revenue, or expense

advertisement

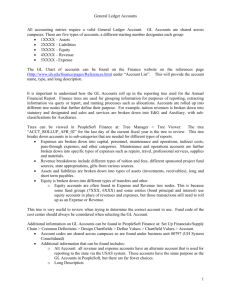

Mr. Pfahl 2015 PRINCIPLES OF ACCOUNTING 30S Unit 2: The Income Statement 1 Mr. Pfahl 2015 Notes are Available online at 2 Mr. Pfahl 2015 3 PART 2: REVENUE AND EXPENSE ACCOUNTS Mr. Pfahl 2015 4 Review • In Unit 1, the purpose of accounting was expressed as a system designed to provide the financial information necessary to make decisions. • We learned how daily transactions are recorded, and how the Balance sheet is prepared. • We learned that the balance sheet presents the assets, liabilities, and owner’s equity at a specific date. Mr. Pfahl 2015 5 Next.. We will expand our knowledge of business transactions and learn how and why the income statement is prepared. Mr. Pfahl 2015 6 The General Ledger • To have the information necessary to prepare an income statement, accounts must be kept for the revenue and expense data for the accounting period. • Therefore, the general ledger must contain all the accounts required to prepare both financial statements: • The Balance Sheet • The Income Statement Balance Sheet • Asset • Liability • Owner’s Equity Income Statement • Revenue • Expenses Mr. Pfahl 2015 7 Income Statement Accounts • There are two main sections in the body of the income statement: • The revenue section • The expense section Remember: Each revenue and expense item has an account in the general ledger. Mr. Pfahl 2015 8 Income Statement Accounts • Revenue Accounts • Review: What is revenue? • There are many different ways a business can generate revenue (i.e. products, services, rentals, member fees, commissions etc.) • A separate revenue account is set up for each distinct type of revenue earned by a company. • Therefore, the types of revenue earned determine the number of revenue accounts required by the business. • Expense Accounts • Review: What are expenses? • There are many different ways a business can incur expenses (i.e. Loan payments, supplies bought, equipment repairs, subscription costs, Advertising expense etc.) • A separate expense account is set up for each distinct type of expense incurred by a company. • Therefore, the types of expenses incurred determine the number of expense accounts required by the business. Mr. Pfahl 2015 9 Rules of Debit and Credit for Revenue and Expense Accounts • Earlier, we explained the procedure for entering transactions in the balance sheet. Summarized in Fig. 3-2 on Pg. 77) • Assets • Assets are shown on the left side of the balance equation. • Because they are shown on the left side, they increase on the left (debit) and decrease on the right (credit) • Liabilities and Owner’s Equity • Liabilities and owner’s equity are shown on the right side of the balance sheet equation. • Because they are on the right side, they increase on the right (credit) and decrease on the left (debit) Mr. Pfahl 2015 10 Rules of Debit and Credit for Revenue and Expense Accounts How does the recording of transactions affect revenue and expense accounts? • Before a transaction can be recorded in the accounts, it is necessary to determine whether the account will be debited or credited. • Net Income and revenue increase owner’s equity. Owner’s Equity is increased on the credit side. Therefore, when revenue occurs, it is recorded on the credit side of the revenue account. • Expenses decrease owner’s equity. Owner’s equity is decreased on the debit side. Therefore, when expenses occur, they are recorded on the debit side of the expense accounts. Debits and Credits to revenue and expense accounts are determined by the effect of each transaction on owner’s equity. POINTS TO REMEMBER Revenue increases equity and is recorded as a credit. 2. Expenses decrease equity and are recorded as debits. 1. 11 Mr. Pfahl 2015 Rules of Debit and Credit for Revenue and Expense Accounts Owner’s Equity Debit (Decrease) Expenses Debit (Increase) Credit (Decrease) Credit (Increase) Revenue Debit (Decrease) Credit (Increase) Mr. Pfahl 2015 12 Reason for Revenue and Expense Accounts • If revenue increases equity, expenses decrease equity, and net income/loss is eventually added to owner’s equity on the balance sheet… Why are revenue and expense accounts necessary? Why not enter transactions directly into the equity account? • The answer is that one of the main purposes of accounting is to provide information to management about the operations of a business. • At-a-glance, separate revenue and expenses accounts show which sources are contributing most to the company’s total revenue, and which expenses are increasing too rapidly. Mr. Pfahl 2015 13 Transaction Analysis • As we have already learned, at least two accounts are involved in recording every business transaction and total debits must equal total credits for each transaction. • In this chapter, we will see that the same principle of double-entry accounting applies when you record transactions that involve revenue and expense accounts. • The transactions in this chapter will involve five types of accounts: Asset, Liability, Owner’s Equity, Revenue, and Expense Mr. Pfahl 2015 14 Transaction Analysis • The following six transactions are from a Lawyer, C. Piccolo. • Transaction #1: Asset and Revenue Transaction • Jul. 1 Received $175 cash from a client for drawing up a new will. • The accounts affected are: Cash & Fees Earned • Cash is an asset that increases on the debit side • Because revenue increases OE, the revenue account, Fees Earned, would be credited Mr. Pfahl 2015 15 Transaction Analysis • Transaction #2: Asset and Revenue Transaction • Jul. 2 Billed client $1200 for legal services to close purchase of home. • The accounts affected are: Accounts Receivable & Fees Earned • A/R is an asset that increases on the debit side • Because revenue increases OE, the revenue account, Fees Earned, would be credited Mr. Pfahl 2015 16 Transaction Analysis • Transaction #3: Expense and Asset Transaction • Jul. 3 Paid $95 to Telus for telephone bill received today. • The accounts affected are: Telephone Expense & Cash • Because expenses decrease OE, the