2.2 E The Multiplier Effect notes

advertisement

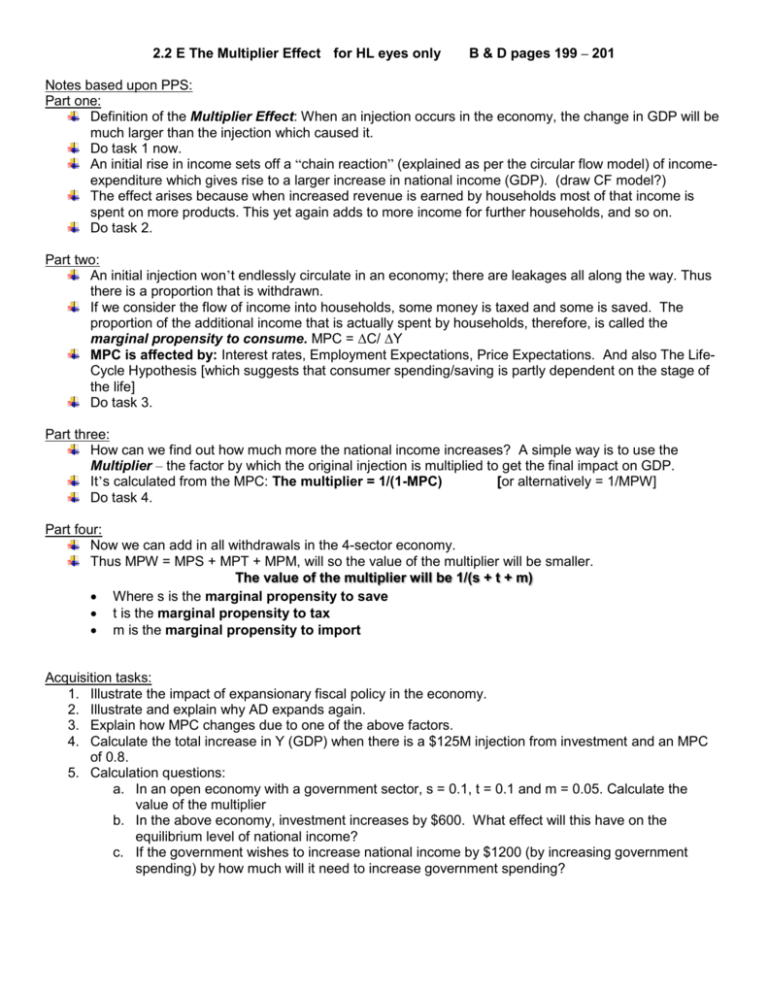

2.2 E The Multiplier Effect for HL eyes only B & D pages 199 – 201 Notes based upon PPS: Part one: Definition of the Multiplier Effect: When an injection occurs in the economy, the change in GDP will be much larger than the injection which caused it. Do task 1 now. An initial rise in income sets off a “chain reaction” (explained as per the circular flow model) of incomeexpenditure which gives rise to a larger increase in national income (GDP). (draw CF model?) The effect arises because when increased revenue is earned by households most of that income is spent on more products. This yet again adds to more income for further households, and so on. Do task 2. Part two: An initial injection won’t endlessly circulate in an economy; there are leakages all along the way. Thus there is a proportion that is withdrawn. If we consider the flow of income into households, some money is taxed and some is saved. The proportion of the additional income that is actually spent by households, therefore, is called the marginal propensity to consume. MPC = ΔC/ ΔY MPC is affected by: Interest rates, Employment Expectations, Price Expectations. And also The LifeCycle Hypothesis [which suggests that consumer spending/saving is partly dependent on the stage of the life] Do task 3. Part three: How can we find out how much more the national income increases? A simple way is to use the Multiplier – the factor by which the original injection is multiplied to get the final impact on GDP. It’s calculated from the MPC: The multiplier = 1/(1-MPC) [or alternatively = 1/MPW] Do task 4. Part four: Now we can add in all withdrawals in the 4-sector economy. Thus MPW = MPS + MPT + MPM, will so the value of the multiplier will be smaller. The value of the multiplier will be 1/(s + t + m) Where s is the marginal propensity to save t is the marginal propensity to tax m is the marginal propensity to import Acquisition tasks: 1. Illustrate the impact of expansionary fiscal policy in the economy. 2. Illustrate and explain why AD expands again. 3. Explain how MPC changes due to one of the above factors. 4. Calculate the total increase in Y (GDP) when there is a $125M injection from investment and an MPC of 0.8. 5. Calculation questions: a. In an open economy with a government sector, s = 0.1, t = 0.1 and m = 0.05. Calculate the value of the multiplier b. In the above economy, investment increases by $600. What effect will this have on the equilibrium level of national income? c. If the government wishes to increase national income by $1200 (by increasing government spending) by how much will it need to increase government spending?