At a Glance my money Strategies for RRSP success

advertisement

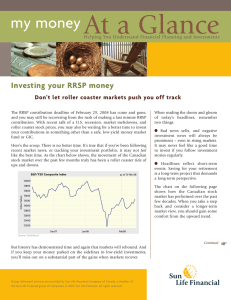

my money At a Glance Helping You Understand Financial Planning and Investments Strategies for RRSP success The registered retirement savings plan (RRSP) contribution deadline is fast approaching, with March 1, 2008 being the last day you can make a contribution and deduct it on your 2007 tax return. Your RRSP represents the most effective way to save for retirement on your own with the double benefit of tax-deductible contributions and tax-sheltered investment earnings. Maximizing your RRSP contributions each year is one of the best ways to help you prepare financially for retirement. If you’re considering a lump sum contribution to top up your 2007 RRSP savings, here are some strategies you may want to consider. Check your contribution limit If you haven’t checked your RRSP contribution limit in a while, you may be surprised to find you have more room than you think. There are a couple of reasons for this. First, any unused RRSP contribution room gets carried forward from previous years. Even if the amount you carry forward each year is small, it can add up quickly. So you may have stockpiled a significant amount of RRSP contribution room without even knowing it. will continue to rise in future years (see chart on next page). While the maximum contribution limit for 2006 was 18% of your previous year’s earned income to a maximum of $18,000, the maximum for 2007 has jumped to $19,000. This dollar limit is increasing by $1,000 a year until it reaches $22,000 in 2010. If your earnings were high enough to hit this dollar maximum in previous years, you may have more room this year than you expected. Second, annual RRSP contribution limits have been rising each year for the past several years and So check your RRSP contribution limit on the Notice of Assessment that was sent to you by the Canada Group retirement services are provided by Sun Life Assurance Company of Canada, a member of the Sun Life Financial group of companies. © 2007, Sun Life Financial. All rights reserved. Revenue Agency when you filed your tax return last year. If you have more room than you realized, consider making use of it before the 2007 contribution deadline. Continued ☛ Avoid parking contributions If you’re like many people who make a last minute RRSP contribution, you may decide to park it in a safe, low-yield money market or guaranteed fund while you decide on a longer-term investment for your savings. While this sounds like a reasonable strategy, it’s easy to forget to “unpark” your funds and keep them in low-yield investments far longer than you intended. While holding cash investments can be useful for saving for short-term goals, their relatively low returns combined with the effects of inflation make this a poor longterm strategy. If you have an investment horizon of more than five years, you should ensure that any lastminute RRSP contribution you make is working immediately towards your long-term financial goals. For most people, that means investing in a diversified mix of investments with some longer-term growth potential. Recycle your refund Revisit savings rate Because RRSP contributions are tax deductible, you may receive a tax refund when you file your 2007 tax return. One of the easiest ways of ensuring you maximize your future RRSP contributions is to take your RRSP refund for 2007 and contribute it as a head start on your 2008 contributions. If you have a lot of RRSP contribution room at year’s end, you may want to consider increasing any payroll contributions you’re making to a group RRSP to avoid the need to make last minute contributions in the future. There are a couple of benefits to this strategy: Because your contributions are invested earlier, they have that much longer to generate and compound investment earnings. You are unlikely to miss the money you contribute, as it comes from a refund of taxes that you’ve already paid. And you’ll need to make much lower contributions for the remainder of the year since you’ve made this contribution early on. Smaller contributions spread over a longer time period will likely have less impact on your lifestyle than trying to find a larger amount once a year to make a lump sum contribution. And you’ll have more of your contributions invested and working for you earlier in the year when you make them on a regular basis. This strategy also allows for dollar cost averaging, an investment technique based on investing your money a little at a time. It’s a way to reduce the risk of buying securities at their highest value. So resist the temptation to spend, and recycle any refund right back into your RRSP. RRSP contribution limits are increasing Year 2006 2007 2008 2009 2010 i RRSP contribution limit $18,000 $19,000 $20,000 $21,000 $22,000 If you have a general question or suggestion about this newsletter, please send an e-mail to can_pencontrol@sunlife.com or write to my money At a Glance Newsletter, Group Retirement Services Marketing, Sun Life Financial, 225 King Street West, Toronto, ON M5V 3C5. This bulletin has been created exclusively for you. It addresses issues to help you with your financial planning and investments, and cannot be reproduced in whole or in part without the express permission of Sun Life Financial. 02/08-st-jc