here

advertisement

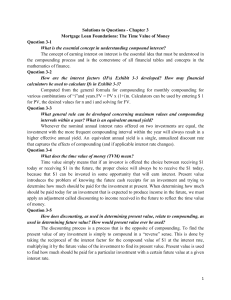

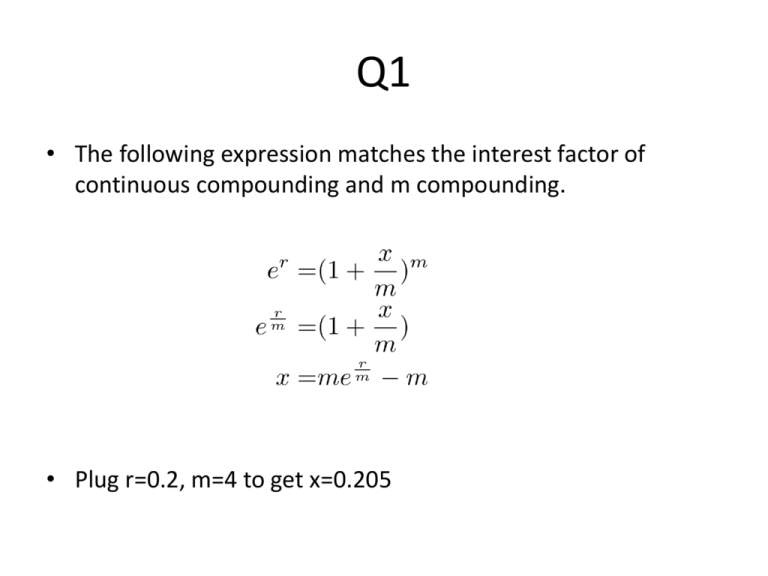

Q1 • The following expression matches the interest factor of continuous compounding and m compounding. • Plug r=0.2, m=4 to get x=0.205 Q2 • C: Two or more outcomes are possible Q3 • Solve for C from the annuity formula • Since the loan is amortized monthly, use effective monthly interest rate and T=180 Q4 • First payment equals principal paid plus interest on total loan amount: Q5 • Last Payment is equal to last amount of principal left, which since it was paid in equal parts is $2000, plus interest on what principal is left. Q6 • C: No, because there may be other constraints that prevent the company from investing in this project Q7 • Use future value formula with simple interest, plug in PV=1000, r=0.07 Q8 • Discount the future flow of cash one at a time since the rate of growth of payments is not constant, r=0.15 C1 500 C2 540 C3 580 C4 620 C5 660 Q9 • There are 14 months between those dates, or t=1.16 years. Use compound interest future value formula, with m=6, r=0.24, and PV=50,000: Q10 • 18 months is equivalent to 0.66 years. In addition, there are 9 years in between the dates. Use compound interest future value formula with t=9, m=0.66, r=0.24, PV=50,000: Q11 • Find what the payments are for a 5 year amortization using monthly compounding. Using this fixed payment, calculate the PV at the end of year 1 for the remaining payments. • For first part, use the formula below using re=0.06/12=0.005, T=60, and PV=50,000: • Then calculate FV at the end of year 1 for remaining payments, using re=0.005, T=48, C=966.64: Q12 • Solve for t in years from the compound interest future value formula, then multiply t by 12 to get months. • For the formula below use FV=178, PV=100, r=0.12, m=12 • 4.82 years is approximately 58 months. Q13 • The internal rate of return is the constant discount rate that would make the investments NPV=0. You can find by solving the following equation with x=(1-p) using the quadratic equation: • Take the positive value, for which IRR=p=x-1=0.36 Q14 • A) Use continuous compounding PV formula with stated interest rate, so r=0.08, t=10, FV=1,200: • B) Use PV formula with effective interest rate, so r=0.08, t=10, FV=1,200: