Bond Valuation - Duke University

advertisement

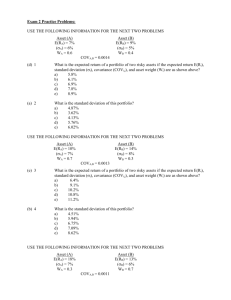

The Capital Asset Pricing Model Global Financial Management Campbell R. Harvey Fuqua School of Business Duke University charvey@mail.duke.edu http://www.duke.edu/~charvey 1 Overview Utility and risk aversion » Choosing efficient portfolios Investing with a risk-free asset » Borrowing and lending » The markt portfolio » The Capital Market Line (CML) The Capital Asset Pricing Model (CAPM) » The Security Market Line (SML) » Beta » Project analysis 2 Efficient Portfolios with Multiple Assets Efficient Frontier Investors prefer E[r] Asset Portfolios Asset 1 of other Portfolios of assets 2 Asset 1 and Asset 2 Minimum-Variance Portfolio 0 s 3 Utility in Risk-Return Space Indifference curves 25.00% tau=0.5, Ubar=6% tau=0.5, Ubar=8% 20.00% tau=0.5, Ubar=10% Investors prefer tau=0.25, Ubar=6% tau=0.25, Ubar=8% tau=0.5, Ubar=10% Return 15.00% 10.00% 5.00% 0.00% Risk 4 Individual Asset Allocations Return 16.00% 14.00% 12.00% x 10.00% y 8.00% Point x is the optimal portfolio for the less risk averse investor (red line) Point y is the optimal portfolio for the more risk averse investor (black line) 6.00% 4.00% 2.00% Risk 20.00% 19.00% 18.00% 17.00% 16.00% 15.00% 14.00% 13.00% 12.00% 11.00% 10.00% 9.00% 8.00% 7.00% 6.00% 5.00% 0.00% 5 Introducing a Riskfree Asset Suppose we introduce the opportunity to invest in a riskfree asset. » How does this alter investors’ portfolio choices? The riskfree asset has a zero variance, and zero covariance with every other asset (or portfolio). » var(rf) = 0. » cov(rf, rj) = 0 for all j. What is the expected return and variance of a portfolio consisting of a fraction (1-a) of the riskfree asset and a of the risky asset (or portfolio)? 6 Risk and Return with a Riskfree asset Expected Return E rP aE rj 1 a )r f Variance and Standard Deviation VarrP s 2P a 2 s 2j s P as j Hence, the risk-return tradeoff is: sP ErP r f Erj rj sj ) 7 Risk and Return with a Riskfree asset Expected Return Asset j (a=1) The line represents all portfolios depending on a E(rj) rf Riskfree asset (a=0) 0 sj Standard Deviation 8 Investing with Borrowing and Lending Expected Return a =2 a = 0.5 E[rM ] M a =1 rf a=0 Lending 0 Borrowing sM Standard Deviation 9 Optimal Investing With Borrowing and Lending 25.00% Return 20.00% tau=0.5, Ubar=8% tau=0.25, Ubar=6% 15.00% Portfolio 10.00% Y = optimal riskreturn tradeoff for risk-averse investor X = optimal riskreturn tradeoff for risk-tolerant investor X 5.00% Y Risk 0.00% 1 3 rf=4% 5 7 9 11 13 15 17 19 21 23 25 27 10 The Capital Market Line Expected Return M E [ rm ] E [ rIBM ] A IBM rf Systematic Risk Diversifiable Risk Standard Deviation 11 The Capital Market Line The CML gives the tradeoff between risk and return for portfolios consisting of the riskfree asset and the tangency portfolio M. » Portfolio M is the market portfolio. The equation of the CML is: E ( rp ) rf s p E (rM ) rf sM The expected rate of return on a risky asset can be thought of as composed of two terms. » The return on a riskfree security, like U.S. Treasury bills; compensating investors for the time value of money. » A risk premium to compensate investors for bearing risk. E(r) = rf + Risk x [Market Price of Risk] 12 Everybody holds the Market Everybody holds the tangency portfolio M » If all hold the same portfolio, it must be the market! Nobody can do better than holding the market » If another asset existed which offers a better return for the same risk, buy that! Can’t be an equilibrium Write the weight of asset j in the market portfolio as wj. Then we have: j N E rM ) j 1 w j E rj rf rf ) Var rM ) i 1 i N ) j 1 wi w j Covrj , ri ) j N » Simply use expressions for multi-asset case 13 All Risk-Return Tradeoffs are Equal Hence, if you increase the weight of asset j in your portfolio (relative to the market), » Then expected returns increase by: E rj ) rf » Then the riskiness of the portfolio increases by: i 1 wi Covrj , ri ) Covrj , rM ) N » Hence, the return/risk gain is: E rj ) rf Cov rj , rM ) » This must be the same for all assets – Why? 14 All Assets are Equal Suppose that for two assets A and B: E rA ) rf CovrA , rM ) E rB ) rf CovrB , rM ) » Asset A offers a better return/risk ratio than asset B – Buy A, sell B – What if everybody does this? » Hence, in equilibrium, all return/risk ratios must be equal for all assets E rA ) rf CovrA , rM ) E rB ) rf CovrB , rM ) 15 The Capital Asset Pricing Model If the risk-return tradeoff is the same for all assets, than it is the one of the market: E rA ) rf CovrA , rM ) E rB ) rf CovrB , rM ) E rM ) rf Var rM ) This gives the relationship between risk and expected return for individual stocks and portfolios. » This is called the Security Market Line. CovrA , rM ) E rA ) rf E rM ) rf rf A E rM ) rf Var rM ) where A ) ) Cov rA , rM ) Var rM ) 16 Capital Asset Pricing Model A Graphical Illustration Expected Return Expected Market Return Expected market risk premium Risk free rate 0 Expected return = 0.5 Risk free rate + 1.0 Beta factor x Beta Expected market risk premium 17 The Intuitive Argument For the CAPM Everybody holds the same portfolio, hence the market. Portfolio-risk cannot be diversified. Investors demand a premium on non-diversifiable risk only, hence portfolio or market risk. Beta measures the market risk, hence it is the correct measure for non-diversifiable risk. Conclusion: In a market where investors can diversify by holding many assets in their portfolio, they demand a risk premium proportional to beta. 18 The SML and mispriced stocks Suppose for a particular stock: ) E rj r f ) Er ) r M f VarrM ) Remember the definition of expected returns: ) E rj Cov rj , rM ) E Pj1 D1j Pj0 Pj0 Then P0 falls, so that E(rj) increases until disequilibrium vanishes and the equation holds! 19 The SML and mispriced stocks Expected Return E(rM) Y X Stock j is overvalued at X: » price drops, » expected return rises. At Y, stock j would be undervalued! » expected return falls » price increases rf j =1 20 The CML and SML E(r) CML E(r) SML M M E(rM) E(rIBM) IBM rf rf sIBM,M/sM sM sIBM s IBM 1.0 21 The Capital Asset Pricing Model The appropriate measure of risk for an individual stock is its beta. Beta measures the stock’s sensitivity to market risk factors. » The higher the beta, the more sensitive the stock is to market movements. The average stock has a beta of 1.0. Portfolio betas are weighted averages of the betas for the individual stocks in the portfolio. The market price of risk is [E(rM)-rf]. 22 Using Regression Analysis to Measure Betas Rate of Return on Stock A Slope = Beta x x x x x x x x x x x x x x Rate of Return on the Market x Jan 1995 23 Calculating the beta of BA Return on BA 40 30 20 10 0 -10 -20 Beta -30 -40 -30 -20 -10 0 Beta is theslope of a regression line which best fits the scatter of monthly returns on the share and on the market index. 10 20 Return on the market index 24 Betas of Selected Common Stocks Stock Beta Stock Beta AT&T 0.96 Ford Motor 1.03 Boston Ed. 0.49 Home Depot 1.34 BM Squibb 0.92 McDonalds 1.06 Delta Airlines 1.31 Microsoft 1.20 Digital Equip. 1.23 Nynex 0.77 Dow Chem. 1.05 Polaroid 0.96 Exxon 0.46 Tandem 1.73 Merck 1.11 UAL 1.84 Betas based on 5 years of monthly returns through mid-1993. 25 Beta and Standard Deviation Risk of a Share (Variance) = Market risk of the share Beta of share Risk of a portfolio x + Risk of market the portfolio Beta of Portfolio x Risk of market of the share This is the major element of a share's risk Market risk of = Specific risk Specific risk of + the portfolio This is negligible for a diversified portfolio 26 Testing the CAPM Black, Jensen and Scholes Average Monthly Return Theoretical Line • • • • • • Fitted Line • • • Beta 27 Estimating the Expected Rate of Return on Equity The SML gives us a way to estimate the expected (or required) rate of return on equity. ) E rj r f j ErM ) r f We need estimates of three things: » Riskfree interest rate, rf. » Market price of risk, [E(rM)-rf]. » Beta for the stock,j. 28 Estimating the Expected Rate of Return on Equity The riskfree rate can be estimated by the current yield on one-year Treasury bills. » As of early 1997, one-year Treasury bills were yielding about 5.0%. The market price of risk can be estimated by looking at the historical difference between the return on stocks and the return on Treasury bills. » This difference has averaged about 8.6% since 1926. The betas are estimated by regression analysis. 29 Estimating the Expected Rate of Return on Equity E(r) = 5.0% + (8.6%) Stock AT&T Boston Ed. BM Squibb Delta Airlines Digital Equip. Dow Chem. Exxon Merck E(r) 13.3% 9.2% 12.9% 16.3% 15.6% 14.0% 9.0% 14.5% Stock Ford Motor Home Depot McDonalds Microsoft Nynex Polaroid Tandem UAL E(r) 13.9% 16.5% 14.1% 15.3% 11.6% 13.3% 19.9% 20.8% 30 Example of Portfolio Betas and Expected Returns What is the beta and expected rate of return of an equally-weighted portfolio consisting of Exxon and Polaroid? Portfolio Beta p (1 / 2)(.46) (1 / 2)(.96) p 0.71 Expected Rate of Return E (rp ) 5.0% (8.6%)(0.71) 111% . How would you construct a portfolio with the same beta and expected return, but with the lowest possible standard deviation? Use the figure on the following page to locate the equally-weighted portfolio of Exxon and Polaroid. Also locate the minimum variance portfolio with the same expected return. 