Chapter 4 Part 2 - University of New Mexico

advertisement

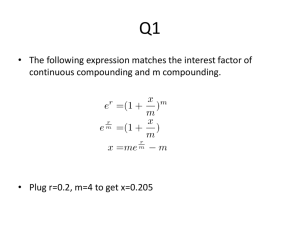

MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Semiannual & Other Compounding Periods What do you do for other than annual compounding? Annual Compounding: Not often used in business/finance world; but it's easier to introduce compounding/discounting with this compounding period Semiannual Compounding: Used most often in bonds Quarterly Compounding: Often used by banks for business loans. Monthly Compounding: Used most often by banks for consumer loans and investments (CD's); also used in short-term bonds (< 1 yr); very common with leases Daily Compounding: Used by banks to lend/borrow from each other for very short terms (days & weeks) Continuous Compounding: Used in mathematical models of various, really complicated financial concepts (i.e. duration, convexity, pricing an option contract, interest rate options & swaps, etc.) 1 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Semiannual & Other Compounding Periods (continued) Example: Calculate the FV of $100 invested for 2 years at 8% if interest is compounded annually and semiannually Nominal Interest Rate ( rnominal ): This is often what people quote as your interest rate for loans and bank accounts and credit cards and bonds. It is also called the quoted rate It must also be accompanied by a statement indicating the compounding frequency In the example above the nominal or quoted interest rate is 8% Annual: rnominal= 8%, compounded annually Semiannual: rnominal = 8%, compounded semiannually Periodic Rate: this is the rate charged per compounding period. periodic Rate = rperiodic = rnominal / m (Learn & know this!) m is the number of compounding/payment periods per year in the example above…… m = 1 for the annual case m = 2 for the semiannual case In the above example, the periodic rates are: Annual: 8% Semiannual: 4% Example: A $1,000 face value bond has a coupon rate of 6.0000% per year but it pays interest semiannually. How much interest is earned each interest paying period? 1) Compute the periodic rate: rperiodic = rnominal / m = 6.0000%/2 = 3.0000% 2) Compute the interest payment: PMT = Principle x Interest rate = $1000 (0.03) = $30.00 These two steps can be combined: PMT = Principle(Interest2 Rate / m) MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Semiannual & Other Compounding Periods (continued) Using FV and PV formulas with other-than-annual compounding: FV = PV(1 + rnominal/m)n PV = FV / (1 + rnominal/m)n Example(repeated): Calculate the FV of $100 invested for 2 years at 8% if interest is compounded annually and semiannually FV = ? Annual Case: r = 8% 0 1 2 T = # of years = 2 m = # of periods per year = 1 n = total # of periods = m x T = 1 x 2 = 2 100 Formula: FV = PV(1 + rnominal/m)n = $100(1 + 0.08/1)2 = $116.64 Financial Calculator: Enter parameters: Clear TVM registers [2nd, CLEAR TVM] Set payments per year = 1; [2nd, P/Y, 1, ENTER, CE/C] Enter number of periods [2, N] Enter PERIODIC interest rate [8, I/Y] Enter PV [-100, PV] Find FV [CPT, FV] and voila! FV = $116.64 3 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Semiannual & Other Compounding Periods (continued) Semiannual Case: 1 r = 8% 0 FV = ? 1 100 2 3 2 years 4 compounding periods T = # of years = 2 m = # of discounting per year = 2 n = total # of periods = m x T = 2 x 2 = 4 Formula: FV = PV(1 + rnominal/m)n = $100(1 + 0.08/2)4 = $116.99 Financial Calculator: Option 1 for Semiannual Case: Enter parameters: 1) Find rperiodic: rnomianl/m = 8%/2 = 4% 2) Enter parameters Clear TVM registers [2nd, CLEAR TVM] Leave payments per year = 1;[2nd, P/Y, 1, ENTER, CE/C] Enter number of periods [4, N] Enter PERIODIC interest rate [4, I/Y] Enter PV [-100, PV] Find FV [CPT, FV] and voila! FV = $116.99 Option 2 for Semiannual Case: 1) Set payments per year = 2; [2nd, P/Y, 2, ENTER, CE/C] 2) Enter parameters: Enter number of periods [ 4 , N] Enter NOMINAL interest rate [8, I/Y] Enter PV [-100, PV] Find FV [CPT, FV] and voila! FV = $116.99 4 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Semiannual & Other Compounding Periods (continued) Example:(extended) Calculate the FV of $100 invested for 2 years at 8% if interest is compounded quarterly and monthly Quarterly Case: FV = ? 