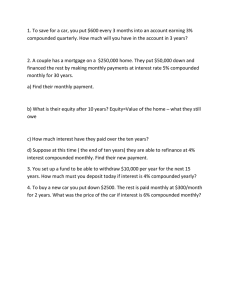

MCR 3U Financial Applications Quiz 1

advertisement

MCR 3U Grade 11 University FINANCIAL APPLICATIONS QUIZ 1 Multiple Choice Identify the choice that best completes the statement or answer the question. 1. At what rate of simple interest must $12 000 be invested to earn $150 in interest each quarter? a) 0.31%/a b) 0.5%/a c) 125%/a d) 5%/a 2. How much interest would you earn on a $1 750 investment at 18.8%/a simple interest for 18 months? a) $493.50 b) $592.20 c) $2243.50 d) $5922.00 3. George is trying to solve this problem: How much money must be invested at 4.2% simple interest to earn $1000 interest each month? Which equation could George use to solve this problem? a) 𝒑 = b) 𝒑 = c) 𝒑 = d) 𝒑 = 𝟏𝟎𝟎 (𝟎.𝟎𝟒𝟐)(𝟏𝟐) 𝟏𝟎𝟎 (𝟎.𝟎𝟒𝟐)(𝟏) 𝟏𝟎𝟎 𝟏 (𝟎.𝟎𝟒𝟐)( ) 𝟏𝟐 𝟏𝟎𝟎 𝟏 𝟏+ (𝟎.𝟎𝟒𝟐)((𝟏𝟐)) 4. How many compounding periods are there in the investment below? Principal $11000 a) 2 b) 8 c) 16 d) 32 Rate of Compound Interest per year 2.8% Compounding Period quarterly Time 8 years 5. Maria borrows $12 000 at 9%/a interest compounded monthly for 10 years. How much money will she owe at the end of 10 years? a) $12 930.99 b) $17 416.28 c) $28 408.36 d) $29 416.28 6. Colin borrows $1 700 at 5.8%/a interest compounded annually. How long will it take Colin to owe triple the amount hr originally borrowed? a) 2.8 years b) 15 years c) 19 years d) 20 years 7. Jamal borrowed some money at 8.4% compounded quarterly. After 4 years, he repays $5926.53 for the principal and interest. How much money did Jamal borrow? a) $4 250.00 b) $5 453.78 c) $5 868.72 d) $8 264.42 8. How much more is the present value of Product 1 than Product 2? Product 1 2 a) $90.00 b) $209.84 c) $222.57 d) $240.27 Rate of Compound Interest per year 4.5% 5.4% Compounding Period semi-annually annually Time 3 years 3 years Future Value $10 000 $10 000 9. Karin can invest money at 6.5% compounded weekly. She would like to have $12 000 in 7 years. How much does she need to invest now? a) $7 722. 07 b) $7 615.54 c) $7 617.70 d) $7 892.82 10. What does A represent in the formula 𝑃𝑉 = a) present value b) annual interest rate c) principal amount d) future value 𝐴 (1 +𝑖 )𝑛 ?