Title Slide

advertisement

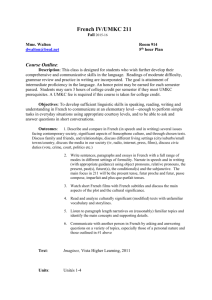

2015 CFA Institute Research Challenge-Kansas City University of Missouri – Kansas City Sponsored by the CFA Society Kansas City Paul Frauen Adam McClusky Sam Snider 2 UMKC CFA Institute Research Challenge Team Investment Thesis SELL Recommendation Price Target: $16.79 Highlights • Limited new portal growth potential • Dependency on same state revenue growth • Difficulty of entrance into federal space • Necessary shift in historical risk/reward profile 3 UMKC CFA Institute Research Challenge Team Investment Thesis: Coming to a Crossroads Current EGOV Positioning Investment Thesis Risk/Reward Profile Valuation Conclusion 4 UMKC CFA Institute Research Challenge Team Investment Thesis: State Portals Upcoming Contract Expirations Enterprise Date New Jersey* 2/28/2015 Alabama 2/28/2015 Oklahoma 3/31/2015 Delaware** 3/31/2015 Kentucky* 8/31/2015 Mississippi 12/31/2015 *Renewal option **Will not be renewing Source: 3Q 2014 NIC, Inc. 10-Q Investment Thesis Risk/Reward Profile Valuation Conclusion 5 UMKC CFA Institute Research Challenge Team Risk/Reward Profile: Historical Low Risk: ▫ Minimal upfront investment ($0.5-1M) ▫ No debt servicing obligations ▫ Lack of third party competition at the enterprise level Investment Thesis Risk/Reward Profile Valuation Conclusion 6 UMKC CFA Institute Research Challenge Team Risk/Reward Profile: Historical High reward: ▫ Speedy cost recovery (~12 months from “go-live”) ▫ Long-term base contracts = reliable initial revenue base ▫ Same state growth driven by cross-selling of Interactive Government Services (IGS) ▫ High margins, ROIC Investment Thesis Risk/Reward Profile Valuation Conclusion 7 UMKC CFA Institute Research Challenge Team Risk/Reward Profile: Forward Looking Risk Implications Diminishing opportunities for new state contracts • Retention of existing contracts and same state growth critically important • Forced to compete at the agency level Maturation of existing contracts • Cross-selling opportunities diminish States’ desire for flexibility (shortterm renewals, alternative funding arrangements) • Revenue stream becomes less predictable Bureaucratic hurdles and capacity/scalability concerns at the federal level • Requires significantly more investment with uncertain payback period Investment Thesis Risk/Reward Profile Valuation Conclusion 8 UMKC CFA Institute Research Challenge Team Valuation: Relative Sales Growth Profit Growth EGOV 2013 2014 18.1% 9.15% 21.6% ~11%* MAXIMUS 2013 2014 13.0% 27.76% -6.2% 25% ACCENTURE 2013 2014 2.1% 5.04% 28.5% -10% Gross Margin Net Margin ROA ROE ROIC 42.9% 12.9% 17.8% 34.8% 34.8% 29.4% 8.8% 13.6% 22.0% 22.0% 32.9% 11.5% 19.5% 66.2% 65.8% 40.8% 14.4% 22.3% 39.8% 40.2% 26.6% 8.5% 17.1% 28.1% 27.1% *Adjusted for non-recurring expenses Investment Thesis Risk/Reward Profile Valuation Conclusion 32.3% 9.8% 16.1% 57.0% 47.9% 9 UMKC CFA Institute Research Challenge Team Valuation: Relative Trailing EV/Sales 4.0 Forward EV/Sales 3.6 2.1 2.0 3.3 4.0 1.6 0.0 2.0 1.7 MMS ACN 0.0 EGOV MMS ACN EGOV Trailing P/E 40.0 1.9 27.1 26.4 20.0 Forward P/E 40.0 18.9 0.0 25.9 25.1 EGOV MMS 20.0 18.7 0.0 EGOV MMS ACN *EV as of 2/17/15 Investment Thesis Risk/Reward Profile Valuation Conclusion ACN 10 UMKC CFA Institute Research Challenge Team Valuation: Relative Relative: $15.77 *EV as of 1/21/15 Investment Thesis Risk/Reward Profile Valuation Conclusion 11 UMKC CFA Institute Research Challenge Team Valuation: Precedent Transaction ▫ Chosen Deals Siris Capital Group acquisition of Digital River EV/EBITDA 50% Premium Bridge Line 