1 r = 8% 0 1 2 3 4 5 $100 6 7 2 years 8 compounding periods T = # of years = 2 m = # of discounting per year = 4 n = total # of periods = m x T = 4 x 2 = 8 Formula: Financial Calculator: 5 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Semiannual & Other Compounding Periods (continued) Example: (continued) Monthly Case: FV = ? r = 8% 2 0 0 1 2 3 $100 4 5 years compounding periods 24 22 23 T = # of years = 2 m = # of discounting per year = 12 n = total # of periods = m x T = 12 x 2 = 24 Formula: Financial Calculator: 6 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Semiannual & Other Compounding Periods (continued) Find PV of an Annuity Example: An ordinary annuity pays $50 semiannually for two years. If the current market interest rate for this annuity is 4%, what is it worth today? rsimple = 4% rperiodic = ? 0 50 50 50 50 1 2 3 4 50 50 50 50 1 2 3 4 PV = ? 0 CF1/(1 + r/m)1 CF2/(1 + r/m)2 CF3/(1 + r/m)3 CF4/(1 + r/m)4 Formula: PV = CF1/(1 + r/m)1 + CF2/(1 + r/m)2 + CF3/(1 + r/m)3 + CF4(1 + r/m)4 = 50/(1 + 0.04/2)1 + 50/(1 + 0.04/2)2 + 50/(1 + 0.04/2)3 + 50/(1+0.04/2)4 = 50/(1.02)1 + 50/(1.02)2 + 50/(1.02)3 + 50(1.02)4 = 50/1.02 + 50/1.0404 + 50/1.0612 + 50/1.0824 = 49.0196 + 48.0584 + 47.1161 + 46.1923 = $190.39 7 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Semiannual & Other Compounding Periods (continued) Example (continued): rsimple = 4% rperiodic = ? 0 50 50 50 50 1 2 3 4 PV = ? T = # of years = 2 m = # of discounting per year = 2 n = total # of periods = m x T = 2 x 2 = 4 Financial Calculator: 8 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Semiannual & Other Compounding Periods (continued) Find the Yield (r, k, i, ROR, etc.) of an Annuity Example: An ordinary annuity paying $100 every quarter for 2 years is currently selling for $765.17. What return is this security yielding? 100 m=4 n=8 100 100 100 100 100 100 100 2 3 4 5 6 7 8 r=? 0 1 T = # of years = 2 m = # of discounting per year = 4 n = total # of periods = m x T = 4 x 2 = 8 $765.17 Option 1: 1) Clear your calculator: [2nd, CLEAR TVM] 2) Leave payments per year to 1: [2nd, P/Y, 1, ENTER, CE/C] 3) Enter parameters: Note: One of the two cash inputs Enter N [8, N] Enter PV [- 765.17, PV] must be negative Enter Pmt [100, PMT] Find I/Y, [CPT, I/Y] and voila! I/Y = 1% This is rperiodic! 4) Find iquoted/nominal: rperiodic = rsimple / m rsimple = rperiodic x m = 1% x 4 = 4% Option 2: 1) Set payments per year to 4: [2nd, P/Y, 4, ENTER, CE/C] 2) Enter parameters: Note: One of the two cash inputs Enter N [8, N] Enter PV [- 765.17, PV] must be negative Enter Pmt [100, PMT] Find I/Y, [CPT, I/Y] and voila! I/Y = 3.9997% = 4% 9 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Effective Annual Rate (EAR) or EFF% (Calculator Symbol) (From Ch 5) Financial institutions have to tell us the interest rate they charge for loans or the interest rate they pay when you invest with them As stated before, the rate they often tell you is called the nominal interest rate or the quoted interest rate This is an annual rate (i.e. 12% per year) They must also tell you the compounding rate (i.e. daily, weekly, monthly, semiannually, annually, bi-annually, etc.) The examples we previously covered showed us that an investment earns more money when the compounding rate is more frequent FV of $100 @ 8% compounded annually, 2 yrs: $116.64 FV of $100 @ 8% compounded semiannually, 2 yrs : $116.98 FV of $100 @ 8% compounded quarterly, 2 yrs : $117.17 FV of $100 @ 8% compounded monthly, 2 yrs : $117.29 The nominal rate is no help in mathematically expressing the power of compounding The EAR expresses an interest rate that compounds more than once per year. This is the actual rate of return being earned or paid per year, when