Chapter 7 Power Point Presentation 1

Chapter 7

The Time

Value of

Money

1

Time Value

A. Process of expressing

1. The present value of $1 invested now in future terms. (Compounding)

Compounding – Process by which interest is paid on interest that was previously earned.

2. The future value of $1 invested in terms of the present

Future Value of a dollar – Amount to which a single payment will grow at some rate of interest.

B. Payments are either:

1. a single payment

2. A series of equal payments (an annuity)

2

Time Value

C. Time value of money problems may be solved by using:

1. Interest tables

2. Financial calculators

3. Software

3

Variables for Time Value of

Money Problems

PV = present value

FV = future value

PMT = annual payment

N = number of time periods

I = interest rate per period

4

Future Value

Future value of $1 takes a single payment in the present into the future.

General equation for the future value of $1:

P

0

(1 + i

) n = P n

FV = PV (1 + i) n

5

Future Value Illustrated

PV = -100

I = 5

N = 20

PMT = 0

FV = ?

= 265.30

6

Greater Terminal Values

Higher interest rates

Longer time periods

Result in greater terminal values

7

Greater Terminal Values

8

Present Value

Present value of $1 brings a single payment in the future back to the present.

Present Value – Current value of a dollar to be received in the future.

Discounting – Process of determining present value.

9

Present Value

General equation for the present value of $1:

P

0

= P n

(1+ i

) n

PV = FV [ 1 / (1 + i) n ]

1.

PV = Present Value

2.

FV = Future Value

3.

i = Interest Rate per Period

4.

n = Number of Compounding Periods

10

Present Value Illustrated

FV = 100

I = 6

N = 5

PMT = 0

PV = ?

= -74.73

11

Lower Present Values

Higher interest rates

Longer time periods

Result in lower present values

12

Lower Present Values

13

Financial Calculators and Excel

Express the cash inputs (PV, FV, and PMT) as cash inflows and cash outflows

At least one of the cash variables must be

–an inflow (+)

–an outflow (-)

14

Simple Interest

Simple Interest – No Compounding

– Good to have if you withdraw interest each period.

– SI = Principal (PV) x rate (i) x time (n)

15

Future Value of a Single

Amount Example

You buy a stock for $10 and expect the price to increase 9 percent annually. After 10 years, what is the anticipated price of the stock?

16

Future Value of a Single Amount

Example

The unknown: FV

The givens:

–PV = 10

–PMT = 0

–N = 10

–I = 9

The answer:

$23.67

17

FV Interpretation

A $10 stock will be worth $23.67 after 10 years if its price grows 9% annually.

18

Present Value of a Single

Amount Example

What is the cost of a stock that was sold for $23.67, held for 10 years and whose value appreciated 9 percent annually?

19

Present Value of a Single

Amount Example

The unknown: PV

The givens:

–FV = 23.67

–PMT = 0

–N = 10

–I = 9

The answer:

$10

20

Interpretation

$23.67 received after ten years is worth $10 today if the rate of return is 9 percent.

21

Interpretation of Future and

Present Values

These two problems are mirror images:

In the first case, the $10 is compounded into its future value ($23.67).

In the second case, the future value

($23.67) is discounted back to its present value ($10).

22

Rate of Return Example

A stock was purchased for $10 and sold for $23.67 after 10 years. What was the return?

23

Future Determination of the Interest Rate

(can use Present too)

The unknown: I

The givens:

–PV = 10

–PMT = 0

–N = 0

–FV = 23.67

The answer:

9%

24

Interpretation

The yield on a $10 investment that was sold after 10 years for $23.67 is 9%.

25

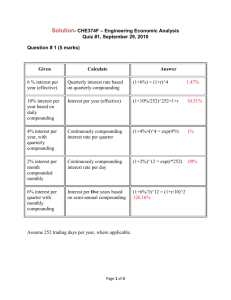

Non-annual Compounding

More than one interest payment a year

State Interest rates are always annual interest rates.

More frequent compounding

26

Non-annual Compounding

Multiply number of years by frequency of compounding

Divide interest rate by frequency of compounding

27

Periods less than One Year

Same variables as in all time value problems except N < 1.

Calculate by dividing the number of days by 365.

28

Illustration for Return on

Investment

What is the return on an investment that costs $98,543 and pays

$100,000 after 45 days?

29

Determination of Return

The unknown: I

The givens:

–PV = -98,543

The answer:

12.64%

–N = 0.1233 (45/365)

–FV = 100,000

–PMT = 0

30

Interpretation

$98,543 invested for 45 days grows to $100,000 at 12.64 percent.

31