introduction to the imf - Organization of American States

advertisement

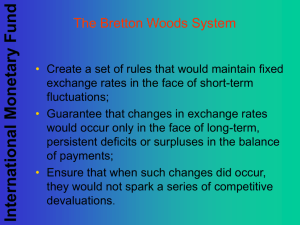

International Monetary Fund: Legal Aspects of Membership XXXIV Course of International Law Organization of American States Rio de Janeiro, Brazil August 13, 2007 Nadia Rendak Senior Counsel Legal Department International Monetary Fund The views expressed herein are those of the author and should not be attributed to the IMF, its Executive Board, or its management. Outline What is the IMF and what does it do? What are the legal implications of membership in the IMF? 1. Purposes 2. Membership and Governance 2. Financial Structure 3. Functions Surveillance Financing Technical Services 2 Introduction The IMF is an intergovernmental institution established by an international treaty in 1945 to create a framework for international economic cooperation focusing on balance of payment problems and the stability of currencies. IMF is part of the “international architecture”. Division of labor and cooperation among the IMF and other international organizations, such as the World Bank, the regional development banks, the WTO, the UN system, the BIS, the OECD and other, has a crucial impact on the achievement of their respective objectives and on promoting economic development by facilitating sustained growth. IMF is an organization with an almost universal membership. Members of the IMF are States. Original members - countries of the 45 listed in Schedule A to the Articles of Agreement who accepted membership by December 31, 1945. 2007- 185 members. The latest admission – the Republic of Montenegro, January 2007. We will consider the legal implications of membership in the IMF under the following broad categories: Quotas and participation in the decision making process Cooperation in the area of exchange arrangements and exchange rate policies aimed at promoting stability of international monetary and financial system Provision of information to the Fund Use of Fund resources 3 1. Purposes of the IMF are set out in Article I of the Articles of Agreement: (i) To promote international monetary cooperation through a permanent institution which provides the machinery for consultation and collaboration on international monetary problems. (ii) To facilitate the expansion and balanced growth of international trade... (iii) To promote exchange stability... (iv) To assist in the establishment of a multilateral system of payments in respect of current transactions and in the elimination of foreign exchange restrictions... (v) To make the general resources of the Fund temporarily available to members for balance of payments purposes under adequate safeguards... (vi) In accordance with the above, to shorten the duration and lessen the degree of disequilibrium in the international balances of payments of members 4 2. Membership and Governance Article II, Section 2: “Membership shall be open to other countries at Membership in the IMF is not conditional on membership in other organizations (e.g., UN, the World Bank) such times and in accordance with such terms as may be prescribed by the Board of Governors. These terms, including the terms for subscription, shall be based on principles consistent with those applied to other countries that are already members.” Terms of membership – the policy is that new members should not have permanent rights and obligations that differ from those of original members Membership is open to an applicant who: (a) is a “country” within the attributes of statehood defined by international law, (b) is willing and able to perform the obligations of membership contained in the Articles, and (c) accepts the terms of a Membership Resolution of the Board of Governors. Domestic legislation is not a valid defense for not observing membership obligations 5 Any member may request an interpretation of the Articles of Agreement pursuant to the provisions of Article XXIX Members can voluntarily withdraw from the Fund. Article XXVI: “Any member may withdraw from the Fund at any time by transmitting a notice in writing to the Fund at its principal office. Withdrawal shall become effective on the date such notice is received.” Withdrawal can also be compulsory. Procedures are outlined in Article XXVI, Section 2: Failure to fulfill obligations may result in ineligibility to use Fund resources; Suspension of voting rights; Decision by the Board of Governors by a majority having 85 percent of the total voting power on withdrawal from membership Upon withdrawal settlements are made between the Fund and the member upon agreement or as prescribed by the Articles of Agreement 6 IMF Organization Chart International Monetary and Financial Committee Board of Governors Executive Board Joint IMF-World Bank Development Committee Independent Evaluation Office Managing Director Deputy Managing Directors 7 Board of Governors Highest policy making body of the IMF: All powers “not conferred directly on the Board of Governors, the Executive Board or the Managing Director shall be vested in the Board of Governors” (Article XII, §2(a)) One governor and one alternate governor appointed by each member May delegate to the Executive Board the exercise of any of its powers, except those directly conferred to it Usually finance ministers or central bank heads Weighted voting--cast the number of votes allotted to the member appointing him Governors elect one of the governors as chairman Not in continuous session; meets once a year—Annual Meetings May establish committees (e.g., International Monetary and Financial Committee (IMFC), joint World Bank-IMF Development Committee) 8 The Executive Board Responsible for conducting the business of the IMF and for exercising the powers delegated to it by the Board of Governors Sits in continuous session, meeting as often as the business of the IMF may require 24 Executive Directors with the Managing Director as the Chairman 5 appointed by the 5 members with the largest quotas (currently US, Japan, Germany, UK and France) and 19 elected by the other members The elected Directors serve for two-year terms Board of Governors, by an 85 percent majority of the total voting power, may increase or decrease the number of Executive Directors in the second category Each director shall appoint an alternate Weighted voting structure - each Executive Director casts the number of votes allotted to members that he or she represents. Most decisions of the Executive Board require only a simple majority of the votes cast; some require either 70% or 85% of the total voting power Voting is rare - most decisions are taken by consensus. The Chairman ascertain the sense of the meeting in lieu of a formal vote. Any Executive Director may require a formal vote. 9 The Managing Director, Staff, Independent Evaluation Office Chairman of the Executive Board and chief of the operating staff Selected by the Executive Board Conducts ordinary business of the IMF under the direction of the Executive Board May not be selected from among the governors or the Executive Directors Term of 5 years, but shall cease to hold office when so decided by the Executive Board Subject to general control of the Executive Board, responsible for organization, appointment and dismissal of staff Staff of the IMF are International civil servants Independent Evaluation Office (IEO). Conducts objective and independent evaluations on issues relevant to the Fund’s mandate. 10 3. Financial structure Sources of Fund financing: (a) members’ quota subscriptions (currently about $305 billion); (b) borrowing to supplement the resources available from quotas (e.g., General Arrangements to Borrow (GAB) since 1962; New Arrangements to Borrow (NAB) in 1997); (c) Income from investments (Article XII, Section 6(f)(i)). (a) Members’ quotas Each member of the Fund is assigned a quota which broadly determined by its economic position relative to other members (economic considerations include the member’s GDP, volume of current account transactions, and official reserves) Determines a member’s : (i) maximum financial commitment to the IMF, (ii) voting power in the IMF, (iii) size of its access to financial resources and (iv) share in any allocation of “Special Drawing Rights” (SDR) Quotas are reviewed every 5 years to determine whether any adjustments are needed in light of the growth of the world economy and changes in individual countries’ economic positions. The Thirteenth general review is to be completed by January 30, 2008. 11 Members must pay subscription equal to their quotas. Up to 25 percent must be paid in reserve assets specified by the IMF (foreign currencies acceptable to the IMF or SDRs); the balance may be paid in the member’s own currency Voting power of each member Each member has 250 votes (referred to as “basic votes”) plus one vote per 100,000 SDRs of quota. Significance of the basic votes have diminished from their original level of 11 percent of total votes to approximately 2 percent because of quota increases A member’s quota cannot be changed without its consent (Article III, Section 2(d)) If a member consents to a reduction of its quota, the Fund shall within 60 days pay to the member an amount equal to the reduction (Article III, Section 3(c)) Over time some member’s quota’s and representation in the Fund got out of line with the members’ relative positions in the world economy. Thus the need for reform of quota and voice. 12 IMF members with largest quota shares (as of April 2007) Member Quota share (%) Votes (% of total) United States 17.14 16.83 Japan 6.14 6.04 Germany 6.00 5.90 France 4.95 4.87 United Kingdom 4.95 4.87 Italy 3.26 3.21 Saudi Arabia 3.22 3.17 China 3.73 3.67 Canada 2.94 2.89 Russia 2.74 2.70 13 4. Functions of the IMF Purposes stated in Article I translate into three main functions: (a) surveillance, (b) financial assistance, (c) technical assistance (a) Surveillance Legal Basis: Article IV of the Articles of Agreement “Obligations Regarding Exchange Arrangements”. Article IV focuses on exchange arrangements and exchange rates. Article IV, Section 1 requires members to “collaborate with the Fund and other members to assure orderly exchange arrangements and to promote a stable system of exchange rates” and requires each member to: Direct its economic and financial policies toward the objective of fostering orderly economic growth Seek to promote stability by fostering orderly underlying economic and financial conditions and an orderly monetary system Avoid manipulating exchange rates or the international monetary system in order to prevent effective balance of payments adjustment or gain an unfair competitive advantage Follow exchange policies compatible with the undertaking of the above The purpose of surveillance is to enable the Fund to oversee (i) the international monetary system to ensure its effective operation (multilateral surveillance, e.g., World Economic Outlook, Global Financial Stability Report, multilateral consultations) and (ii) member’s’ compliance with the obligations specified under Article IV, Section 1 (bilateral surveillance). 14 Under Article IV, Section 2 members have the right to have exchange arrangements of their choice consistent with the purposes of the Fund and the obligations under Article IV, Section 1. Each members shall notify the Fund of its exchange arrangements and of any changes in exchange arrangements. Under Article IV, Section 3, the Fund must “exercise firm surveillance over the exchange rate policies of members and shall adopt specific principles for the guidance of all members with respect to those policies: principles provide by the Fund shall respect the domestic social and political policies of members, and in applying these principles the Fund shall pay due regard to the circumstances of members. Principles for the guidance of members’ policies were adopted by the Board, Decision - Decision No. 13919-(07/51), adopted on June 15, 2007, on Bilateral Surveillance Over Member's Policies, replaced the 1977 Decision. The Fund conducts surveillance on an ongoing basis, including through regular reviews of member’s economic policies, known as Article IV consultations. Increasingly, Article IV consultation reports are published. Members shall provide information to the Fund as required under Article IV, Section 3 and Article VIII, Section 5. In practice, the Fund has relied on Article VIII to obtain information. 15 (b) Financing Article I(v) – “To give confidence to members by making the general resources of the Fund temporarily available to them under adequate safeguards, thus providing them with opportunity to correct maladjustments in their balance of payments...” IMF financing can only be provided to deal with balance of payments problems; cannot be provided for other purposes or specific projects. The requested use of the resources must be consistent with the provisions of the Articles and policies adopted under the Articles. IMF financing from the GRA does not take the form of loans, but rather the member receiving assistance “purchases” the currencies of other members that have strong balances of payments positions or SDRs with its own currency. Fund arrangements are not international agreements. IMF’s resources are only meant for temporary use (“revolving” character) – a member is required to repurchase its currency within a specified period of time. IMF financing is provided under adequate safeguards Only if a member is prepared to take the steps necessary to address its balance of payments difficulties Achieved through the member implementing a program of economic reform that deals with problem Member can purchase the reserve tranche subject to representation of balance of payments need which cannot be challenged ex-ante by the Fund and free from conditionality, charges, or repurchase obligations 16 IMF financing is subject to access limits – provided on the basis of quota and the amount of access is normally subject to maximum limits specified by the IMF IMF makes financial resources available to members in accordance with policies it adopts. Special policies may be adopted for special balance of payment problems to assist members to solve their problems in a manner consistent with the provisions of the Articles of Agreement (Article V, Section 3). Examples of policies: policy on standby arrangements, extended Fund facility, supplemental reserve facility, emergency natural disaster and emergency post conflict assistance). A member can walk away from the arrangement/program and repay outstanding Fund resources at any time. Conditionality seeks to ensure that IMF resources are provided to assist the member in resolving its balance of payments problems in a manner that is consistent with the Articles and establishes adequate safeguards for the temporary use of IMF resources. Principle of uniform treatment - the use of IMF resources is based on the uniform and nondiscriminatory treatment of members. Members must provide the Fund with information necessary for it to carry out its functions (Article VIII, Section 5). The Fund also provides concessional financing to qualifying members under the Poverty Reduction and Growth Facility (PRGF) and Exogenous Shocks Facility (ESF). 17 Some other obligations under the Articles of Agreement Article V, Section 3(e): Obligations to ensure exchange of members’ currencies for freely usable currencies Article VIII, Section 5: Obligation to Furnish Information . The IMF relies on information provided by members in order to carry out its mandate and functions effectively. IMF acts “as a centre for the collection and exchange of information on monetary and financial problems”. The procedures for obtaining data from members are founded on a cooperative approach and trust in members to provide the required information accurately. Information is important for effective surveillance and ensuring that the IMF’s resources are used for their intended purposes. Section 5(a) requires members to provide the IMF with the information “necessary” for its activities; thus Article VIII, Section 5 applies both in the context of use of the IMF resources and surveillance. The required minimum of data is listed in Article VIII, Section 5. The list was expanded by Executive Board Decision No. 13183-(04/10), January 4, 2004 on Strengthening the Effectiveness of Article VIII, Section 5 18 Obligation to provide information is continuous, not just limited to provision of data at time of Article IV consultations Obligation is not absolute, must take into account varying abilities of members to provide information—defense of capacity; “benefit of any doubt” given to member in assessing its ability to provide information (Article VIII, Section 5(b)): Section 5(b) only calls for information to be furnished “in as detailed and accurate a manner as is practicable and, so far as possible, to avoid mere estimates”. Not in such detail that affairs of individuals or corporations are disclosed. International investment position (IIP): so far as it is possible to furnish this information. No breach of obligation if failure to provide information/accurate information is due to lack of capacity. Whether a member has capacity is determined on a case-by-case basis. Members have an ongoing obligation to improve their reporting systems and the accuracy of information provided. Section 5(c) deals mostly with the IMF’s authority to enter into voluntary arrangements with members “to obtain further information”. 19 Article VIII, Section 2: members shall not, without the approval of the Fund, impose restrictions on the making of payments and transfers for current international transactions Payments for current transactions means payments which are not for the purpose of transferring capital (Article XXX) The Fund may approve exchange restrictions and multiple currency practices under certain circumstances (e.g., if necessary (imposed for BOP reasons), temporary and non-discriminatory, if imposed for national security reasons) Article VIII, Section 3: members shall not, without Fund’s approval, engage, or permit any of its fiscal agencies to engage in, any discriminatory currency arrangements or multiple currency practices. Exception – transitional arrangements under Article XIV. Article VIII, Section 4: obligation on convertibility of foreign-held balances Article XIV allows members to avail themselves of transitional arrangements before accepting obligations of Article VIII, Sections 2,3 and 4. A member may “maintain and adapt to changing circumstances the exchange restrictions that were in effect on the date on which it became a member” but should make efforts to remove those restrictions as soon as they can. 20 Article VIII, Section 7: members shall collaborate with the Fund and with other members to ensure that the members’ policies with respect to reserve assets shall be consistent with the objectives of promoting better international surveillance of international liquidity Article IX: members shall grant certain privileges and immunities to the Fund, its officers and employees, premises, property, assets and archives Article XI: relations with non-members. Members cannot engage in transactions or cooperate with non-members or with persons in nonmember territories if such transactions or cooperation is contrary to the provisions of the Articles of Agreement Article XII, Section 8: the Fund may, by a 70 percent majority of the total voting power, decide to publish a report made to a member regarding its monetary or economic conditions and developments which directly tend to produce a serious disequilibrium in the international balance of payment of members. 21 (c) Technical assistance Services provided under Article V, Section 2(b) shall not impose any obligation on a member without its consent Administration of the Poverty Reduction and Growth Facility and Exogenous Shocks Facility (PRGF-ESF) Trust (1987) and PRGF-HIPC Trust are examples of financial services provided under this Article The PRGF is a concessional lending facility for low-income members (annual interest rate of 0.5 percent, loan maturity stretching from five-and-a-half to 10 years) Resources from the PRGF-HIPC Trust are used for debt relief operations Other examples of technical assistance: in fiscal area (drafting of tax or budget legislation); in statistics (helping to set a framework for collection and analysis of data); banking sector reform (banking laws, supervision matters, financial sector restructuring); law reform (judicial reform). Mainly in support of private sector development. Reports on Observance of Standards and Codes (ROSCs): summarize countries’ observance of certain internationally recognized standards and codes. The Fund has recognized 12 areas and associated standards: accounting; auditing; anti-money laundering and countering the financing of terrorism (AML/CFT); banking supervision; corporate governance; data dissemination; fiscal transparency; insolvency and creditor rights; insurance supervision; monetary and financial policy transparency; payments systems; securities regulation; and AML/CFT; are prepared and published at the request of the member country. 22 Financial Sector Assessment Program (FSAP): a joint IMF and World Bank effort introduced in May 1999 aimed at increasing the effectiveness of efforts to promote the soundness of financial systems in member countries. The FSAP forms the basis of Financial System Stability Assessments (FSSAs), in which IMF staff address issues of relevance to IMF surveillance, including risks to macroeconomic stability stemming from the financial sector Current challenge – better incorporate financial sector work into Fund surveillance Technical services are provided by the IMF staff under the authority of the Managing Director 23 Questions? Comments? nrendak@imf.org Tel. +1 (202) 623-4104 Fax: +1 (202) 623-4331 24