Managerial Finance Final Exam - BSAD 180

advertisement

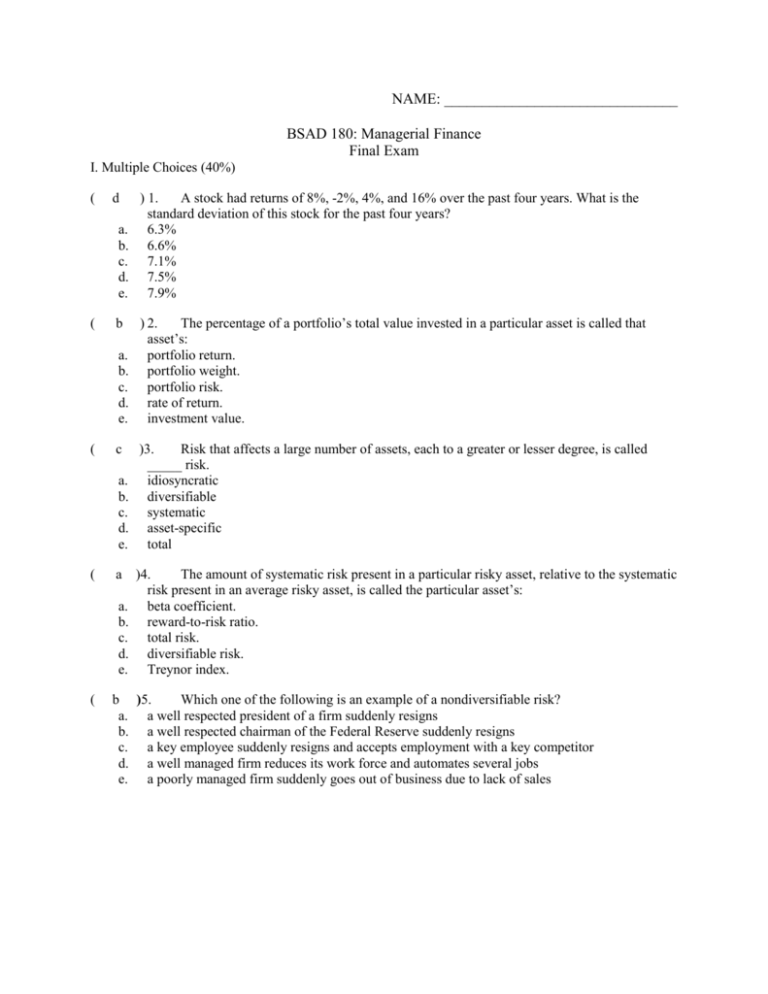

NAME: _______________________________ BSAD 180: Managerial Finance Final Exam I. Multiple Choices (40%) ( d a. b. c. d. e. ( b a. b. c. d. e. ( c a. b. c. d. e. ) 1. A stock had returns of 8%, -2%, 4%, and 16% over the past four years. What is the standard deviation of this stock for the past four years? 6.3% 6.6% 7.1% 7.5% 7.9% ) 2. The percentage of a portfolio’s total value invested in a particular asset is called that asset’s: portfolio return. portfolio weight. portfolio risk. rate of return. investment value. )3. Risk that affects a large number of assets, each to a greater or lesser degree, is called _____ risk. idiosyncratic diversifiable systematic asset-specific total ( a )4. The amount of systematic risk present in a particular risky asset, relative to the systematic risk present in an average risky asset, is called the particular asset’s: a. beta coefficient. b. reward-to-risk ratio. c. total risk. d. diversifiable risk. e. Treynor index. ( b )5. Which one of the following is an example of a nondiversifiable risk? a. a well respected president of a firm suddenly resigns b. a well respected chairman of the Federal Reserve suddenly resigns c. a key employee suddenly resigns and accepts employment with a key competitor d. a well managed firm reduces its work force and automates several jobs e. a poorly managed firm suddenly goes out of business due to lack of sales ( c a. b. c. d. e. )6. Diversification can effectively reduce risk. Once a portfolio is diversified, the type of risk remaining is: individual security risk. riskless security risk. systematic risk. total standard deviations. None of the above. ( )7. Jack’s Construction Co. has 80,000 bonds outstanding that are selling at par value. Bonds with similar characteristics are yielding 8.5%. The company also has 4 million shares of common stock outstanding. The stock has a beta of 1.1 and sells for $40 a share. The U.S. Treasury bill is yielding 4% and the market risk premium is 8%. Jack’s tax rate is 35%. What is Jack’s weighted average cost of capital? a. 7.10 % b. 7.39 % c. 10.38 % d. 10.65 % e. 11.37 % ( a c a. b. c. d. e. )8. Assuming the CAPM or one-factor model holds, what is the cost of equity for a firm if the firm's equity has a beta of 1.2, the risk-free rate of return is 2%, the expected return on the market is 9%, and the return to the company's debt is 7%? 10.4% 10.8% 12.8% 14.4% None of the above. ( c )9. Which of the following will increase sustainable growth? a. Buy back existing stock b. Decrease debt c. Increase profit margin d. Increase asset requirement ratio e. Increase dividend payout ratio ( b )10. Wilbert’s, Inc. paid $90,000, in cash, for a piece of equipment three years ago. Last year, the company spent $10,000 to update the equipment with the latest technology. The company no longer uses this equipment in its current operations and has received