IS 3-3 note

advertisement

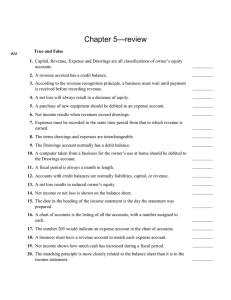

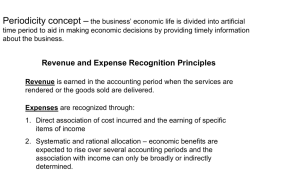

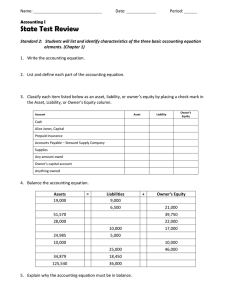

Revenue and Expense Accounts 1.Revenue – a separate account is set up for each distinct type of revenue earned by a company 2.Expense – a separate account is set up for each type of expense, ◦ The major criteria used to decide whether a separate expense account is needed are (1) frequency of usage and (2) dollar value of expenditure Balance Sheet Accounts 1.Assets – Increase (Debit) Decrease (Credit) 2.Liabilities and OE – Increase (Credit) Decrease (Debit) 1.Revenue increases Owner’s Equity, therefore Revenue will act like the Owner’s Equity account. 2.Credit (Increase) Debit (Decrease) 1.Expenses decrease Owner’s Equity therefore they are the opposite of the OE account 2.Debit (Increase) Credit (Decrease) 3.When the business incurs an expense, it is always an increase (increased cost to the business) 1.Different Revenue and Expense accounts are created for management and internal control Owner’s Drawing Account 1.Records the withdrawal of money or other assets from the business by the owner 2.Basically anything that is taken out of the company for personal use 3.Has a debit side of origin because it decreases OE 1.SEE PAGE 84 2.The income statement is prepared first because the result, the net income or net loss, affects the balance sheet 3.The owner’s capital account and drawings appear in the OE section of the balance sheet Example of OE 1.Owner’s Equity 2.C. Cronk Capital September 1 $30,000 3.Add: Net Income $5,000 4.Less: C. Cronk, Drawings 2,000 5.Increase in Capital 3 000 6.C. Cronk Capital September 30 $33 000 Transactions 1. Purchased $300 of office supplies for cash 2. Issued a cheque for $50 for an advertisement in a local newspaper 3. Received a bill from Office Supply Company for a desk, chair and filing cabinet at a total cost of $1100 on account 4. A bill was issued for $900 for services performed 5. A cheque for $100 was sent as a donation to the Salvation Army 6. A cheque for $300 was received on account 7. Paid Louis’s Service station $120 for gasoline and repairs to the business automobile 1. 8. Performed a service for T. Wu and received $200 cash in full payment. 2. 9. The owner withdrew $400 for personal use ANSWERS 1. Dr Office Supplies Cr Cash 2. Dr Advertising Ex Cr Cash 3. Dr Office Supplies Cr Accounts Payable 4. Dr Accounts Receivable Cr Fees Earned 5. Dr Misc. Expense Cr Cash 6. Dr Cash Cr Accounts Receiv. 7. De Automobile Ex Cr Cash 8. Dr Cash Cr Fees Earned 9. Dr Drawing Cr Cash Transactions 1.Look at page 79 2.Questions ◦ Page 90 Q - 13,14,15 ◦ Ex 8,10,11 3.Page 93 Ex 13, 14, 16