File

advertisement

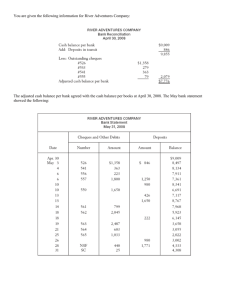

Chapter 7 Solutions EXERCISE 7-7 (a) VERWEY COMPANY Bank Reconciliation November 30 Cash balance per bank statement ................................................. $8,509 Add: Deposits in transit ................................................................ 01,575 10,084 Less: Outstanding cheques .......................................................... 0 2,449 Adjusted cash balance per bank ................................................... $7,635 Cash balance per books ................................................. $7,005 Add: Correction of error in cheque No. 373 ................ $ 90 EFT deposits ...................................................... 883 973 7,978 Less: Bank service charge ............................................ $ 24 NSF cheque ........................................................ 319 343 Adjusted cash balance per books ................................................. $7,635 (b) Nov. 30 30 Cash .................................................... 973 Office Supplies ............................. 90 Accounts Receivable ................... 883 Bank Charges Expense ..................... 24 Account Receivable ........................... 319 Cash............................................... 343 EXERCISE 7-8 (a) Deposit in transit on May 31: $1,353 (b) Other adjustments: Interest earned of $32 must be added to the balance per books. EFT deposit of $849 must be added to the balance per books The error in the May 20th deposit must be corrected on the books; therefore the balance per books must decrease by $9 ($954 - $945). EXERCISE 7-9 (a) Outstanding cheques on May 31st: No. No. No. (b) 255 261 264 $ 262 867 650 $1,779 Other adjustments: Decrease balance per books $54 for service charges recorded by bank. Increase balance per books $450 for error in cheque 260—should be $50 not $500. Decrease balance per books for NSF cheque of $395. EXERCISE 7-10 (a) HIDDEN VALLEY COMPANY Bank Reconciliation May 31 Cash balance per bank statement ................................................. $7,664 Add: Deposits in transit ................................................................ , 1,353 9,017 Less: Outstanding cheques .......................................................... 1,779 Adjusted cash balance per bank ................................................... $7,238 Cash balance per books ................................................................. $6,365 Add: Interest earned ................................................................... Error correction: Cheque # 260 ........................................ EFT Deposit ........................................................................ 32 450 849 7,696 Less: Bank service charge .......................................... Error correction: May 20 deposit ($954 - $945) 9 NSF cheque ........................................................................ Adjusted cash balance per books ................................. 54 395 $7,238 (b) May. 31 Cash ($32 + $450 + $849) .................... 1,331 Interest Revenue ............................ Accounts Payable .......................... Accounts Receivable (EFT)........... 32 450 849 31 Bank Charges Expense ...................... 54 Accounts Receivable (error) .............. Accounts Receivable (NSF)................ 9 395 Cash ($54 + $9 + $395) .................. 458 PROBLEM 7-4A (a) June 1 8 8 15 15 Petty Cash .......................................... Cash............................................... 150 Cash .................................................... Debit Card Expense (52 X $0.50) .. 26 Credit Card Expense ($6,400 x 2.75%) ............................ Sales .............................................. 15,548 Freight Out ......................................... Postage Expense ............................... Advertising Expense ......................... Miscellaneous Expense..................... Cash Over and Short ......................... Cash ($150 - $9) ............................ 42 28 57 10 4 Cash .................................................... Debit Card Expense (78 X $0.50) .. 39 Credit Card Expense ($8,000 x 2.75%) ............................ Sales .............................................. 17,941 Petty Cash ($250 - $150) .................... Drawings............................................. Office Supplies Expense ................... 100 50 77 150 176 15,750 141 220 18,200 Coffee Supplies Expense .................. Cash Over And Short......................... Cash ($250 - $4) ............................ 20 1 246 PROBLEM 7-4A (Continued) (b) The advantage of accepting debit and bank credit card transactions as opposed to accepting only cash and personal cheques from customers is that the company knows immediately if the customer has enough money in the bank to pay for their purchases. A second advantage is that it will likely increase sales if customers can use debit or credit cards. The disadvantage is that the bank charges a fee on all transactions using debit and credit cards. (c) The benefit of having a petty cash fund is that it can be used to pay relatively small amounts, while still maintaining control. Some expenses are best made by cash rather than by cheque because of the nature of the expense–there are some instances where either a cheque is not accepted or it is not practical to issue a cheque. The cost-benefit principle justifies paying some expenses with cash rather than issuing a cheque. There are a number of internal controls over the petty cash fund that Gamba should follow: One person should be appointed the petty cash custodian and will be responsible for the fund. A prenumbered petty cash receipt should be signed by the custodian and the individual receiving payment for each payment from the fund. The treasurer’s office should examine all payments and stamps supporting documents to indicate they were paid when the fund is replenished. Surprise counts should be made at any time to determine whether the fund is intact. PROBLEM 7-5A (a) Jan. 2 15 31 Feb. 1 15 28 Petty Cash .......................................... Cash............................................... 200 Freight Out ......................................... Postage Expense ............................... Office Supplies Expense ................... Miscellaneous Expense..................... Cash Over and Short ......................... Cash ($200 - $13) .......................... 