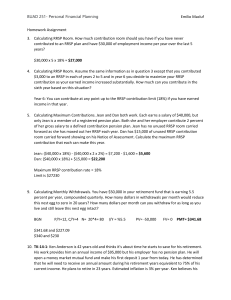

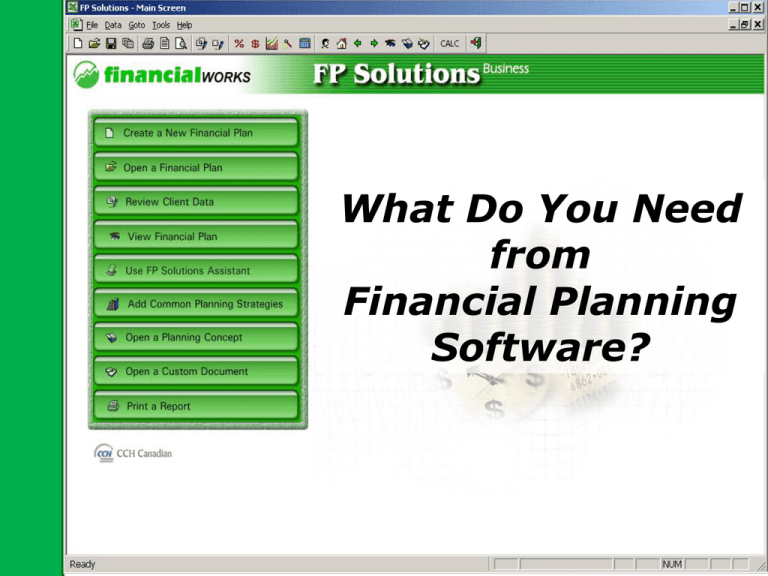

FP Solutions Advanced

advertisement

What Do You Need from Financial Planning Software? FP Solutions Four levels of planning power to meet the needs of any practice. Business Advanced – Cash flow Plus – Insurance needs analysis Basic – Retirement planning & Sales concepts FP Solutions Basic Single Needs, Concepts and Retirement Planning • RRSP / RRIF • Life Insurance • Education Savings • Pension and Annuities • T1 General Tax • Financial Calculators • Solve Functions • Mutual Fund Import FP Solutions Plus Goal Based Personal Financial Planning • • • • Retirement Capital Needs Survivor Capital Needs Estate Capital Needs Disability Capital Needs (DI, CI, LTC) FP Solutions Advanced Cash Flow Based Personal Financial Planning • • • • • Detailed Cash Flow Projections Detailed Net Worth Projections Change in Financial Position Planning Assistant Planning Strategies FP Solutions Business Integrated Corporate Financial Planning • Holding & Operating Companies • Corporate Owned… – Life Insurance – Investments – Real Estate • CDA & RDTOH Calculations FP Solutions Top 10 1. T1 Tax Calculations 6. Planning Strategies 2. Fact Finder 7. Planning Concepts 3. Annual Review 8. Value of Advice 4. FP Focus 9. Customization 5. Planning Assistant 10. Software Support #1 T1 Tax Calculations General Income Tax and Benefit Guide • Highest standard in Industry • Calculated based on CRA guidelines. • No assumptions #2 Fact Finder • • • • • • Fully integrated Easy to use Printable Email to client Saves time Financial Snapshot Displays current position Shows retirement income excess or shortfall Shows need for life insurance #3 Annual Review Tool • Displays existing data • Fully integrated • Highlights changes • Easy to use • Saves time Annual Review Tool Fast Easy Review Process #4 FP Focus • Executive summary • Easy for clients to understand • Flexibility to change graphs on the fly. Sample Graph – FP Focus Sample Graph – FP Focus #5 Planning Assistant 7 Step Wizard Guides thru Plan Process Tips on Planning Strategies Your Expert Guide #6 Planning Strategies • 20 Strategies covering common areas including: – Income Splitting – Retirement Strategies – Tax Planning – RRSP / RRIF – Investment Strategies – Pension / LIRA #7 Planning Concepts Stand-Alone or Build into Plan • • • • • • • Estate Multiplier Insured Annuity Retirement Leverage RRSP Strategies RRSP Leverage Income Comparison Debt Consolidation • • • • • • Terminal Return Tax Freedom Day Tax Funding Alternatives Investment Strategies Investment Leverage Lost Opportunity Cost Shows impact taxes will have on estate Choose assets that need protection Motivates better tax planning Shows tax liability payable on second death at life expectancy #8 Value of Advice & Return on Advice • Validation of Plan • Integrates fees into plan • Shows Financial Plan as best investment clients can make Shows Value of Advice and Financial Planning #9 Customization • Custom Documents Easy to use Any Document Any Graphs Branding Custom formulas • Client Reports Personalized Fine tuned Permanent record Email #10 Software Support FREE • 1 800 263-4983 – 8:00 AM to 8:00 PM • www.training.cch.ca – Live web classroom – Interactive tutorials – Knowledge base • Workshops