Presentation Title

advertisement

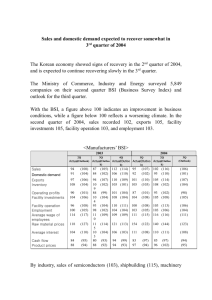

Third Quarter 2004 Conference Call November 2, 2004 Safe Harbor Statements made in this press release include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, including those relating to future financial expectations, involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward looking statements. Information on other significant potential risks and uncertainties not discussed herein may be found in the Company’s filings with the Securities and Exchange Commission including its Form 10K/A for the year ended December 31, 2003. This presentation was prepared for the November 2, 2004 earnings conference call. Information contained within will not be updated. The following slides should be read and considered in connection with the information given orally during the conference call . 1 Agenda Overview Ingrid Wiik Vice Chairman, President & CEO FDA Compliance/ Research & Development Dr. Ronald Warner Executive VP Human Pharmaceutical Scientific Affairs & Global Compliance Gabapentin Fred Lynch President, Global Generic Pharmaceuticals Financials and Outlook Matt Farrell Executive VP & CFO Closing Comments Ingrid Wiik Vice Chairman, President & CEO 2 Third Quarter Overview • • • • • • • • GAAP results: $(0.09) DLPS Diluted loss per share (DLPS) includes a legal settlement, and inventory and fixed asset write-offs totaling $(0.07), all related to a U.S. generics product Excluding these charges, DLPS of $(0.02) versus guidance of approximately breakeven USHP Generics: reduced sales due to wholesaler inventory reduction and pricing declines Kadian® : expanded sales force in place; 29% ytd script growth International Generics Highly competitive markets API Continued strong margins AHD Solid quarter; revenue growth, margin gains Other Income Includes $5.2M income from settlement of litigation R&D investment ramping up Spending in Q3 2004 up 42% vs. year ago, year-to-date up 32%, in line with target of over 25% for the full year Targeting major increase in filings (10 in 2004 vs. 4 in 2003), 7 filings to date Outlook for year 2004 increased from $0.45 - $0.55 to $0.60 to 0.70 driven by gabapentin 3 FDA Compliance Status- USHP Sites • Elizabeth-solids • FDA has notified company the site is eligible for new product approvals Received four new product approvals, including gabapentin tablets Next inspection expected in 2005 Baltimore-liquids • FDA concluded inspection in September Continued remediation, next inspection expected in 2005 Lincolnton-creams/ointments General cGMP and new approval inspections in July 2004 – no observations All U.S sites, except Baltimore, eligible for new product approvals Compliance remains a top priority 4 ANDA Filing History and Target # of ANDAS Filed YTD R&D spending + 32% 20 18 16 14 12 10 8 6 4 2 0 15 - 20 10 10 Filings YTD 6 2001 2002 4 7 2003 2004F Long Term Target Increased investment in pipeline development 5 Gabapentin • Capsule launch in October • Pfizer’s preliminary injunction motion denied Hearing on ALO summary judgment request in mid-November FDA approval for tablets • Pricing competitive: Teva, Ivax, Greenstone, ALO Launch date to be announced Teva agreement ALO to receive a portion of Teva’s profits upon favorable outcome of Pfizer patent infringement litigation Despite pricing pressure, good market 6 Third Quarter: Financial Performance Third Quarter 2003 Revenue Operating Margin $315 6.6% 2004 $ 298 0.1% DEPS / (DLPS) Continuing Operations $0.09 $(0.09) Discontinued Operations (0.08) -- $0.01 $(0.09) Total 7 USHP • • Revenue $ in millions $131.7 $96.8 • 6.5% Operating Margins (17.7)% • Q3 2003 Q3 2004 Revenues declined 26% U.S. generic revenues decline of $38 million due to volume/pricing wholesaler inventory reduction Kadian® revenues increased continued sequential script growth ytd script growth of 29% Margins impacted by reduced volume / pricing pressure write-offs increased R&D 8 International Generics Revenue $ in millions $88.0 $90.5 • • • 7.0% Q3 2003 Revenue declined 6% ex-Fx Increased competition and continuing pricing pressure Increased R&D Operating Margins 6.2% Q3 2004 9 API Revenue $ in millions $35.8 • Revenues increased 44% ex-Fx Increased U.S. volumes $24.3 Weak Q3 in 2003 due to customer inventory reductions Operating 32.5% Margins 47.8% Q3 2003 • Increased R&D Q3 2004 Continued strong margins 10 Animal Health Revenue $ in millions • $73.9 9.6% Q3 2003 $74.6 Operating Margins 11.1% • • • 5% revenue growth, excluding Fx and aquatic divestiture Strong sales of poultry products Livestock: signs of stability Improved margins cost reduction productivity initiatives product mix Q3 2004 Solid quarter 11 Current Debt Profile $ in millions Bank debt Dec. 31 2003 Sept. 30 2004 Term A $ 86 $ 56 Term B 286 226 9 55 381 337 220 220 34 10 147 152 35 0 $817 $719 Revolver 8.625% Senior Notes 5.75% Converts 3% Converts (3.875% PIK) Other Effective Interest Rate 5.5% Free cash flow of $102 million year-to-date 12 Key Financial Items $ in millions 12/31/03 9/30/04 $258 $176 Inventory 309 360 A/P 123 138 Total Debt 817 719 59 67 A/R Cash Free cash flow in Q3 of $53 million - influenced by timing of receivable collections 13 Other Financial Data $ in millions Q3 Depreciation and Amortization CAPEX and Purchased Intangibles Dividends Interest expense* * 2003 2004 $23.6 $23.9 14.9 11.3 2.3 2.4 15.7 14.9 Includes amortization of debt issuance costs of $0.8 million and $0.7 million for 2003 and 2004, respectively Full year Capex estimate: $45 to $50M 14 2004 Outlook Outlook • Increased outlook driven by gabapentin launch Impact offset in part by weaker U.S. Generics base business and disappointing contribution from new product launches in the U.S. Other businesses on track Fourth Quarter • • • DEPS $0.47 to $0.57 Approximately $0.50 DEPS related to gabapentin No significant contribution from other new product launches Full Year 2004 • • Outlook of $0.60-$0.70 DEPS Full year free cash flow $75 - $90 million 15 Current Outlook Full Year $0.45 – 0.55 Previous Guidance Q3 results (0.09) USGx – Q4 New Products (0.15) Gabapentin 0.50 Base Business (0.11) Current Outlook 0.24 $0.60 – 0.70 16 Summary • Significant progress New product launches-gabapentin and citalopram FDA – Elizabeth site eligible for new product approvals Four U.S. generic product approvals Kadian script growth API – continued strong margins Animal Health revenue and margin growth Significant free cash flow generation and debt reduction • Intensifying challenges in the U.S. generic industry • Gabapentin continues to be a significant opportunity Tablet launch to be announced Share of Teva profits – receipt upon favorable outcome of Pfizer patent infringement litigation 17 QUESTIONS & ANSWERS 18