5 Acquisitions ▫ Premiums Sensitivity Range: 25%-50% Based on trailing 3-month US small cap tech M&A activity Investment Thesis Risk/Reward Profile Valuation Conclusion 12 UMKC CFA Institute Research Challenge Team Valuation: Precedent Transaction Precedent: $16.00 Investment Thesis Risk/Reward Profile Valuation Conclusion 13 UMKC CFA Institute Research Challenge Team Valuation: DCF Enterprise Value Equity Value Dil Shares Outstanding Present Value Per Share Upside (as of 2/20/15) Recommendation 1,060 0 94 1,155 65 $17.69 3.7% Sell Terminal Year FCF WACC Terminal Value Implied Perpetuity Growth Rate 78 8.7% 1,629 3.7% Less: Debt Plus: Cash Numbers in millions except per share Investment Thesis Risk/Reward Profile Valuation Conclusion 14 UMKC CFA Institute Research Challenge Team Valuation: DCF Input Assumptions/Methodology Revenue* Simulated using 5 scenarios ranging from worst case to best case Margins Small but steady increase as benefits of operating leverage are partially offset by additional federal spending Effective Tax Rate Held constant at 39% (consistent with company guidance and historical average) CAPEX Growth parallels revenue growth WACC* Cost of equity: CAPM Cost of debt: N/A (assume constant capital structure) Exit Multiple* 11.0x EBITDA (based on relative valuation) * Indicates highly sensitive inputs Investment Thesis Risk/Reward Profile Valuation Conclusion 15 UMKC CFA Institute Research Challenge Team Conclusions and Recommendations SELL Recommendation Relative: $15.77 Precedent: $16.00 50% 25% 25% DCF: $17.69 Price Target: $16.79 Investment Thesis Risk/Reward Profile Valuation Conclusion 16 UMKC CFA Institute Research Challenge Team Presentation Body • • • • • • • • • • • • • • Investment Thesis: Price Target Investment Thesis: Crossroads Investment Thesis: State Portals Risk/Reward Profile: Low Risk Risk/Reward Profile: High Reward Risk/Reward Profile: Forward Looking Valuation: Relative, Ratio Analysis Valuation: Relative, Multiples Charts Valuation: Relative, Football Chart Valuation: Precedent, Overview Valuation: Precedent, Football Chart Valuation: DCF Summary Result Valuation: DCF Assumptions Conclusions and Recommendations Compan y Overvie Appendices • • • • • • • • • • • • • • • • • • • • • • • Competitive • Landscape • Existing Contract Overview State Enterprise Growth Prospects Revenue Concentration Existing Enterprise Portal Contracts by Year Contract Extension Trends Mgt. Comments on Federal Expansion Business Model Overview Income Statement Balance Sheet Cash Flow Financial Analysis: Profitability Financial Analysis: Growth Financial Analysis: Liquidity/Efficiency EGOV Dividend History Relative Multiples Relative Valuation Precedent Transaction: Valuation Precedent Transaction: Deals Revenue Simulation State Contract Value Estimation DCF Model Spreadsheet DCF Model Results WACC Estimation SensitivityValuation Analysis: Price Sensitivity Sensitivity Analysis: Terminal Sensitivity 17 UMKC CFA Institute Research Challenge Team Existing Contract Overview ▫ 28 Enterprise Contracts Includes DE (expires March 2015) ▫ 3 Additional States with Agency-Level Contracts New Mexico Virginia Louisiana (currently in pilot phase – no revenue) ▫ 1 Federal Contract Department of Transportation Federal Motor Carrier Safety Administration 18 UMKC CFA Institute Research Challenge Team State Enterprise Growth Prospects State Pop. (MM) Importance Likelihood Evidence California 38.3 High Low Nationally recognized state portal*, conversations with state CIO office New York 19.8 High Low State portal already optimized for mobile Florida 