expense account, Telephone Expense, would be debited. • Cash is an asset that decreases on the credit side. Mr. Pfahl 2015 17 Transaction Analysis • Transaction #4: Expense and Liability Transaction • Jul. 4 Received a bill from Calgary Herald for $150 for advertising the new location of the practice. The terms of payment allow for 30 days to pay. The bill will be paid later. • The accounts affected are: Advertising Expense & Accounts Payable • Because expenses decrease OE, the expense account, Advertising Expense, would be debited. • Accounts Payable is a liability that increases on the credit side. Mr. Pfahl 2015 18 Transaction Analysis • Now try a few on your own! Remember! Received $600 from the client as partial What accounts were affected? payment of the $1200 billed on July 2. equity, revenue, or •Were Jul. 6they asset, Paidliability, $100 toowner’s the Calgary Herald as partial expense accounts? payment of their bill for $150 received on July Did the accounts 4. increase / decrease? Were the accounts debited / credited? • Jul. 5 1. 2. 3. 4. Mr. Pfahl 2015 19 Summary of Debit and Credit Theory • Balance Sheet Accounts • Assets are on the left side of the balance sheet equation. • Assets increase on the left or debit side. • Liabilities and OE are on the right side of the balance sheet equation. • Liabilities and OE increase on the right side or credit side. Mr. Pfahl 2015 20 Summary of Debit and Credit Theory • Income Statement Accounts • OE increases on the right or credit side. • Revenues increase OE, and therefore are recorded on the credit side. • Expenses decrease OE, and therefore are recorded on the debit side. Mr. Pfahl 2015 21 Introducing the Owner’s Drawings Account • One of the reasons people start a business is to earn a profit and increase the value of their equity. • The owner of a business may make regular withdrawings of money or other assets for personal use. • This practice reduces Owner’s Equity, and is similar to an expense transaction. • The difference is expenses are recognized only if the cost was incurred to produce revenue. • A withdrawal of assets is recorded in an account called drawings. • The drawings account is an OE account, and appears on the OE side of the General Ledger, and decreases OE on the Balance Sheet. • Therefore, the Owner’s Drawings account has a normal debit balance. Mr. Pfahl 2015 22 Introducing the Owner’s Drawings Account • The Owner’s Drawings account is debited whenever assets are withdrawn by the owner for personal use. • Some examples of this are; • Withdrawing cash • Removing merchandise for personal use • Taking equipment from the business for personal use, and • Using company funds for personal • Owner’s Salary • A salary may be paid by a business to the owner of that business. • For income tax purposes, the business may not record the payment of salaries as an expense. • Therefore the payment of salaries must be recorded in the Drawings account. Mr. Pfahl 2015 23 Drawings Account in the General Ledger • As we already know, the General Ledger is a group of accounts. • There is one account for each asset, liability and for owner’s equity. (Balance Sheet) • There is also an account for each type of revenue, expense, and for Drawings (Income Statement) • At the end of an accounting period, a trial balance is prepared. • The balances of each account are used to prepare the Balance Sheet, and Income Statement. • Observe the General Ledger on Pg. 84 Mr. Pfahl 2015 24 Equity Accounts on the Balance Sheet • The Income Statement is always prepared first because the net income or net loss, affects the balance sheet. • Both the Owner’s Capital account and Drawings account appear in the Owner’s Equity section of the balance sheet. • The Capital account is a record of the Owner’s claim against the assets. • Capital increases if; there is a net income earned, or if the owner increase the assets of the business through investments. • Capital decreases if; there is a net loss, or if the owner withdraws assets from the business for personal use. • Observe Fig 3-6, 3-7, and 3-8 on Pg. 85 & 86 Mr. Pfahl 2015 25 Report Form of Balance Sheet • Up to this point, the account form of balance sheet has been used. • The account form balance sheet lists the assets on the left, and the Liabilities and OE on the right • The balance sheet does not always appear in account form. Another form of balance sheet is the report form. • The report form balance sheet lists the assets, liabilities, and OE vertically • Although the concept of left side = right side no longer applies (because the accounts are now listed vertically) • Remember that the balance sheet equation still applies (A=L+OE) Mr. Pfahl 2015 26 Report Form of Balance Sheet • Facts to Remember! • A slight modification of the rule given in Unit 1 for the placement of $ signs on the balance sheet is now required. • For the report form balance sheet, $ signs should be placed as follows; • Beside the first figure in each column in both sections of the statement; and • Beside the final total in both sections of the statement. Mr. Pfahl 2015 27 Preparing Financial Statements from Trial Balance Trial Balance Income Statement Balance Sheet Mr. Pfahl 2015 28 Review: GAAPs and Key Ideas • The Time-Period Principle requires that each company sets and defines an accounting period. The period may be a month, three months, a year etc. The company consistently uses the same time period when it prepares its financial statements. • The Matching Principle requires that the costs recorded in the expense accounts be matched with the revenue of the same accounting period to determine net income. • The accrual basis of accounting records revenue when it is earned, whether that revenue is in the form of cash or credit granted. Expenses are recorded when incurred, whether those expenses are paid for in cash or credit granted by the supplier. Mr. Pfahl 2015 30 Homework • IN CLASS DEMO: Pg. 94 #15 • Pg. 90 – 96 #8, 12, 13, 14 Workbook available on Shared Drive or online @ www.mrpfahl.weebly.com Next Homework Check: