Government Policies Toward the Foreign Exchange Market

advertisement

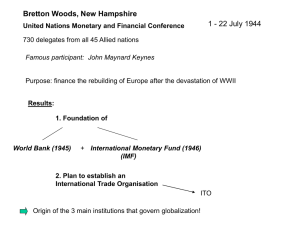

International Monetary Fund The Bretton Woods System • Create a set of rules that would maintain fixed exchange rates in the face of short-term fluctuations; • Guarantee that changes in exchange rates would occur only in the face of long-term, persistent deficits or surpluses in the balance of payments; • Ensure that when such changes did occur, they would not spark a series of competitive devaluations. International Monetary Fund The International Monetary Fund (IMF) The IMF was intended to play two major roles in the Bretton Woods System: • the Fund should discourage aggressive exchange rate behavior by members and help them manage their balance of payments efficiently; • the Fund was given resources to lend international reserves to countries with balance of payments difficulties. International Monetary Fund The Quota System The IMF is financed by its members. Upon joining the IMF, a nation has to subscribe to a Quota, which is based on its relative economic significance and the level of its international business activities. The size of the member’s quota determines the country’s voting power and borrowing rights. International Monetary Fund The Quota System • Voting Power – 250 “basic votes” plus one vote for each SDR100,000 of quota. • Borrowing Rights – Unconditional Borrowing Rights – Conditional Borrowing Rights International Monetary Fund IMF Credit Facilities • • • • • • Stand-By Arrangements (SBA) Extended Fund Facility (EFF) Supplemental Reserve Facility (SRF) Contingent Credit Lines (CCL) Compensatory Financing Facility (CFF) Poverty Reduction and Growth Facility (PRGF) International Monetary Fund Functions of the IMF • • • • The Bretton Woods System was officially abandoned in 1973. With the collapse of the system, the IMF’s functions changed to Policy Cooperation; Share Expertise; Financial Assistance; and Help the World’s Poorest Countries International Monetary Fund Structural Adjustment Programs • • • • • Cut Social Spending; Shrink Government; Increase Interest Rates; Eliminate Tariffs; Eliminate Regulations on Foreign Ownership of Resources and Businesses; • Cut Subsidies for Basic Goods; and • Re-orient Economies from Subsistence to Exports International Monetary Fund The Special Drawing Right (SDR) The Special Drawing Right (SDR) is an international reserve asset created by the IMF to supplement existing reserves. It is valued on the basis of a basket of five currencies and can be used in a wide variety of transactions and operations among official holders. International Monetary Fund Valued Gateway Client: Valued Gateway SDR Valuation Euro Currency Amount (Rule O-1) 0.4260 Exchange Rate as of Sep 20, 04 1.213200 U.S. Dollar Equivalent 0.516823 Yen 21.0000 0.009104 0.191257 Pound 0.0984 1.783000 0.175447 U.S. $ 0.5770 1.000000 0.577000 Currency $ Value of SDR1 1.460527