19.6 High Low Conversations with state CIO office Illinois 12.9 High Low State portal already optimized for mobile Ohio 11.6 High Low State portal already optimized for mobile Georgia 10.0 High Low State portal already optimized for mobile Michigan 9.9 High Low State portal already optimized for mobile North Carolina 9.8 High Low State portal already optimized for mobile Viriginia 8.3 Moderate Low Prefer to decentralize to the agency level Washington 7.0 Moderate High State portal not optimized for mobile Massachusetts 6.7 Moderate Low State portal already optimized for mobile Arizona 6.6 Moderate Low EGOV elected not to rebid due to preference for T&M based funding Missouri 6.0 Moderate Low Neighbor to EGOV's oldest partner; nationally recognized state portal** Minnesota 5.4 Moderate High State portal not optimized for mobile Louisiana 4.7 Moderate Moderate 12-18 mo pilot ($2 million, but no revenue) underway with 1 agency Nevada 2.8 Moderate High State portal not optimized for mobile New Mexico 2.1 Moderate Low Servicing MVD for 5 years, but no further expansion New Hampshire 1.3 Low High State portal not optimized for mobile Delaware 0.9 Low Low Contract will lapse March 2015 South Dakota 0.8 Low High Recently issued RFP for self-funded eGovernment solutions Alaska 0.7 Low High State portal not optimized for mobile North Dakota 0.7 Low High State portal not optimized for mobile Wyoming 0.6 Low High State portal not optimized for mobile *2013 Finalist for Best in the Web: State Portal Category (Center for Digital Government) **2014 Finalist for Best in the Web: State Portal Category (Center for Digital Government) Compan Estimated number ofy new state portal contracts: 8 Overvie Competitive Valuation Estimated total number of state portal contracts: 36 Landscape 19 UMKC CFA Institute Research Challenge Team Revenue Concentration* • Service Type ▫ Driver History Record (DHR) Retrieval ▫ Motor Vehicle Registrations 34% 13% • Customer ▫ LexisNexis Risk Solutions 22% • Portal ▫ Texas ▫ Contracts Without Cancellation Penalty *Revenue sources of 10% or greater Investment Thesis 23% 59% Source: NIC, Inc. 3Q 2014 10-Q Valuation Conclusion 20 UMKC CFA Institute Research Challenge Team Existing Enterprise Portal Contracts by Year *Based on 2004-2013 NIC, Inc. 10Ks and 2014 4Q NIC, Inc. 10Q Compan y Overvie Competitive Landscape Valuation 21 UMKC CFA Institute Research Challenge Team Contract Renewal Trends *Based on 2009-2013 NIC, Inc. 10Ks Compan y Overvie Competitive Landscape Valuation 22 UMKC CFA Institute Research Challenge Team Management Commentary on Federal Expansion Harry H. Herrington (CEO, Chairman): “As far as federal, frustrated is a good word for us, absolutely. I would say I was naïve… Security at the federal level is night and day above what we’ve seen in the past, with the stringent requirements they take you through.” “We worked with agencies that they would change some of their rules and regs so that they can do self funding….That’s where our initial investment went” Stephen M. Kovzan (CFO): Regarding recently announced plans to spend an incremental $1 million on agency education and an expanded federal sales staff: “Well, I think, our current intention is to have as part of our expense run rate going forward. It’s not a one time deal.” Source: NIC, Inc. 4Q Earnings Call Transcript 23 UMKC CFA Institute Research Challenge Team Business Model ▫ Establish baseline revenue using transaction-based, selffunding model (typically with DHR as foundation) ▫ Cross-sell IGS to build on DHR foundation ▫ Use alternative funding models (fixed