84 42 47 12 2 Freight Out ......................................... Charitable Contributions Expense40 Postage Expense ............................... Miscellaneous Expense..................... Cash Over and Short .................... Cash ($200 - $5) ............................ 86 Petty Cash .......................................... Cash............................................... 100 Freight Out ......................................... Entertainment Expense ..................... Postage Expense ............................... Merchandise Inventory ...................... Miscellaneous Expense..................... Cash Over and Short ......................... Cash ($300 - $58) .......................... 36 53 33 60 54 6 Postage Expense ............................... Travel Expense .................................. Freight Out ......................................... Office Supplies Expense ................... Cash Over and Short .................... Cash ($250 - $63) .......................... Petty Cash ($300 - $250) .............. 95 46 44 57 200 187 28 44 3 195 100 242 5 187 50 PROBLEM 7-5A (Continued) (b) Date Jan. Feb. Explanation 2 1 28 (c) Petty Cash Ref. Debit Credit 200 100 Balance 200 300 50 250 Some expenses are made from petty cash rather than by cheque because of the nature of the expense–there are some instances where either a cheque is not accepted or it is not practical to issue a cheque. The cost-benefit principle justifies paying some expenses with cash rather than issuing a cheque. There are internal controls over payments from petty cash. A custodian is responsible for the fund. A prenumbered petty cash receipt signed by the custodian and the individual receiving payment is required for each payment from the fund. The treasurer’s office examines all payments and stamps supporting documents to indicate they were paid when the fund is replenished. Surprise counts can be made at any time to determine whether the fund is intact. PROBLEM 7-6A (a) AGRICULTURAL GENETICS COMPANY Bank Reconciliation May 31, 2008 Cash balance per bank statement ................................................. Add: Deposit in transit................................................ $1,141 Bank error, May 12 deposit ($638 - $386) 252 Less: Outstanding cheques [($233 + $732 + $813 + $401)] ............................................ Adjusted cash balance per bank ................................................... Cash balance per books ................................................................. Add: Error in recording cheque No. 1151 ($855 - $585) ....................................................... $ 270 EFT collections .................................................. 2,382 Interest revenue ................................................. 24 Less: NSF cheque and service charge ......................... $820 Error in recording cheque No. 1192 ($1,387 - $1,738) ................................................. 351 Bank service charge .......................................... 50 Adjusted cash balance per books ................................................. (b) May 31 31 31 31 31 31 Cash .................................................... Accounts Payable—L. Kingston . 270 Cash .................................................... Accounts Receivable ................... 2,382 Cash .................................................... Interest Revenue .......................... 24 Accounts Receivable—P. Dell .......... Cash............................................... 820 Computer Equipment ........................ Cash............................................... 351 Bank Charges Expense ..................... Cash............................................... 50 $11,689 1,393 13,082 2,179 $10,903 $ 9,448 2,676 12,124 1,221 $10,903 270 2,382 24 820 351 50 Check: $9,448 + $270 + $2,382 + $24 - $820 - $351 - $50 = $10,903 adjusted cash balance PROBLEM 7-7A (a) Cash balance per books, November 30, 2008 (from Nov. 30 bank reconciliation) ................................. Add: Cash receipts ............................................................ Less: Cash payments ........................................................ Unadjusted cash balance per books, December 31, 2008........................................................... $10,216 16,830 14,816 $12,230 (b) HUANG COMPANY Bank Reconciliation December 31, 2008 Cash balance per bank statement .............................................. $19,155 Add: Deposits in transit ............................................................. 1,198 20,353 Less: Outstanding cheques No. 3470 .............................................. $1,100 No. 3474 .............................................. 1,050 No. 3478 ................................................................... No. 3481 .............................................. 538 807 No. 3484 ................................................................... No. 3486 .............................................. 1,274 1,390 6,159 Adjusted cash balance per bank................................................ $14,194 Cash balance per books ............................................................. $12,230 Add: EFT collected by bank ..................................................... 3,145 15,375 Less: NSF cheque ............................................... $1,027 Error in recording cheque No. 3485 ($541 - $441) .............................................................. 100 Bank service charges ................................................. Error in Dec. 21st deposit 45 ($2,954 - $2,945) .................................... 9 1,181 Adjusted cash balance per books .............................................. $14,194 PROBLEM 7-7A (Continued) (c) Dec. 31 31 Cash .................................................... 3,145 Accounts Receivable .................................... 3,080 Interest Revenue ........................................... 65 Accounts Receivable—Hilo Holdings 1,027 Cash .................................................................... 31 Accounts Payable .............................. 1,027 100 Cash............................................... 31 Bank Charges Expense ..................... 100 45 Cash............................................... 31 Accounts Receivable ......................... Cash............................................... 45 9 9 Check: $12,230 + $3,145 - $1,027 - $100 - $45 - $9 = $14,194 adjusted cash balance