compounding is factored in. EAR (EFF%) = ( 1 + rnominal / m )n - 1 m = number of compounding/discounting periods per year n = the total number of compounding periods in question; in most cases, this will be the same as “m” since you’re usually dealing with an annual return EAR is also the annual ROR; the profit is recognized once per year at the end of the year 10 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Effective Annual Rate (EAR) or (EFF%) (continued) The examples we previously covered showed us that an investment earns more money when the compounding rate is more frequent. This means that the effective rate of return or effective annual rate (EAR) is greater than the nominal rate when there is more than one interest payment (compounding period) per year. FV of $100 @ 8% compounded annually, 2 yrs: $116.64 EAR = 8% Note: EAR for annual compounding = rnominal FV of $100 @ 8% compounded semiannually, 2 yrs : $116.98 EAR = 8.16% FV of $100 @ 8% compounded quarterly, 2 yrs : $117.17 EAR = 8.24% FV of $100 @ 8% compounded monthly, 2 yrs : $117.29 EAR = 8.30% In the last 3 cases, the effective annual rate of return is greater than the quoted/nominal rate of return. The Effective Annual Rate is also referred to as the Annual Percentage Yield (APY) or Effective Annual Yield (EAY) by banks and some investment companies 11 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Effective Annual Rate (EAR) or (EFF%) (continued) Example: $400 dollars is deposited in a checking account that pays 5% interest compounded monthly. What is the effective annual rate? Option 1: Formula Solution EAR (EFF%) = ( 1 + rnominal / m )n - 1 = ( 1 + 0.05/12)12 - 1 = ( 1.004167)12 - 1 = 1.051162 - 1 = 5.1162% Option 2: Calculator Financial Function Solution 1) Access interest rate conversion worksheet [2nd, ICONV] 2) Enter rnominal [5, ENTER] 3) Enter # of payments/compounding periods [↓, ↓, 12, ENTER] 4) Find EFF [↓, ↓, CPT] and viola! EFF% = 5.1162% Another way to look at EAR, an Empirical Demonstration: Example: $400 dollars is deposited in a checking account that pays 5% interest compounded monthly. Find FV after 1 year using iperiodic and EAR. a. Find FV using rperiodic: 1) Find rperiodic: 5% / 12 = 0.4167% 2) Enter parameters: Enter number of periods [ 12, N] Enter periodic interest rate [ 0. 4167 , I/YR] Enter PV [-400, PV] Find FV, [CPT,FV] and voila! FV = $420.47 b. Find ROR: Profit = $420.47 - $400 = $20.47 ROR = $20.47 / $400 = 0.0512 = 5.1162% = EAR 12 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Effective Annual Rate (EAR) or (EFF%) (continued) Empirical Demonstration of EAR: (continued) Find FV using EAR: 1) Find EAR (EFF%): 5.1162% (as per above example) 2) Enter parameters: Enter number of periods [2nd, P/Y, 1, ENTER, CE/C] Enter N [1, N] Enter periodic interest rate [5.1162, I/Y] Enter PV [-400, PV] Find FV, [CPT,FV] and voila! FV = $420.46 Another Example: If a security earns 6% p.a. with monthly compounding, what would be the total ROR if the security is held for 2 years? EAR (EFF%) = ( 1 + rnominal / m )n – 1 (n = the total # of compounding periods = 2 yrs x 12 per/yr = 24 per.) = ( 1 + 0.06/12)24 - 1 = ( 1.0050)24 - 1 = 1.127160 - 1 = 12.7160% 13 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Note: You can use EAR (EFF%) to solve Annuities but you must “annualize” the payments Example Using EAR: An ordinary annuity paying $100 every quarter for 2 years is currently yielding 5%. What is the fair market value of this security yielding? 100 100 100 100 100 100 100 100 r = 5% 0 1 2 3 4 5 6 7 8 T = # of years = 2 m = # of discounting per year = 4 n = total # of periods = m x T = 4 x 2 = 8 PV? 1) Annualize the payments: Find the FV of 4 payments of $100 @ 5% a) Find rperiodic: rnominal / m = 5%/4 = 1.25% b) Find FV Enter number of periods [ 4, N] Enter periodic interest rate [ 1.25 , I/Y] Enter PMT [100, PMT] Press FV, [CPT,FV] and voila! FV = $407.56, Interpretation: 4 quarterly pymts of $100 @ 5% equal one annual payment of $407.56 407.56 407.56 The CF diagram now looks like this: 1 rnominal = 5% 0 reffective = ? 