fees, time & materials), as a last resort only 4% Interactive Government Services (IGS) 6% Driver History Records (DHR) 36% 54% Fixed Fees Time & Materials Note: Percentages as of 12/31/2013 Source: NIC, Inc. 2013 Annual Report 24 UMKC CFA Institute Research Challenge Team NIC Inc (EGOV US) - Income Statement In Millions of USD except Per Share Revenue - Cost of Revenue Gross Profit + Other Operating Revenue - Operating Expenses Operating Income - Interest Expense - Net Non-Operating Losses (Gains) Pretax Income - Income Tax Expense Annual Tax Rate Income Before XO Items Net Income Net Inc Avail to Common Shareholders FY 2007 85.8 45.5 40.2 -24.1 16.1 0.0 -2.2 18.4 6.4 35% 12.0 12.0 FY 2008 100.6 55.8 44.8 -26.2 18.6 0.0 -0.6 19.3 7.3 38% 11.9 11.9 FY 2009 132.9 79.2 53.7 0.0 31.6 22.0 --0.1 22.1 8.1 37% 13.9 13.9 FY 2010 161.5 99.5 62.0 0.0 32.6 29.4 -0.0 29.4 11.0 38% 18.4 18.4 FY 2011 180.9 108.8 72.1 0.0 33.6 38.5 -0.0 38.5 15.5 40% 22.9 22.9 FY 2012 210.2 127.6 82.6 0.0 39.4 43.2 -0.0 43.2 16.8 39% 26.3 26.3 FY 2013 249.3 147.4 101.9 0.0 49.3 52.6 -0.1 52.6 20.5 39% 32.0 32.0 12.0 11.9 13.9 18.4 22.9 26.3 32.0 Abnormal Losses (Gains) Tax Effect on Abnormal Items Normalized Income -0.3 0.1 11.7 --11.9 -0.5 -0.6 12.9 2.4 -0.8 19.9 -0.3 0.1 22.7 0.5 -0.2 26.7 9.1 -3.3 37.9 Basic EPS Before Abnormal Items Basic EPS Before XO Items Basic EPS Basic Weighted Avg Shares Diluted EPS Before Abnormal Items Diluted EPS Before XO Items Diluted EPS Diluted Weighted Avg Shares Source: Bloomberg 0.18 0.19 0.19 61.8 0.18 0.19 0.19 62.5 0.19 0.19 0.19 62.5 0.19 0.19 0.19 62.8 0.20 0.22 0.22 63.0 0.20 0.22 0.22 63.1 0.31 0.28 0.28 63.5 0.30 0.28 0.28 63.6 0.36 0.35 0.35 64.0 0.35 0.35 0.35 64.2 0.41 0.40 0.40 64.5 0.41 0.40 0.40 64.6 0.58 0.49 0.49 64.9 0.58 0.49 0.49 65.0 25 UMKC CFA Institute Research Challenge Team NIC Inc (EGOV US) - Balance Sheet In Millions of USD except Per Share Assets + Cash & Near Cash Items + Short-Term Investments + Accounts & Notes Receivable + Inventories + Other Current Assets Total Current Assets + LT Investments & LT Receivables + Net Fixed Assets + Gross Fixed Assets - Accumulated Depreciation + Other Long-Term Assets Total Long-Term Assets Total Assets Liabilities & Shareholders' Equity + Accounts Payable + Short-Term Borrowings + Other Short-Term Liabilities Total Current Liabilities + Long-Term Borrowings + Other Long-Term Liabilities Total Long-Term Liabilities Total Liabilities + Total Preferred Equity + Minority Interest + Share Capital & APIC + Retained Earnings & Other Equity Total Equity Total Liabilities & Equity Source: Bloomberg FY 2004 FY 2005 FY 2006 FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 30.8 0.0 17.6 3.4 4.7 56.5 36.9 20.5 22.3 2.2 2.1 83.9 36.7 45.0 28.7 1.1 2.4 113.9 38.2 17.6 28.1 0.7 8.9 93.6 60.4 0.0 37.5 0.4 6.6 104.8 68.6 0.0 39.0 0.0 4.1 111.7 51.7 0.0 42.1 0.0 6.8 100.5 61.6 0.0 49.3 0.0 23.1 134.1 62.4 0.0 55.3 0.0 10.2 127.8 74.2 0.0 52.8 0.0 35.6 162.7 0.0 2.6 11.6 9.0 33.9 36.5 93.1 0.0 3.3 13.8 10.5 30.6 33.9 117.8 0.0 3.8 13.2 9.4 22.4 26.2 140.1 0.0 6.1 15.0 8.9 11.7 17.8 111.4 0.0 6.6 17.5 10.8 8.0 14.6 119.4 0.0 6.4 20.3 13.8 5.5 11.9 123.6 0.0 6.8 22.3 15.6 4.1 10.8 111.4 0.0 8.9 26.4 17.6 1.4 10.3 144.4 0.0 16.0 37.5 21.4 1.3 17.3 145.1 0.0 15.2 42.3 27.1 2.2 17.3 180.0 14.4 0.0 6.4 20.8 0.0 0.0 0.0 20.8 0.0 0.0 200.9 24.5 0.0 8.2 32.7 0.0 0.0 0.0 32.7 0.0 0.0 207.4 34.2 0.0 6.7 40.9 0.0 0.0 0.0 40.9 0.0 0.0 210.2 36.5 0.0 7.3 43.8 0.0 0.7 0.7 44.5 0.0 0.0 165.9 41.8 0.0 9.5 51.3 0.0 0.9 0.9 52.2 0.0 0.0 154.2 42.9 0.0 13.6 56.4 0.0 0.6 0.6 57.0 0.0 0.0 139.6 41.6 0.0 