 Dorchester case Read the case carefully from the text Develop and present all the calculations in Excel The goal is to calculate the APV (formula 18.7 in the text) Follow the methodology described for Centralia in the text First exhibit summarizes the assumptions and the simple calculations Prepare the same exhibits 18-12