Commanding Heights: Globalization & Asian Contagion Notes

advertisement

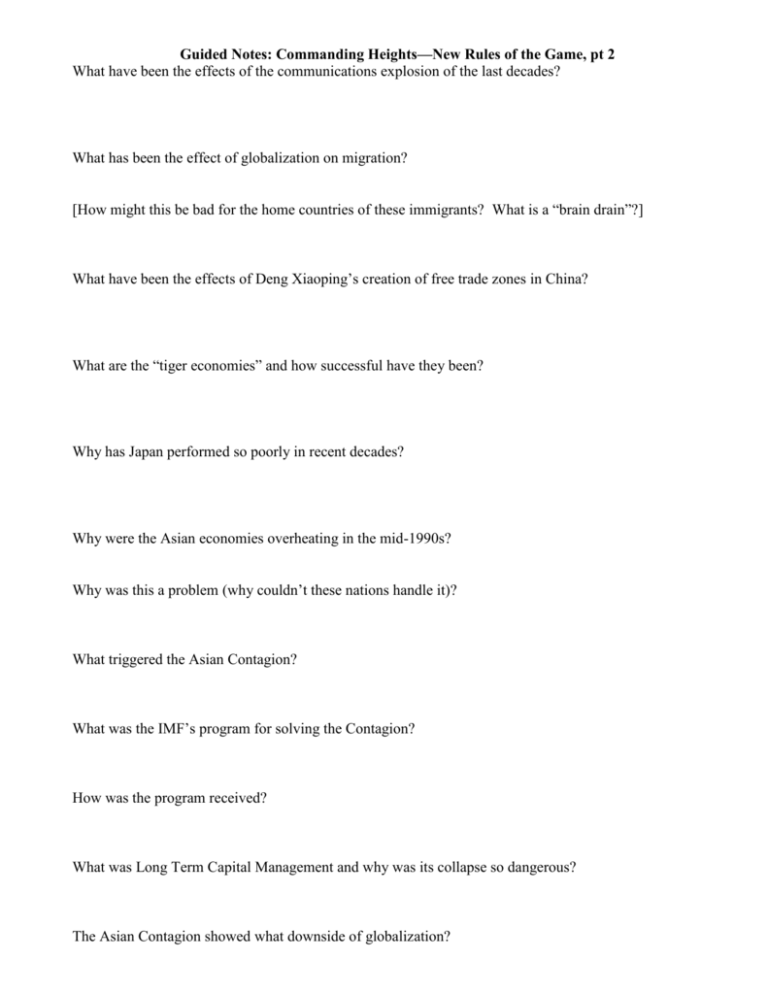

Guided Notes: Commanding Heights—New Rules of the Game, pt 2 What have been the effects of the communications explosion of the last decades? What has been the effect of globalization on migration? [How might this be bad for the home countries of these immigrants? What is a “brain drain”?] What have been the effects of Deng Xiaoping’s creation of free trade zones in China? What are the “tiger economies” and how successful have they been? Why has Japan performed so poorly in recent decades? Why were the Asian economies overheating in the mid-1990s? Why was this a problem (why couldn’t these nations handle it)? What triggered the Asian Contagion? What was the IMF’s program for solving the Contagion? How was the program received? What was Long Term Capital Management and why was its collapse so dangerous? The Asian Contagion showed what downside of globalization? IMF and World Bank: What's the Difference? Bruce Gottlieb Oct. 8, 1998, Slate.com <http://slate.msn.com/id/1001979/> The job of the International Monetary Fund is to protect international trade. The World Bank's is to promote economic development. Both institutions were created at an international conference held at Bretton Woods, NH in June 1944. Both are controlled and financed by member nations (about 180 of them), with larger nations coughing up more money and having greater say in decision-making. The IMF's primary responsibility is preventing or minimizing international trade crises. When a country buys more goods abroad than it sells abroad, it must borrow foreign currency to cover the difference. (This is the trade deficit. It is different than national debt, which is when a government spends more than it raises through taxes). Many nations, including the U.S., run trade deficits and it's not a crisis. Investors are willing to loan money to healthy countries because they are confident they'll eventually be paid back. It's only a crisis when international investors lose faith and stop lending money. The nation needs the money to repay its loans and to pay for imported goods. It reneges on its loan payments and slashes its imports. The disease spreads as banks go under, other countries lose export business, they renege.... This is the disaster scenario the IMF is supposed to prevent. The IMF has a pool of almost $200 billion which it may loan to debtor nations at slightly below market rates. The IMF conditions a loan on reforms intended to enable the debtor to pay off its debts, which means earning more foreign currency than it spends, which means turning the trade deficit into a surplus. In other words, the price of a rescue from the IMF is to stop getting more from the rest of the world than you give, and to start giving more than you get. That is why the IMF is often unpopular. The World Bank's job is to help less-developed countries [LDCs] become less less-developed. The Bank also has a pool of around $200 billion, which it also loans to countries. But the World Bank loans are for development projects, not for trade stabilization. The idea is that they will be able to pay off the loans by making themselves more economically productive. The countries use the money to build roads, schools, clinics, irrigation systems, and so on. That is why the World Bank is generally popular. John Maynard Keynes--the intellectual architect of the system-- thought the Fund should be called a bank and the Bank should be called a fund.