15.2 56.8 0.0 1.3 1.3 58.1 0.0 0.0 107.9 45.0 0.0 32.8 77.9 0.0 1.4 1.4 79.3 0.0 0.0 96.8 43.7 0.0 19.2 62.8 0.0 3.4 3.4 66.2 0.0 0.0 84.3 39.1 0.0 44.2 83.3 0.0 4.8 4.8 88.0 0.0 0.0 88.4 -128.7 72.3 93.1 -122.3 85.2 117.8 -111.0 99.3 140.1 -99.1 66.9 111.4 -87.0 67.2 119.4 -73.0 66.6 123.6 -54.7 53.3 111.4 -31.7 65.1 144.4 -5.4 78.9 145.1 3.5 91.9 180.0 26 UMKC CFA Institute Research Challenge Team NIC Inc (EGOV US) - Cash Flow Statement In Millions of USD except Per Share Cash From Operating Activities + Net Income + Depreciation & Amortization + Other Non-Cash Adjustments + Changes in Non-Cash Capital Cash From Operations Cash From Investing Activities + Disposal of Fixed Assets + Capital Expenditures + Increase in Investments + Decrease in Investments + Other Investing Activities Cash From Investing Activities Cash from Financing Activities + Dividends Paid + Change in Short-Term Borrowings + Increase in Long-Term Borrowings + Decrease In Long-Term Borrowings + Increase in Capital Stocks + Decrease in Capital Stocks + Other Financing Activities Cash from Financing Activities Net Changes in Cash Direct Method Cashflow Source: Bloomberg FY 2005 FY 2006 FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 6.4 1.6 5.4 7.8 21.2 10.7 2.0 7.9 5.0 25.7 12.0 2.5 7.0 3.2 24.6 11.9 3.6 9.1 -1.9 22.7 13.9 8.2 6.2 2.2 30.5 18.4 4.7 5.7 -6.8 22.0 22.9 4.9 5.6 -2.9 30.6 26.3 6.5 4.5 -9.0 28.4 32.0 8.3 9.1 -8.6 40.9 0.0 -2.3 0.0 0.0 -20.5 -22.8 0.0 -2.6 0.0 0.0 -24.7 -27.3 0.0 -4.9 0.0 0.0 27.3 22.5 0.0 -3.9 0.0 0.0 16.9 13.0 0.0 -3.4 0.0 0.0 -2.0 -5.3 0.0 -4.1 0.0 0.0 -0.5 -4.6 0.0 -6.1 0.0 0.0 -0.5 -6.6 0.0 -12.8 0.0 0.0 -0.7 -13.5 0.0 -6.7 0.0 0.0 -1.5 -8.2 0.0 0.0 -46.7 -15.7 -19.2 -35.5 -16.2 -16.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 4.8 0.0 3.0 7.8 6.1 0.0 1.4 0.0 0.0 1.4 -0.2 0.0 1.1 0.0 0.0 -45.6 1.5 0.0 2.1 0.0 0.0 -13.6 22.1 0.0 2.2 0.0 0.0 -16.9 8.3 0.0 1.1 0.0 0.0 -34.4 -16.9 0.0 2.2 0.0 0.0 -14.1 10.0 0.0 2.2 0.0 0.0 -14.2 0.7 0.0 2.2 0.0 -23.0 -20.8 11.9 27 UMKC CFA Institute Research Challenge Team Financial Analysis: Historical Trends Profitability Return on Equity 50% 38.8% 40% 30% 20% 30.6% 36.6% Return on Invested Capital 37.5% 36% 34.5% 33.4% 34% 20.8% 32% 30% 10% 34.8% 30.0% 28% 0% 2009 2010 2011 2012 2013 26% 2009 Gross Margin 40.9% 40.4% 39.9% 40% 2011 2012 2013 15% 10.5% 11.4% 12.7% 12.5% 12.9% 2009 2010 2011 2012 2013 10% 39.3% 38.4% 39% 2010 Net Margin 42% 41% 35.3% 5% 38% 37% 0% 2009 2010 2011 2012 2013 Source: Bloomberg 28 UMKC CFA Institute Research Challenge Team Financial Analysis: Historical Trends Growth Annual Revenue Growth 35% Annual EPS Growth 30% 32.1% 30% 27.3% 25.0% 25% 25% 20% 21.6% 18.6% 20% 16.2% 15% 22.5% 15.8% 14.3% 15% 12.0% 10% 10% 5% 5% 0% 0% 2009 2010 2011 2012 2013 2009 2010 2011 2012 Source: Bloomberg 2013 29 UMKC CFA Institute Research Challenge Team Financial Analysis: Historical Trends Liquidity/Efficiency Current Ratio 2.5 2.0 1.98 1.77 1.72 A/R Turnover 2.04 1.95 5.0 4.0 1.5 3.0 1.0 2.0 0.5 1.0 0.0 0.0 2009 2010 2011 2012 2013 3.5 2009 Days of Sales Outstanding 4.0 4.0 4.0 2010 2011 2012 2.0 100 91.5 92.2 90.8 2013 Total Asset Turnover 150 105.0 4.6 79.1 1.5 1.09 1.37 1.41 1.45 1.53 2010 2011 2012 2013 1.0 50 0.5 0 0.0 2009 2010 2011 2012 2013 2009 Source: Bloomberg 30 UMKC CFA Institute Research Challenge Team EGOV Dividend History EGOV Special Dividends $0.80 $0.75 $0.70 $0.60 $0.50 $0.50 $0.40 $0.35 $0.30 $0.30 $0.30 $0.25 $0.25 $0.25 $0.25 Dec-10 Dec-11 Nov-12 $0.20 $0.10 $Feb-07 Feb-08 Feb-09 Feb-10 Nov-13 Source: Bloomberg Nov-14 31 UMKC CFA Institute Research Challenge Team