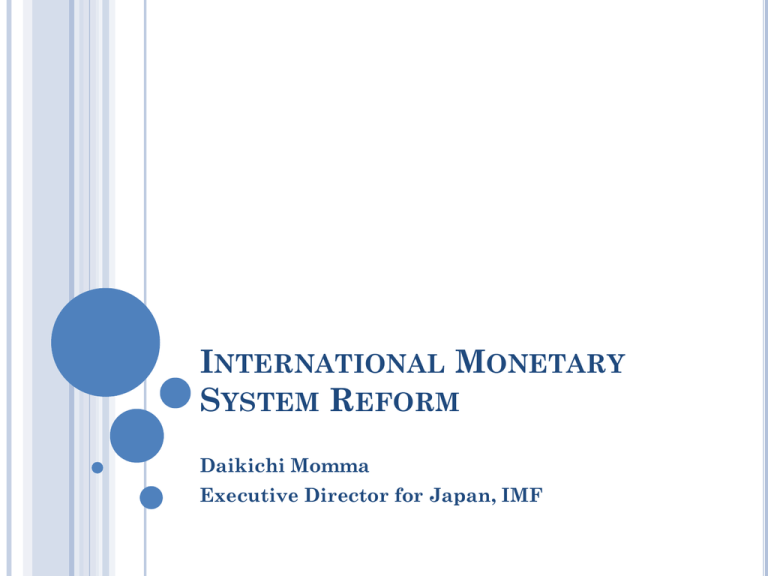

Panel 4, Daikichi Momma | International Monetary System Reform

advertisement

INTERNATIONAL MONETARY SYSTEM REFORM Daikichi Momma Executive Director for Japan, IMF INSTABILITY OF CURRENT IMS Frequent Crises Persistent current account imbalances and exchange rate misalignments Volatile capital flows and currencies FOUR ROOT CAUSES Inadequate global adjustment mechanisms Lack of comprehensive oversight framework for cross-border capital flows Inadequate systemic liquidity provision Supply of safe assets/currencies REFORM AVENUES TO REFORM IMS Policy collaborations Monitoring and management of capital flows Financial safety nets Financial deepening and internationalization of currencies POLICY COLLABORATIONS IMFC/IMF Article-IV Consultations Spillover reports G20 Framework for strong, sustainable, and balanced growth ASEAN + 3 (China, Korea and Japan) AMRO (Macroeconomic Research Office) Bilateral Economic policy Talks Japan-Korea, Japan-China…… MONITORIING AND MANAGEMENT OF CAPITAL FLOWS Capital inflows to emerging markets can easily be reversed Monitoring and analysis of the cause of capital inflows is useful to prepare and prevent potential massive and sudden reversals low global interest rates, high tolerance for risk debt is creating net flows or equity-creating debt Identify sources of systemic risk (FSB) Capital flow management / Macro prudential measures FINANCIAL SAFETY NETS Global IMF Double size of quota resources (US$734 billion) NAB (US$570B) Bilateral loans to IMF (US$461B) Precautionary Facilities (FCL, PLL and HAPA SBA) Regional (Europe, Chiang Mai Initiative Multilateral) Double size (US$240 billion) Precautionary Facilities De-link from IMF 20%30%40% Bilateral currency swap Japan-Korea (US$70billion), etc. FED, ECB and BOJ currency swaps Indonesia stand-by loans (WB, ADB, Japan and Australia) FINANCIAL DEEPENING Countries with deeper domestic financial markets liquid, long-term domestic currency bond markets Asian Bond Markets Initiative ABMF (Asian Bond Market Forum) CGIF (Credit Guarantee and Investment Facility) Sound financial supervision and regulatory frameworks CURRENCY INTERNATIONALIZATION Merits: Reduce exchange risks to trade, borrow and invest Demerits: Key currency countries should supply enough liquidity of money Monetary policy difficult Japanese Experience 1980~ Exports 40% Imports 25% Demand elasticity relative to prices (North America) Natural resources ( Oil, LNG etc) Japan-China Financial Collaboration Yen-Yuan direct exchange market