1 2 3 4 2 years 5 6 PV? Example Using Ear (continued) 2) Find EAR Access interest rate conversion worksheet [2nd, ICONV] Enter isimple [5, ENTER] Enter # of payments/compounding periods [↓, ↓, 4, ENTER] Find EAR (EFF%): [↓, ↓, CPT] and viola! EFF% = 5.0945% 3) Find PV Set payments per year to 1: [2nd, P/Y, 1, ENTER, CE/C] Enter number of periods [2, N] Enter EFF% [5.0945, I/Y] Enter Annualized PMT [407.56, PV] Find PV, [CPT,PV] and voila! FV14= -$756.81 7 8 qtrs MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Why should you care about EAR? Answer: It’s used as a basis of comparison to choose the best rsimple/nominal/quoted between investment/loan options that have different payment frequencies Example: You are considering two different stock mutual funds in which to invest. Fund A offers 8.5808% APR rate of return with quarterly reinvestment of profits. Fund B offers a 8.5410% APR rate of return with monthly reinvestment of profits. Which fund is more profitable? Fund A: 2nd, INCONV, 8.5808%, ENTER, ↓, ↓, 4, ENTER, ↓, ↓, CPT: 8.8609% Fund B: 2nd, INCONV, 8.5410%, ENTER, ↓, ↓, 12, ENTER, ↓, ↓, CPT: 8.8834% Fund B is more profitable Example: Your company needs to borrow $100,000.00 for a warehouse modification. You have received five different quoted rates (rates and compounding periods per year are shown below). Which one should you choose? Answer: Compute the EAR for each quoted rate. The one with the lowest EAR is the lowest annual rate of cost. r (APR) # of Com pounding Periods per Year EFF% 6.350% 1 6.350% 6.238% 2 6.335% 6.223% 4 6.370% 6.187% 12 6.365% 6.177% 52 6.368% 15 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Find the Annual ROR, given a Total Return Example: Your broker proposes an investment scheme that will pay you $1000 two years from now for an initial cost of $900 today. The investment promises a total return of 11.11%. What is the annual rate of return on this investment? ROR (per annum) = (1 + RORtotal)1/n – 1 = (1 + 0.1111)1/2 – 1 = (1.1111)1/2 – 1 = 1.054093 – 1 = 0.054093 = 5.4093% Annual Percentage Rate (APR) This is the rate reported (as required by law) to borrowers. (Look at your mortgage or auto loan paper work) There are several different formulas to compute APR and they result in different numbers But for all practical purposes, APR = rquoted since it is the rate that the financial institution will quote you APR EAR 16 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Uneven Cash Flows $500 m=1 $300 $250 0 r = 4% 1 $200 2 3 PV = ? 4 5 FV = ? (-) $150 (-) $450 General Equations PV = CF0 + CF1/(1 + r/m)1 + CF2/(1 + r/m)2…+ CFn/(1 + r/m)n FV = CF0(1 + r/m)n + CF1(1 + r/m)n-1 + CF2(1 + r/m)n-2 ….+ CFn Formula Solution PV = -450 + 300/(1.04) + 250/(1.04)2 + -150/(1.04)3 + 200/(1.04)4 + 500/(1.04)5 = -450 + 300/(1.04) + 250/(1.08499) + -150/(1.1248) +200/(1.1698) + 500/(1.2166) = -450 + 288.4615 + 230.4169 - 133.3570 + 170.9694 + 410.9814 = $517.47 FV = Left as an exercise for the student 17 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Present Value of Uneven Cash Flows Example: You are tasked with estimating the fair market value of a security that promises uneven future payments. The table below shows the quarterly payment schedule (each cash flow occurs at the end of the quarter). You consider 7.2000% APR to be the appropriate opportunity cost. What is the theoretical value of this security? 700 300 400 1 yr 0 1 2 3 4 Formula Solution: 500 1 2 PV = CF1/(1 + r/m) + CF2/(1 + r/m) + CF3/(1 + r/m)3 + CF4(1 + r/m)4 = 300/(1 + 0.072/4)1 + 400/(1 + 0.072/4)2 - 500/(1 + 0.072/4)3 + 700/(1 +0.072/4)4 = 300/(1.018)1 + 400/(1.018)2 + 500/(1.018)3 + 700(1.018)4 = 300/1.018 0+ 400/1.03632 - 500/1.05498 + 700/1.07397 = 294.6955 + 385.9797 - 473.9426 + 651.7889 = $858.52 Calculator Solution: 1) Compute periodic rate: rperiodic = rnominal/m = 7.2000%/4 = 1.8000% 2) Access Cash Flow Worksheet [CF] 3) Clear registers: [2nd, CLR WORK] 2) Enter parameters: Enter CF0; [Default is 0] Enter CF1; [↓, 300, ENTER] Enter CF2; [↓, ↓, 400, ENTER] Enter CF3; [↓, ↓, -500, ENTER] Enter CF4; [↓, ↓, 700, ENTER] Enter discount rate: [NPV, 1.8, ENTER] Find NPV [↓, CPT] and viola! PV = $858.52 Net Present Value 18 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Uneven Cash Flows (continued) FV Calculator Solution If your calculator has a “NFV” (Net Future Value) key, you’re in luck! (TI BA II Plus Professional has this function) If there’s no NFV key, you have to compound each CF to the last (terminal) time period Fractional Time Periods Example: Calculate the FV of $100 invested for 18 months in a bank account that pays a quoted rate of 10%, compounded annually. FV = ? rnominal = 10% rperiodic = ? m=1 n=? 0 PV = $100 1 2 18 mos T = # of years = 18mos/12mos per yr = 1.5 m = # of discounting per year = 1 n = total # of periods = m x T = 1 x 1.5= 1.5 Numerical Solution 1) Find n: 18 mos / 12 mos per period = 1.5 periods 2) FV0.75 = PV(1 + r/m)n = 100(1 + 0.10/1)1.5 = 100(1.10)1.5 = $115.37 Calculator Solution: 1) Find rperiodic: 10% / 1 = 10% 2) Find n: 18 mos / 12 mos per period = 1.5 periods 3) Enter parameters: Enter number of periods [ 1.5, N] Enter periodic interest rate [ 10 , I/YR] Enter PV [100, PV] Find FV, [CPT,FV] and viola! FV = (-)$115.37 19 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Fractional Time Periods (continued) Example: Today you deposit $2000 in a bank account that pays 3.6% APR compounded quarterly. How much money would you have in that account 20 months from now. Continuous Compounding Used in mathematical models of various more complicated financial concepts (i.e. duration, convexity, pricing an option contract, interest rate options & swaps, etc.) Formula: FV = PVerT where is an annual rate and T is time in years Example: If today you deposit $1,000 in to an account that pays 7.2000% per annum with continuous compounding, how much will you have in the account three years from now? FV = PVerT = $1,000e(0.072)(3) = $1,000e(0.216) = $1,000(1.2411) = $1,241.10 20 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Continuous Compounding (continued) EAR with continuous compounding Example: If rnominal is 6% what is the EAR with continuous compounding? EARcontinuous = er – 1 = e(0.06) – 1 = 1.061837 = 0.061837 = 6.1837% Perpetuities A type of annuity The uniform payments go on indefinitely PMT r =? 0 1 2 3 4 5 ∞ PV PV = PMT + (1 + r/m)1 S ∞ = PMT PMT + ……+ (1 + r/m)2 (1 + r/m)∞ PMT (1 + r/m)n n=1 PVperpetuity = PMT / (r/m) = PMT / rperiodic Example: What is the PV of a perpetuity that pays $500 per year @ 8 % APR? PV = PMT / rperiodic = 500/0.08 = $6,250.00 21 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Perpetuities (continued) Example: An endowment is established with an initial deposit of $1m. How much can be drawn out each month @ 6% APR? 1) Find rperiodic: 6% / 12 = 0.5% 2) Find PMT: PMT = PV(rperiodic) = $1m(0.005) = $5,000 Why worry about Perpetuities? Answer: Many pensions are perpetuities We will use the perpetuity model to find stock values and: Capitalize (Capitalization) Example: What is the value of a firm that earns $100m per year and its cost of debt is 10%? (Assume this firm is totally financed by debt.) VFirm = $100m / 0.10 = $1 billion Growing Perpetuity: A perpetuity in which the cash flows are not constant; they grow at a particular rate indefinitely Example: A wealthy businessman wishes to establish a scholarship endowment for a local university business school. The donator wants to initially provide $6,000 per semester but he wants that amount to grow to compensate for inflation. He estimates that inflation is likely to be 3.5% per year. The endowment account pays 6.5% p.a. How large must the endowment be? PV(Growing Perp.) = Initial PMT / (r/m – g/m) (g is the growth rate) = $6,000 / (0.065/2 – 0.035/2) = $6,000 / (0.03/2) = $6,000 / 0.015 = $400,000.00 22 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Amortized Loan: Definition: a loan