an offer of $50,000 from a firm who would like to purchase it. Wilbert’s is debating whether to sell the equipment or to expand its operations such that the equipment can be used. When evaluating the expansion option, what value, if any, should Wilbert’s assign to this equipment as an initial cost of the project? a. $40,000 b. $50,000 c. $60,000 d. $80,000 e. $90,000 II. Essays/Calculations (60%) 1. (a) Please draw the efficient frontier for a portfolio of N>2 risky assets (with x-axis and y-axis properly labeled). (b) When the risk-free asset is included into the portfolio, what happened to the optimal feasible set? 2. Is it possible that a risky asset could have a beta of zero? Explain. Based on the CAPM, what is the expected return on such an asset? Is it possible that a risky asset could have a negative beta? What does the CAPM predict about the expected return on such an asset? 3. Johnson Inc. is considering a new project that has a life of 3 years. The initial capital (fixed assets) investment for the project is $75,000. The firms use 3-year straight-line depreciation (with no salvage value) to write off the capital investment. The firm needs to invest $20,000 in net working capital (NWC) for the project and expects to recover this investment at the end of the project. In addition to the initial capital investment, the project requires the use of a vacant site owned by the firm. The present value of the opportunity cost for this site is estimated to be $12,000. The firm uses no debt. The beta of the firm is 0.8. The T-bill rate is 3%. The expected market risk premium is 8%. What is the NPV of the project? The pro forma income statements for year 1, year 2, and year 3 are the same. For each year, it looks like the following: Sales (50,000 units at $6.00/unit) Variable Costs ($4/unit) Gross profit Fixed costs Depreciation EBIT Taxes (20%) Net Income $300,000 $200,000 $100,000 $40,000 $25,000 $35,000 $7,000 $ 28,000 4. Security F has an expected return of 12% and a standard deviation of 34% per year. Security G has an expected return of 18% and a standard deviation of 50% per year. (a) What is the expected return on a portfolio composed of 40% of security F and 60% of security G? (b) If the correlation coefficient between F and G is 0.1, what is the standard deviation of the portfolio described in part (a)? 5. (a) Please define the term “separation.” (b) Please discuss the Du Pont identity. (c) Please define the term “sunk costs.” Should sunk costs be included into the calculation of NPV? 6. The most recent financial statements for Martin, Inc., are as follows. Sales Costs Taxable Income Taxes (34%) NI $19,200 $15,550 $3,650 $1,241 $2,409 Assets $93,000 Debt $20,400 Equity $72,600 Total $93,000 Assets and costs are proportional to sales. Debt and Equity are not. A dividend of $1,156 is expected to be paid in the coming year. Sales are projected to be $23,040 in the coming year. What external financing is needed for the coming year?