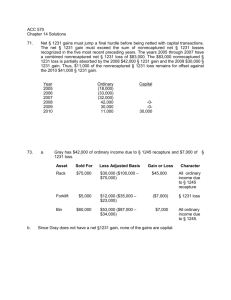

CH 14

advertisement

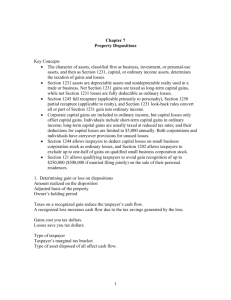

570 Notes, 14-1 CHAPTER 14 PROPERTY TRANSACTIONS – CAPITAL, § 1231, RECAPTURE Code Subchapter P (§1201 - §1298) Part I --Treatment Of Capital Gains [Secs. 1201-1202] Part II --Treatment Of Capital Losses [Secs. 1211-1212] Part III --General Rules For Determining Capital Gains And Losses [Secs. 1221-1223] Part IV --Special Rules For Determining Capital Gains And Losses [Secs. 1231-1260] Part V --Special Rules For Bonds And Other Debt Instruments [Secs. 1271-1288] Part VI --Treatment Of Certain Passive Foreign Investment Companies [Secs. 1291-1298] I. Character of Gain or Loss A. Overview: Character Capital §1231 Ordinary Definition Tax Form Treatment 570 Notes, 14-2 B. Classify the following assets as Capital, §1231, or ordinary: Asset Inventory Type Asset Bldg. & Eqpt. used in business Accounts Receivable Investments in stocks, bonds, etc. Land used in business Land held for investment Personal residence Goodwill C. Special Rules. (§1231 - §1260) Asset 1. §1244 Stock Type Treatment 2. Nonbusiness Bad Debt. 3. Worthless Securities 4. Investment in bonds Generally, any difference between the sales (or redemption) price of a bond & purchase price is a capital gain. Amortization of premium is elective for corporate bonds, required for municipal bonds. OID (Original Issue Discount) bonds. 5. Subdivided Real Property Capital gain treatment is allowed if: (1) Taxpayer is not a regular (C) corporation. (2) Taxpayer is not a real estate dealer. (3) No substantial improvements made to the real estate. (4) Owned for five years (except for inherited property). However, in year in which the 6th lot is sold, some of the gain may be ordinary income. (5% of sales revenue is ordinary income, but is reduced by the selling expenses) 570 Notes, 14-3 Lapse – treated as a sale. Grantor has STCG if option is stock, securities, commodities, or futures; ordinary income for everything else. Grantee has capital loss. 6. Options 7. Patents Exercise – Option price is added to the sales/purchase price of the property. §1231 if used in trade or business (being amortized). 8. Short Sales Capital if considered a “holder” of patent. Holder is the individual (not a corporation) who created the patent, or who purchased it from the creator before it was “reduced to practice.” Gain or loss is generally not recognized until the short sale is closed. Property held LT that’s substantially identical to that sold short results in LT treatment; otherwise, ST. II. Capital Gains & Losses (§1221 - §1223) A. Baskets (Individuals) Basket Type of property included B. The Netting Process (Individuals): (1) STCGs STCLs LTCGs (25% type) LTCGs (15% type) LTCLs (15% type) 10,000 (16,000) 7,000 8,000 (3,000) 570 Notes, 14-4 (2) C. STCGs STCLs LTCGs (28% type) LTCLs (28% type) LTCGs (25% type) LTCGs (15% type) LTCLs (15% type) 8,000 (5,000) 4,000 (3,000) 12,000 6,000 (10,000) Computing the Alternative CG Tax: Order for computing LTCG Rates: 1. 25% 2. 28% 3. 15% Examples: Assume the following rate structure: TAXABLE BUT NOT TAX IS INCOME OVER: OVER: $ 0 8,375 34,000 82,400 171,850 373,650 $ 8,375 34,000 82,400 171,850 373,650 ………… $ 0 837.50 4,681.25 16,781.25 41,827.25 108,421.25 PLUS THIS % 10% 15% 25% 28% 33% 35% OF TAXABLE INCOME OVER: $ 0 8,375 34,000 82,400 171,850 373,650 Ex. 1. $100,000 taxable income, including $20,000 of 15% LTCG. Ex. 2. $100,000 taxable income, including $80,000 of 15% LTCG. Ex. 3: $62,000 taxable income, including $19,000 of 15%& 13,000 of 25% LTCGs. Ex. 4: $62,000 taxable income, including $19,000 of 15%& 6,000 of 25% LTCGs & $7,000 of 28% LTCGs. 570 Notes, 14-5 III. § 1231 Gains & Losses NET CASUALTY GAINS & LOSSES FOR 1231 ASSETS SALES OF 1231 ASSETS AT GAINS SALES OF 1231 ASSETS AT LOSSES COMBINE § 1231 GAINS § 1231 LOSSES RECAPTURES §1245, §1250 LOOKBACK RULE CAPITAL (SCH. D) ORDINARY 570 Notes, 14-6 A. Lookback Rule. If the taxpayer has had net Sec. 1231 losses in any of the previous five taxable years, the current year's net Sec. 1231 gain may be treated as ordinary to the extent of the previous unrecovered net Sec. 1231 losses. Example: Company has net §1231 gains and losses as follows: Net Gain Net Loss Classification 2005 (15,000) ______________ 2006 (10,000) ______________ 2007 (35,000) ______________ 2008 10,000 ______________ 2009 30,000 ______________ 2010 35,000 ______________ Suppose that $35,000 in 10 consists of $18,000 of 25% gain & $17,000 of 15% gain. IV. Recapture Provisions of Sec. 1245 A. General Treatment 1. A gain from the disposition of Sec. 1245 property is treated as ordinary to the extent of depreciation/cost recovery taken, limited by the realized gain. Sec. 1245 is a characterization provision only (i.e. does not create or add to recognized gain) and does not apply to losses. Example: Taxpayer sells §1245 property for $275,000. Its original cost was $250,000, and $150,000 of MACRS had been taken as of the sale. B. Sec. 1245 Property 1. The most common example of Sec. 1245 property is depreciable PERSONAL property. 