Relative Multiples Company EGOV MMS ACN Price 2/17/15 $16.23 $59.29 $89.30 EV ($MM) 972.0 3,756.7 52,149.0 Company Trailing EV/Sales Forward EV/Sales EGOV 3.6 3.3 MMS 2.1 1.9 ACN 1.6 1.7 EBITDA ($MM) 72.2 256.2 4,936.0 Forward P/E 25.9 25.1 18.7 EBIT ($MM) 63.0 225.3 4,315.0 Trailing P/E Trailing EV/EBITDA Trailing EV/EBIT 27.1 13.5 15.4 26.4 14.7 16.7 18.9 10.6 12.1 *Source: Thomson ONE, 3Q 2014 NIC, INC 10-Q Compan y Overvie Competitive Landscape Valuation 32 UMKC CFA Institute Research Challenge Team Relative Valuation EGOV Relative Firms Valuation EV/Sales 2013 2014E 2015E Price Target Multiple Range Sales (NIC) Low 249.28 273.00 298.00 298.00 High 1.84 1.85 1.75 1.85 Implied EV Implied Equity Value Implied Share Price Less: Debt + Low High (Cash) Low High Shares Out. Low High 2.24 459.47 559.13 -106.00 565.47 665.13 65.30 $8.66 $10.19 2.10 505.05 573.30 -106.00 611.05 679.30 65.30 $9.36 $10.40 1.80 521.50 536.40 -106.00 627.50 642.40 65.30 $9.61 $9.84 2.10 551.30 625.80 -106.00 657.30 731.80 65.30 $10.07 $11.21 EV/EBITDA Multiple Range Implied EV Implied Equity Value Implied Share Price Less: Debt + EBITDA (NIC) Low High Low High (Cash) Low High Shares Out. Low High 2013 66.04 11.74 14.19 775.62 936.89 -106.00 881.62 1042.89 65.30 $13.50 $15.97 2014E 75.00 11.48 12.76 860.87 956.74 -106.00 966.87 1062.74 65.30 $14.81 $16.28 2015E 83.00 10.85 11.60 900.55 962.80 -106.00 1006.55 1068.80 65.30 $15.41 $16.37 Price Target 83.00 11.48 12.76 952.70 1058.80 -106.00 1058.70 1164.80 65.30 $16.21 $17.84 EV/EBIT Multiple Range Implied EV Implied Equity Value Implied Share Price Less: Debt + EBIT (NIC) Low High Low High (Cash) Low High Shares Out. Low High 2013 57.71 13.94 17.14 804.51 989.02 -106.00 910.51 1095.02 65.30 $13.94 $16.77 2014E 65.00 13.61 15.51 884.39 1008.28 -106.00 990.39 1114.28 65.30 $15.17 $17.06 2015E 74.00 12.80 14.10 947.20 1043.40 -106.00 1053.20 1149.40 65.30 $16.13 $17.60 Price Target 74.00 13.61 15.51 1006.84 1147.89 -106.00 1112.84 1253.89 65.30 $17.04 $19.20 P/E Multiple Range Low High Low 0.49 21.20 23.90 Compan 0.61 22.50 26.30 y 0.68 21.20 23.90 Overvie 0.68 22.50 26.30 EPS (NIC) 2013 2014E 2015E Price Target Implied Price High 10.39 11.71 13.73 16.04 Competitive 14.42 16.25 Landscape 15.30 17.88 Valuation 33 UMKC CFA Institute Research Challenge Team Precedent Transaction Valuation Precedent Transaction Analysis Multiple Range Implied Equity Value (Offer) Implied Deal Offer Minus Premium (25%) EV/Sales Sales 2014 E Low High Low High Less: Net Debt Low High FMV 273.00 2.63 5.40 717.21 1474.2 -106 823.21 1580.2 Low High Low High Less: Net Debt Low High Low EV/EBITD EBITDA 2014 E A Low High Implied Share Price Minus Premium (50%) Low High Dil. Shares Low High 411.605 790.1 65.299 $6.30 $18.15 High Low High Dil. Shares Low High 617.4075 1185.15 FMV 75.00 17.92 17.92 1344 1344 -106 1450 1450 1087.5 1087.5 725 725 65.299 EV/NI Net Income 2014 E Low High Low High Less: Net Debt Low High Low High Low High Dil. Shares FMV 39.1 51.15 51.15 1999.97 1999.97 -106 2105.97 2105.97 1052.98 1052.98 65.299 # Deals 93 90 211 411 257 Volume 8.79B 22.65B 56.23B 129.51B 81.18B Premiums Paid >100% 75.01-100% 50.01-75% 25.01-50% 10.01-25% 1579.47 1579.47 *Source: Bloomberg (Last 3 Months) Competitive Landscape Valuation $11.10 $16.65 Low High $16.13 $24.19 34 UMKC CFA Institute Research Challenge Team Precedent Transaction: Deals Company Accenture Bridgeline Deal Digital River Mean Max Compan y Overvie Acquires Acquity Group Acquires ElementsLocal Inc. Acquires MarketNet Inc. Acquires Magnetic Corp Acquires e.magination network Acquires TMX