in which portions of the principle are combined with periodic interest payments to form a series of uniform payments the entire principle is paid back to the lender by the end of the loan term most consumer loans (mortgages, auto loans, etc.) are amortized Each successive payment contains a little less interest and a little more balance but the total amount of each payment is the same Example: You finance the entire $16,785 cost of a new car @ 8% APR for 3 years. You have managed to convince your bank to allow you to make quarterly payments. What is the amount of each quarterly payment? PV = $16,785 0 T=3 m=4 n = 3x4 =12 interest principle isimple = 8% iperiodic = ? 1 1 2 3 4 3 10 11 PMT = ? Calculator Solution: 1) Find rperiodic: 8% / 4 = 2% 2) Enter parameters: Enter number of periods [ 12, N] Enter periodic interest rate [ 2 , I/Y] Enter PV [16785, PV] Find PMT, [CPT,PMT] and viola! PMT = -$1,587.18 23 years 12 compounding periods MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 Payments Don’t Coincide with Compounding Periods (not covered in your text) Example: Today you open a new savings account that pays 3.7% compounded weekly. You plan to deposit $400 into this account at the end of every month, starting at the end of this month. How much will you have in this account 2 years from now? FV = ? r = 3.7% 0 0 1 2 3 4 5 22 PMT = $400 23 2 years 24 months T = # of years = 2 m = # of payments per year = 12 n = total # of payments = m x T = 12 x 2 = 24 Enter Parameters: Set payments per year to 12; [2nd, P/Y, 12, ENTER] Set compounding periods per year to 52; [↓, 52, ENTER, CE/E] Enter number of payments [24, N] (Note: in this case, N is the number of payments, not number of compounding periods) Enter interest rate; [3.7, I/Y] Enter payments; [400, PMT] Find FV, [CPT,FV] and viola! FV = $9,948.65 24 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 You Can Invest Interest Payments at a Different Rate Than You Are Currently Receiving (not covered in your text) Example: You currently have $5,000 in a savings account that pays 3.00% APR, compounded monthly. For the next two years you plan to reinvest each savings account interest payment in a mutual fund that guarantees 5.00% APR, compounded monthly. How much money would you have in the mutual fund after two years? Assume the current balance in the mutual fund account is 0. FV = ? r = 5.00% 2 0 0 1 2 3 4 5 22 PMT = ? 23 24 years compounding periods T = # of years = 2 m = # of compounding per year = 12 n = total # of periods = m x T = 12 x 2 = 24 1) Find the interest payment from the savings account: PMT = $5,000(rnominal/m) = $5,000(0.03/12) = $12.50 2) Enter Parameters: Set payments per year to 12; [2nd, P/Y, 12, ENTER] Set compounding periods per year to 12; [↓, 12, ENTER, CE/E] Enter number of compounding periods [24, N] Enter interest rate; [5, I/Y] Enter payments; [12.50, PMT] Find FV, [CPT,FV] and viola! FV = $314.82 25 MGT 326 Ch. 4: Time Value of Money (bdh), Part 2 More than One Interest Rate (not covered in your text) What do you do if the interest rate changes? Example: You are negotiating a loan with a bank in order to raise funds for the start of your new business. You estimate that your business will earn $50k NI each year for the next 4 years. You manage to convince the bank that your company will become progressively less risky as time goes on. You and the bank agree that your cost of debt for the first two years should be 7% and that it should fall to 5% for the next 2 years. What is the value of your company? 50k 50k 50k 50k 1 2 3 4 r1-2 = 7% APR r3-4 = 5% APR PV = ? 0 m=1 n=4 Solution: Approach: divide the problem into two parts PV0 = ? m=1 n=4 PV2 = ? 50k 50k 50k 50k 1 2 3 4 r1-2 = 7% APR r3-4 = 5% APR 0 PV = PV0(CFs 1, 2) + PV0(PV2 of CFs 3, 4) = 50/(1.07)1 + 50/(1.07)2 + [ 50/(1.05)1 + 50/(1.05)2] / (1.07)2 = 50/1.07 + 50/1.1449 + (50/1.05 + 50/1.1025)/1.1449 = 46.729 + 43.6719 + (47.619 + 45.3515)/1.1449 = 46.729 + 43.6719 + 81.204 = $90.40k + $81.20k = $171,604.91 26