investment

advertisement

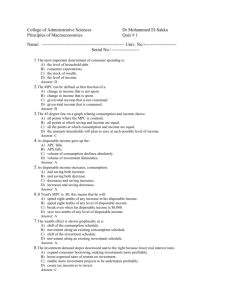

Basic Macroeconomic Relationships Chapter 11 •Remember: GDP = C+I+G+ (X-M) •PART 1: What explains the trends in consumption (consumer spending) and saving reported in the news? •PART 2: How do changes in interest rates affect investment? •PART 3: How can initial changes in spending ultimately produce multiplied changes in GDP? (C,I, and G) the multiplier effect PART 1 Consumption (Consumer Spending) CONSUMER SPENDING • Already studied how consumer spending is affected by wealth and interest rates (see previous notes) • Now let us look at two additional factors – current disposable income and expected future disposable income Current Disposable Income and Consumer Spending • Disposable income – income you have left to spend of save after all expenses have been paid; • Consumption function – equation showing how an individual household’s consumer spending varies with the household’s current disposable income; Reflects the direct consumptiondisposable income relationship – http://www.reffonomics.com/textbook2/macroecono mics2/keynesianthought/keynesiancross.swf Consumption Schedule • Aggregate consumption function – consumption in the economy as a whole – Your spending can be affected by what you think/know your disposable income is going to do in the future (you are starting a higher paying job in a month but you start spending now…or you know your company is going to begin layoffs and you stop spending now) – Life-cycle hypothesis – consumers plan their spending over a lifetime…so people will save some of their income during peak earnings and live off the wealth they have accumulated while working during their retirement (wealth effect) • Change s in wealth across the economy can change the aggregate consumption function (home values increase, etc.) Average Propensity (to consume and to save) • APC- the fraction, or percentage, of total income that is consumed (propensity means tendency/inclination to…) – APC= consumption/income • APS – the fraction, or percentage, or total income that is saved – APS=savings/income • APC+APS=1 (think about this… for every $1 you have, you are going to spend some and save some) Marginal Propensity (to consume and to save) • The fact that households consume a certain proportion of a particular total income does not guarantee they will consume the same proportion of any CHANGE (marginal) in income they might receive • The proportion, or fraction, of any change in income consumed is the marginal propensity to consume (MPC) – MPC=change in consumption/change in income • The fraction of any change in income saved is the marginal propensity to save (MPS) – MPS=change in saving/change in income • MPC+MPS=1 Part 2 Interest Rate-Investment Relationship Investment • Consists of expenditures on new plants, capital equipment, machinery, inventories, and so on. • Investment demand curve • Marginal-benefit-marginal-cost decision (my dad’s story) – Marginal benefit from investment is the expected rate of return businesses hope to realize. – Marginal cost is the interest rate that must be paid for borrowed funds • Investment decision guided by profit motive (businesses buy capital only when they think such purchases will be profitable) – EXPECTED RATE OF RETURN (r) – what businesses expect to get out of investment; not guaranteed – nominal rate of return – inflation rate = real rate of return What is actual investment spending? • It is planned investment spending + unplanned inventory investment • Planned investment spending – Investment spending that firms intend to undertake during a given period • Unplanned inventory investment – Occurs when actual sales are more or less than businesses expected, leading to unplanned changes in inventories – Inventories – stocks of goods held to satisfy future sales – Firms hold inventories so they can quickly satisfy buyers (a consumer can purchase off the shelf instead of waiting for it to be manufactured) – Read example on page 278 Shifts in Investment Demand Curve • Investment Demand Curve – other things equal… relationship between the interest rate and the amount of investment demanded; movement along curve caused by change in real interest rate (r) and expected rate of return (i) • When OTHER THINGS CHANGE, the investment curve shifts – Any factor that leads businesses collectively to expect greater rates of return on their investments increases investment demand (shift to the right); vice versa Factors that cause shifts • Acquisition, Maintenance, and Operating Costs • Business Taxes • Technological Change • Stock of Capital Goods on Hand • Expectations Instability of Investment • Unstable; rises and falls quite often • Most volatile component of total spending • Factors that affect variability of investment: – Durability (capital durable; businesses can choose to get rid of capital, fix capital to last few years, etc.) – Irregularity of Innovation (does not happen too often; when it does, surge in investment but then levels off) – Variability of Profits (affects incentives to invest) – Variability of Expectations Leakages and Injections (must know) • Injections – firms sell some of its output to other businesses (investment) – Investment (purchases of capital goods) is an injection of spending into the income-expenditure stream • Leakages – a withdrawal of spending from the income-expenditures stream – Saving is a leakage!!!! – Saving is what causes consumption to be less than total output (or Real GDP) • If leakage exceeds injection of investment = leads to GDP decreasing (in other words…people save more than spend) • If injection of investment exceeds leakage = leads to GDP increasing • CIRCULAR FLOW: households are savers (leakages) and businesses are investors (injections)…leakage is OUTFLOW and injections are INFLOW • Examples of leakages: savings, taxes • Examples of injections: investment, government spending, net exports • At equilibrium when leakages = injections PART 3 Multiplier Effect (relationship between changes in spending and changes in real GDP) Multiplier Effect • Definition: change in a component of total spending leads to a larger change in GDP – In other words, when there is a shift in the aggregate demand curve, HOW MUCH will it shift???????? • Multiplier: determines how much larger that change will be • Multiplier = change in real GDP/initial change in spending – Change in GDP = multiplier x initial change in spending Two Facts of Multiplier 1) Economy supports repetitive, continuous flows of expenditures and income (your spending becomes someone’s income, then they spend, which is someone’s income, etc.) 2) Any change in income will vary both consumption and saving in the same direction as, and by a fraction of, the change in income The Multiplier and the Marginal Propensities • Multiplier = 1/ (1-MPC) • Multiplier = 1/MPS • The higher the MPC (the lower MPS), the larger the multiplier • Spend more, save less = Multiplier will be greater • Save more, spend less = Multiplier will be smaller TAX MULTIPLIER • Taxes are leakages • Raise taxes, lower spending (vice versa) • INVERSE RELATIONSHIP BETWEEN TAXES AND SPENDING!!!! • Tax Multiplier will be smaller than spending multiplier because some dollars leak out into savings • Tax Multiplier = MPC/1-MPC – Will always will 1 less than spending multiplier