2. Commercial real property acquired between 1981 and 1986 which was subject to ACRS is subject to Sec. 1245 recapture. If straight-line depreciation was elected for this type of property Sec. 1250 recapture rules apply. 570 Notes, 14-7 V. Recapture Provisions of Sec. 1250 A. General Treatment 1. A gain from the disposition of Sec. 1250 property is ordinary gain to the extent of EXCESS depreciation/cost recovery taken, limited by the realized gain. Example: Taxpayer sells §1250 property for $275,000. Its original cost was $250,000, and $150,000 of MACRS had been taken as of the sale. Straight-line depreciation would have been $120,000. B. Section 1250 Property Defined 1. §1250 property is depreciable REAL property not covered by §1245 recapture rules C. Individuals - Unrecaptured Sec. 1250 Gain 1. After the §1250 recapture, the excess of what would have been recaptured under §1245 over the actual §1250 recapture is “Unrecaptured §1250 gain” (25% rate) is thrown into the Sec. §1231 netting process. Continuing the Example: Of the §1231 gain from the preceding example, how much is unrecaptured 1250 gain? . D. Corporations - Additional Recapture 1. Corporations have additional recapture under §291 equal to 20% of the excess of what would be recaptured under Sec. 1245 over the actual Sec. 1250 recapture. Back to the Example: If the taxpayer is a C corporation, how is the gain characterized? 570 Notes, 14-8 Comprehensive Practice Problem (adapted from CPA Exam) Dawn is a cash-basis, calendar year taxpayer. She engaged in several property transactions relevant to federal income taxes during 2010, for which the appropriate tax treatment must be determined. Dawn is not a dealer in securities, real property, cars, or jewelry, nor is she in the business of lending money. Dawn received a gift of 1,200 shares of Music common stock from her father on January 10, when its FMV was $195 per share. No gift tax was paid. Dawn’s father purchased the stock in 2001 for $252,000 ($210 per share). Dawn sold 200 of the shares on a national exchange for $190 each on January 15. On March 21, Music distributed 2 shares of preferred stock for each share of its common stock in a nontaxable distribution. The FMV of the common on March 21 was $100 per share, and that of the preferred was $75 per share. Dawn sold all her Music common stock on October 9 for $125,000 Dawn exchanged 500 shares of common stock in Keys, Inc. for 1,000 shares of Tones, Inc. common on April 30, when the FMV per share was $400 and $200 per share respectively. Both corporations are in the business of manufacturing and wholesaling musical keyboards that interface with computers, and both are listed on a national exchange. Dawn had purchased the Keys, Inc. stock for $250,000 in 2006. Dawn wrote off as wholly worthless the $25,000 balance of a personal loan made to a friend when the friend received a discharge in bankruptcy in April. Dawn’s mother gave her a diamond necklace, appraised at $90,000 on April 30. Gift tax of $21,000 was paid on the transfer. Her mother purchased the necklace for $60,000 in 2002. Dawn sold it for $90,000 on October 9. On September 7, Dawn received $60,000 insurance recovery on a small building used in her music teaching business, which was destroyed by fire. Dawn had purchased the building 10 years earlier for $67,000, and her adjusted basis just before the fire was $50,000. Dawn has decided t use rented space rather than rebuild for at least the next five years. Answer the following questions: 1. Amount and character of gain or loss recognized on the January 15 sale of Music common stock. 2. Basis in the Music preferred stock acquired in the March 21 distribution. 3. Amount and character of gain or loss recognized on the October 9 sale of Music common stock. 4. Amount and character of gain or loss recognized on the April 30 exchange of Keys common stock for Tones common stock. 5. Treatment of the $25,000 debt written off. 6. Amount and character of gain or loss recognized on the October 9 sale of the necklace. 7. Amount and character of gain or loss recognized from the insurance proceeds on the building.