Prep Questions for Aplia Chapter #4

advertisement

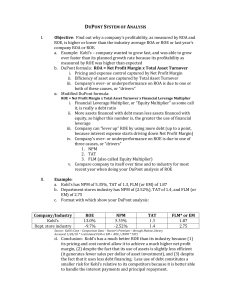

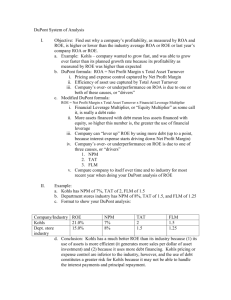

Prep Questions for Aplia Chapter #4 Cash $100 A/R ? Inv 150 NFA 200 ----A/P 150 LTD 200 Equity ? 1) CR=2, What is QR? A) CA/150 = 2 => CA=300, QR=(300 – 150)/150=1 2) If you want to increase inventories by using short-term notes payable, while maintaining QR=0.75x, how much is the increase in inventory? And new CR? A) Let N=short-term notes payable, QR=((300+N)-(150+N))/(150+N)=0.75, N=50 3) If Sales=$182.5, What is TAT? (While we can get total assets directly from B/S, Aplia also provides DSO=100 days to help you get the Assets) A) TAT=182.5/500=0.365 4) If you want to have DSO=80 days, and sales is expected to drop 5%, what is the change in A/R? A) New Sales=182.5*0.95=173.375, DSO=AR/(Sales/365)=AR/(173.375/365)=80 => AR=38 5) TAT=.365x, What is DR? A) TAT=182.5/TA=.365 => TA=500, DR=(150+200)/500 = 0.75 6) 10% annual interest on total debt. Assuming no CGS and the operation costs including depreciation= $32.50, What is TIE=EBIT/Int Exp? A) EBIT=Sales-CGS-Operation costs=182.5 - 0 – 32.5=150. Interest Expenses=(150+200)*0.1 = 35. TIE=150/35=4.29 7) Aside: IT is more important for the company whose business relies on good inventory management. NFA=TFA – accumulated depreciation. The firm with older machines have smaller NFA. Sales 182.5 CGS -0 ----GM 182.5 Op Exp -32.5 ----EBIT 150 Int Exp- 35 ----EBT 115 Tax -23 (20% tax rate) ---NE 92 1) ROE du Pont equation? ROE=PM*TAT*EM=(92/182.5)*(182.5/500)*(500/150) = 0.613 2) If TAT increases by 10%, then how much ROE increases? A) ROE also increases by 10%, 0.613*1.1=0.675 3) If TAT increases from 182.5/500=0.365 to 0.4, what is the new ROE? A) 0.613*(0.4/0.365)=0.674 4) Given 100 shares, What is EPS? Given the current stock price=$18.40, what is P/E? If the company increases #shares from 100 to 120 shares and the net earnings are expected to increase 30%, what is the projected stock price if the company does not change? A) EPS=92/100=$0.92, P/E=18.40/0.92=20, New EPS=92*1.3/120 = 0.997. Projected stock price = current PE*projected EPS=20*0.997=$19.94. 5) Aside: ROE and ROA are dependent on financial structure