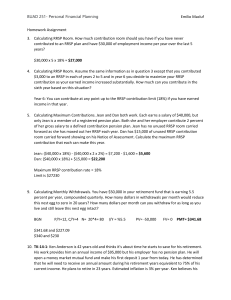

Your group plan at work

advertisement

Your group plan at work Securing your future with your group plan Sources of Retirement Income Your responsibilities under this plan As a member of a group retirement savings plan with more than one investment option, you are responsible for: • Making sure you understand how your plan works. • Taking advantage of the information and tools available to make your investment decisions. • Taking advantage of the investment advisory services of a plan advisor if available. • Making actual investment decisions. • Determining how much you will contribute to your plan. • Checking to see how your investments are performing • Revising your investment strategy if personal circumstances change. Sources of retirement income Supplementary Secondary Primary Canada Pension Plan (CPP) Old Age Security (OAS) Home Other Savings Personal RRSP Your company retirement plan Government benefits Monthly maximum payments 2015 Canada Pension Plan* Quebec Pension Plan* Old Age Security Age 60 Age 65 $694.38 $1,065.00 $707.16 $1,065.00 $0 $563.74 Age 70 $1,512.30 $1,512.30 ----------- *Amounts based on earnings, length of employment history and rate of your contributions. Will this be enough for you? The tax advantage of automatic payroll deductions You get $50 for $30 Before RRSP Less RRSP Taxable pay $ 500 $ 0 $ 500 $ 500 $ 50 $ 450 Tax @ (40%) Net pay $(200) $ 300 $(180) $ 270 Gross pay Contribution limits Lesser of 18% of previous years earnings or $24,930 Year CRA RRSP Limit 2015 $24,930 2016 $25,370 + Unused RRSP Room (if any) You are responsible for monitoring your personal RRSP limit as per CRA Notice of Assessment For more information about your personal limits visit www.cra.gc.ca Choice of two accounts Group RRSP • Tax-deductible savings • Tax-sheltered earnings • Contribute up to RRSP limit • Ideal for retirement savings Tax-Free Savings Account (TFSA) • No tax-deductibility, but tax sheltering • Contribute up to $10,000 each year • Tax free withdrawals, and can “re-contribute” the amount withdrawn • Great for any savings goal Investing details Understand Risk vs. Return Guaranteed Guaranteed interest during fixed term Less long-term growth potential Canadian, US, Global & International Equities Money Market Government treasury bills (T-Bills) Less long-term growth potential Balanced Target Risk Equities (Stocks) Share in company profits Canadian, U.S., Global & International Greater long-term growth potential Bonds Balanced Mix of cash, bonds and equities Automatic diversification Low Money Market Guaranteed Funds Low Risk Bonds (Fixed Income) Promise to repay debt Pays a rate of interest Government and corporate High Target Risk “Hands-free” approach Re-balances automatically Wide range of investment options Built by me - Choose your own portfolio from the following asset categories: • Money Market • Guaranteed Funds (1, 2, 3, 4, 5 year) • Fixed Income • Balanced • Canadian Equity • U.S. Equity • International Equity • Global Equity Built for me – “prebuilt” portfolio funds • Milestone Target Date Funds with guaranteed maturity value • Granite Target Date Funds • Granite Asset Allocation Funds Milestone Funds® – Target Date Sun Life Financial Milestone Segregated Funds • Target date funds • All you have to do is choose the Fund that is closest to the date you’d like your money, and it takes it from there Six options to choose from • 2020, 2025, 2030, 2035, 2040 and 2045. • Maturity dates of June 30th Milestone guarantee Granite Funds™ – Target Date When do you need the money? • Pre-built solutions – with an asset mix that changes over the life of the fund • Managers were selected who have: Superior long term performance Expertise in their asset classes or investment styles • Low cost multi-manager target date funds Granite Funds™ – Asset Allocation Pre-built asset allocation funds • 5 funds that correspond to a risk profile: Granite Conservative Segregated Fund Granite Moderate Segregated Fund Granite Balanced Segregated Fund Granite Growth Segregated Fund Granite Aggressive Segregated Fund The importance of diversification You should always be diversified in your approach to investing – Investment Style – growth and value, active and passive fund managers – Asset class – cash equivalents, fixed income and equities – Geographic region – Canadian, U.S. and International equities – Currency – limit exposure to U.S. currency risk Communication & Technology Customer Care Centre • Toll-free line 1-866-733-8613 • Perform transactions 24 hours a day through the Automated Telephone System • Customer Care Centre representatives available 8 a.m. to 8 p.m. ET any business day Operate live in 189 languages Plan member services website • • • • • • • • www.mysunlife.ca Fund and account balances Summary of contributions Move money between funds Access historical fund performance information Update your future investment instructions Lump sum contributions Newsletters View historical account statements Convenient, Quick, Easy! Plan member services website continued • Complete the Investment Risk Profiler to help you determine your tolerance for risk and how you should invest. • Use the Retirement Planner to help understand your retirement goals and ensure you are saving enough. Statements and Receipts • Annual account statements mailed directly to your home in December • Semi-annual account statements available online in June and December • Tax slips and receipts Mailed directly to your home RRSP receipts for income tax purposes sent twice per calendar year Withdrawals, Termination, and Retirement Options Termination and Retirement options At the point of Termination/Retirement: • You will be mailed a package that outlines your various options • If we don’t hear from you within 90 days after termination/retirement your account will be automatically transferred to a personal account in the Group Choices Plan Withdrawals • Withdrawals or transfers from guaranteed funds prior to maturity are paid at market value. Death benefits are paid without a market value adjustment. • Withdrawals from a Milestone Fund prior to the maturity of that fund are calculated at the current market value of the fund, not the guaranteed maturity value • $25 fee will apply for each withdrawal from your RRSP • The first withdrawal from your TFSA in each calendar year is free. A $25 fee will apply for any additional withdrawals during the year. • Termination withdrawals and transfers - $75 (except when transferring within Sun Life Financial) Getting Started How do I get started? • my savings Group RRSP & TFSA Employee Enrolment Kit • Complete and submit signed enrolment form(s) to your employer • That’s it! my savings has been designed to make this entire process ‘quick and easy’. How do I get started? ABC Company John Main Street Toronto Doe ON H0H 0H0 How do I get started? Jane Jill Doe Spouse 100 Doe daughter 100 How do I get started? 5 How do I get started? ABC Company John Doe 29-06-2015 How do I get started? •Completion of the •TFSA enrolment form •is necessary if you •would like to •contribute to the •Tax-Free Savings Account Your future is waiting… enrol today!