31 Graphical Illustration E(r) E(r) SML CML 13.6% M M 11.1% 5.0% 5.0% sM s 0.71 1.0 32 Example The S&P500 Index has a standard deviation of about 12% per year. Gold mining stocks have a standard deviation of about 24% per year and a correlation with the S&P500 of about r = 0.15. If the yield on U.S. Treasury bills is 6% and the market risk premium is [E(rM)-rf] = 7.0%, what is the expected rate of return on gold mining stocks? 33 Example The beta for gold mining stocks is calculated as follows: s gM r gM s g s M .15(.24) 2 0.30 2 . 12 sM sM The expected rate of return on gold mining stocks is: E (rg ) 6.0% ( 7.0%)(0.30) 7.1% Question: What portfolio has the same expected return as gold mining stocks, but the lowest possible standard deviation? Answer: A portfolio consisting of 70% invested in U.S. Treasury bills and 30% invested in the S&P500 Index. Beta (.7)(0) (.3)(1.0) 0.30 E ( rp ) 6.0% ( 7.0%)(0.30) 8.1% Sd (rp ) (.7)( 0) (.3)(12.0%) 3.6% 34 Using the CAPM for Project Evaluation Suppose Microsoft is considering an expansion of its current operations. » The expansion will cost $100 million today » expected to generate a net cash flow of $25 million per year for the next 20 years. » What is the appropriate risk-adjusted discount rate for the expansion project? » What is the NPV of Microsoft’s investment project? 35 Microsoft’s Expansion Project The risk-adjusted discount rate for the project, rp, can be estimated by using Microsoft’s beta and the CAPM. rP r f E rm r f ) Thus, the NPV of the project is: rP 0.05 1.2 * 0.086) NPV t 1 20 $25 $100 $53.92 million t . ) 1153 36 Company Risk Versus Project Risk The company-wide discount rate is the appropriate discount rate for evaluating investment projects that have the same risk as the firm as a whole. For investment projects that have different risk from the firm’s existing assets, the company-wide discount rate is not the appropriate discount rate. In these cases, we must rely on industry betas for estimates of project risk. 37 Company Risk versus Project Risk Suppose Microsoft is considering investing in the development of a new airline. » What is the risk of this investment? » What is the appropriate risk-adjusted discount rate for evaluating the project? » Suppose the project offers a 17% rate of return. Is the investment a good one for Microsoft? 38 Industry Asset Betas Industry Beta Industry Beta Airlines 1.80 Agriculture 1.00 Electronics 1.60 Food 1.00 Consumer Durables 1.45 Liquor 0.90 Producer Goods 1.30 Banks 0.85 Chemicals 1.25 International Oils 0.85 Shipping 1.20 Tobacco 0.80 Steel 1.05 Telephone Utilities 0.75 Containers 1.05 Energy Utilities 0.60 Nonferrous Metals 1.00 Gold 0.35 Source: D. Mullins, “Does the Capital Asset Pricing Model Work?,” Havard Business Review, vol. 60, pp. 105-114. 39 Company Risk versus Project Risk The project risk is closer to the risk of other airlines than it is to the risk of Microsoft’s software business. The appropriate risk-adjusted discount rate for the project depends upon the risk of the project. If the average asset beta for airlines is 1.8, then the project’s cost of capital is: rp rf p E rm rf ) rp 0.05 18 . 0.086) 20.5% 40 Company Risk versus Project Risk Required Return SML Project-specific Discount Rate Project IRR A Company-wide Discount Rate Company Beta Project Beta 41 Project Evaluation: Rules The risk of an investment project is given by the project’s beta. » Can be different from company’s beta » Can often use industry as approximation The Security Market Line provides an estimate of an appropriate discount rate for the project based upon the project’s beta. » Same company may use different discount rates for different projects This discount rate is used when computing the project’s net present value. 42 Summary Optimal investments depend on trading off risk and return » Investors with higher risk tolerance invest more in risky assets » Only risk that can’t be diversified counts If investors can borrow and lend, then everybody holds a combination of two portfolios » The market portfolio of all risky assets » The riskless asset – Covariance with the market portfolio counts In equilibrium, all stocks must lie on the security market line » Beta measures the amount of nondiversifiable risk » Expected returns reflect only market risk » Use these as required returns in project evaluation 43