Interactive Investor Group Acquires DRIV Acquires 30% of Softonic Int. SL EV/LTM Revenue EV/LTM EBITDA 2.24 2.1 2.7 2 5.4 2.4 1.55 Competitive Landscape Valuation 2.63 5.4 EV/LTM NI 17.92 17.92 17.92 51.15 51.15 51.15 35 UMKC CFA Institute Research Challenge Team Revenue Simulation 5-yr Scenario Prob. Worst Case 10% -4.8% Bad Case 20% 2.2% Base Case 40% 6.8% CAGR Good Case 20% 13.7% Best Case 10% 18.8% N/A 8.7% N/A 2.3% Simulation (10K Trials) Texas Case Compan y Overvie Est. Price $6.87 • Worst Case: Significant loss of business and less than anticipated growth. • Bad Case: Midpoint between base and worst case (i.e., growth lags, but not to such an extreme) • Base Case: EGOV’s revenue base stays relatively stable, with the bulk of growth coming from existing states. • Good Case: Midpoint between base and best case (i.e., EGOV gains more new business than lost business, but not to such an extreme) • Best Case: EGOV consistently adds states at a faster than anticipated rate of 2-3 per year, or realizes a comparable amount of revenue from alternative sources, (e.g., federal, international, acquisitions). (-59.7%) $11.61 (-31.9%) $16.41 (-3.7%) $24.02 (+40.9%) $31.67 (+85.7%) $17.69 (+3.8%) $13.97 (-18.1%) Texas Case: Base Case assumptions with Texas August of 2017 Competitive expiring inValuation • Landscape 36 UMKC CFA Institute Research Challenge Team Estimating Value of State Contracts • Existing contracts allotted historical revenue based on state population. • New contracts assumed to bring in $0.50 per capita in year of commencement from DHR, per management guidance. • Same state growth over time estimated using a three-stage growth model based on the age of the contract: • 0-3 years = 59% per annum (assumes revenue will grow from $0.50 per capita to $2.00 per capita over this time) • 4-10 years = 10% (growth in line with historical average same state growth rate) • > 10 years = 3% (assumed growth into perpetuity) • FMCSA contract assumed constant at $9.5M per annum (based on management guidance of $9-10M) Compan y Overvie Competitive Landscape Valuation 37 UMKC CFA Institute Research Challenge Team DCF Model Free Cash to the Firm Growth Rate Revenue EBIT Margin EBIT EBIT Growth 2013 17% 249 21% 53 12% 2014 22% 275 21% 58 10% 2015 10% 303 21% 64 10% 2016 4% 315 21% 66 4% 2017 11% 350 22% 75 14% 2018 11% 388 22% 83 11% 2019 9% 424 22% 91 9% 2020 8% 460 23% 103 14% 2021 7% 493 23% 111 7% 2022 4% 514 23% 116 4% 2023 5% 537 23% 121 5% 2024 5% 566 23% 127 5% Interest Pre-Tax Earnings Tax Net Income Net Income Growth S/O (Basic) EPS 0 53 21 26 15% 65 0.41 0 58 23 32 22% 65 0.49 0 64 25 39 21% 65 0.60 0 66 26 40 4% 65 0.62 0 75 29 46 14% 65 0.71 0 83 33 51 11% 65 0.78 0 91 36 56 9% 65 0.85 0 103 40 63 14% 65 0.97 0 111 43 68 7% 65 1.04 0 116 45 70 4% 65 1.08 0 121 47 74 5% 65 1.13 0 127 50 78 5% 65 1.19 39.0% 35 10 79 39% 39 11 83 39.0% 40 12 85 39.0% 46 13 90 39.0% 51 14 95 39.0% 56 16 99 39.0% 63 17 103 39.0% 68 18 107 39.0% 70 19 109 39.0% 74 20 112 39.0% 78 21 115 (14) (4) (2) (5) (5) (4) (4) (4) (2) (2) (3) 54 60 (11) (12) 43 48 34 35 Competitive Landscape 67 (13) 54 35 82 (15) 67 37 87 (16) 71 37 91 (17) 74 35 95 (18) 78 34 Tax Rate 39.0% EBIT*(1-tax rate) 32 Add Back: Depr. & Amort 8 Working Capital 65 Less: Changes in Working Capital (9) Operating Cash Flow to Firm 32 Capital Expenditures (14) Free Cash Flow to Firm 18 PV of Cash Flows Compan y Overvie 31 (9) 22 46 (9) 37 34 Historical Performance 50 (10) 41 34 76 (14) 62 37 Valuation Note: Values in millions except per share 38 UMKC CFA Institute Research Challenge Team DCF Model (continued) Present Value of FCF 352 Terminal EBITDA 148 Exit Multiple 11.0x Terminal Value 1,629 Discount Factor 0.43 Present Value of Terminal Value 708 67% of enterprise value Enterprise Value 1,125 Less: Debt 0 Plus: Cash 94 Equity Value 1,155 Dil Shares Outstanding 65 Present Value Per Share $17.69 Upside / (Downside) 3.7% Recommendation Sell Terminal Year FCF WACC Terminal Value Implied Perpetuity Growth Rate Compan y Overvie Historical Performance 78 8.7% 1,629 3.7% Competitive Landscape Valuation Note: Values in millions except per share 39 UMKC CFA Institute Research Challenge Team WACC Estimation Input Value Assumption/Methodology Cost of Equity 8.68% CAPM Risk-free rate 2.17% 10-Year Treasury yield as of 12/31/2014. 10-Year Beta 1.03 MRP 6.30% Midpoint between Ibbotson equity risk premiums over long-term government bonds and T-bills over period 1926-2010 Cost of Debt N/A WACC 8.68% Compan y Overvie S&P 500 used as market index. Assume constant capital structure (i.e., no debt) Historical Performance Competitive Landscape Valuation 40 UMKC CFA Institute Research Challenge Team Sensitivity Analysis WACC • WACC/Exit Multiple and Price 25% 20% 15% 10% 5% Base -5% -10% -15% -20% -25% *Green cells indicates Sensitivity Analysis of EGOV Valuation Exit Multiple (EV/EBITDA) 9.75x 10.00x 10.25x 10.50x 10.75x 11.00x 11.25x 11.50x 10.85% $14.18 $14.38 $14.58 $14.78 $14.99 $15.19 $15.39 $15.59 10.42% $14.60 $14.81 $15.02 $15.23 $15.44 $15.65 $15.86 $16.07 9.98% $15.03 $15.25 $15.47 $15.69 $15.91 $16.13 $16.35 $16.56 9.55% $15.49 $15.71 $15.94 $16.17 $16.40 $16.63 $16.85 $17.08 9.12% $15.96 $16.20 $16.43 $16.67 $16.91 $17.15 $17.38 $17.62 8.68% $16.45 $16.70 $16.95 $17.19 $17.44 $17.69 $17.93 $18.18 8.25% $16.97 $17.22 $17.48 $17.74 $17.99 $18.25 $18.51 $18.76 7.81% $17.50 $17.77 $18.04 $18.31 $18.57 $18.84 $19.11 $19.37 7.38% $18.06 $18.34 $18.62 $18.90 $19.18 $19.45 $19.73 $20.01 6.94% $18.64 $18.93 $19.22 $19.51 $19.80 $20.09 $20.38 $20.67 6.51% $19.25 $19.55 $19.86 $20.16 $20.46 $20.76 $21.06 $21.36 a buying price, red cells indicate sell price. Buying threshold assumes 20% upside. 11.75x $15.79 $16.28 $16.78 $17.31 $17.86 $18.43 $19.02 $19.64 $20.29 $20.96 $21.67 12.00x $16.00 $16.49 $17.00 $17.54 $18.09 $18.67 $19.28 $19.91 $20.57 $21.25 $21.97 12.25x $16.20 $16.70 $17.22 $17.76 $18.33 $18.92 $19.53 $20.18 $20.84 $21.54 $22.27 41 UMKC CFA Institute Research Challenge Team Sensitivity Analysis WACC • WACC/Exit Multiple and Perpetuity Growth Rate 25% 20% 15% 10% 5% Base -5% -10% -15% -20% -25% *Green cells indicates Implied Perpetuity Growth Rate Associated with Valuation Sensitivity Exit Multiple (EV/EBITDA) 9.75x 10.00x 10.25x 10.50x 10.75x 11.00x 11.25x 11.50x 11.75x 10.85% 5.17% 5.31% 5.44% 5.56% 5.68% 5.79% 5.90% 6.00% 6.10% 10.42% 4.76% 4.90% 5.02% 5.15% 5.26% 5.38% 5.48% 5.58% 5.68% 9.98% 4.35% 4.48% 4.61% 4.73% 4.85% 4.96% 5.07% 5.17% 5.27% 9.55% 3.94% 4.07% 4.20% 4.32% 4.44% 4.55% 4.65% 4.75% 4.85% 9.12% 3.53% 3.66% 3.79% 3.91% 4.02% 4.13% 4.24% 4.34% 4.44% 8.68% 3.11% 3.25% 3.37% 3.49% 3.61% 3.72% 3.82% 3.92% 4.02% 8.25% 2.70% 2.83% 2.96% 3.08% 3.19% 3.30% 3.41% 3.51% 3.61% 7.81% 2.29% 2.42% 2.55% 2.67% 2.78% 2.89% 2.99% 3.09% 3.19% 7.38% 1.88% 2.01% 2.13% 2.25% 2.37% 2.48% 2.58% 2.68% 2.78% 6.94% 1.47% 1.60% 1.72% 1.84% 1.95% 2.06% 2.17% 2.26% 2.36% 6.51% 1.06% 1.19% 1.31% 1.43% 1.54% 1.65% 1.75% 1.85% 1.94% a buying price, red cells indicate sell price. Buying threshold assumes 20% upside. 12.00x 6.19% 5.78% 5.36% 4.95% 4.53% 4.11% 3.70% 3.28% 2.87% 2.45% 2.04% 12.25x 6.28% 5.87% 5.45% 5.04% 4.62% 4.20% 3.79% 3.37% 2.96% 2.54% 2.12%