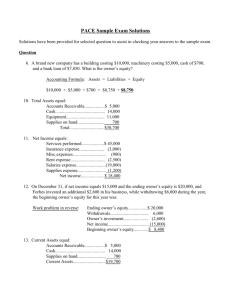

Decrease in owner's equity is recorded by a debit to supplies

advertisement

Periodicity concept – the business’ economic life is divided into artificial time period to aid in making economic decisions by providing timely information about the business. Revenue and Expense Recognition Principles Revenue is earned in the accounting period when the services are rendered or the goods sold are delivered. Expenses are recognized through: 1. Direct association of cost incurred and the earning of specific items of income 2. Systematic and rational allocation – economic benefits are expected to rise over several accounting periods and the association with income can only be broadly or indirectly determined. Adjusting Entries 1. To reflect in the accounts information on economic activities that have occurred but have not yet been recorded. 2. Assign revenues to the period in which they are earned, and expenses to the period in which they are incurred. 3. To measure properly the profit for the period and to bring related asset and liability accounts to correct balances for the financial statements. 4. Involves the changing of account balances at the end of the period from what is the current balance of the account to what is the correct balance for proper financial reporting. 5. Each adjusting entry affects a balance sheet account and a income statement account. Deferrals The postponement of the recognition of : •An expense already paid but not yet incurred •A revenue already collected but not yet earned Deals with an amount already recorded in a balance sheet account, the entry therefore: •Decreases the balance sheet account •Increases an income statement account Deferrals are needed in: •Allocating assets to expense ( prepaid insurance, supplies, depreciation) •Allocating revenues received in advance to revenue to reflect revenues earned during the accounting period (subscriptions) Accruals The recognition of: •An expense already incurred but unpaid and unrecorded •Revenue earned but uncollected and unrecorded Deals with an amount unrecorded in any account The entry would: •Increase both a balance sheet account and an income statement account Adjustments for Deferrals Prepaid expenses are assets that expires either with •The passage of time •Through use and consumption If no adjustments are made: •The assets will be overstated •The expenses will be understated •Owner’s equity in the balance sheet is overstated •Profit in the income statement is overstated Prepaid Rent (adjustment) The accountant of Barbie Health and Beauty Specialist makes an adjusting entry to record the expiration of the three months’ advance rent paid in July 1 for P21,000 Transaction : expiration of one month’s rent Analysis : assets decreased. Owner’s equity decreased. Rules : decrease in assets are recorded by credits. decrease in owner’s equity are recorded by debits. Entries : Decrease in owner’s equity is recorded by a debit to rent expense. Decrease in assets is recorded by a credit to prepaid rent. Rent expense Prepaid Rent 7,000 7,000 After adjustment…… Prepaid rent Jul 1 21,000 14,000 ====== Jul 31 7,000 Prepaid Insurance ….. The accountant of Barbie Health and Beauty Specialist records the expiration of one-twelfth of the company’s one-year insurance policy taken last July 1 for P24,000 Transaction : expiration of one month’s insurance Analysis : assets decreased. Owner’s equity decreased. Rules : decrease in assets are recorded by credits. decrease in owner’s equity are recorded by debits. Entries : Decrease in owner’s equity is recorded by a debit to insurance expense. Decrease in assets is recorded by a credit to prepaid insurance. Insurance Expense Prepaid Insurance 2,000 2,000 Supplies …. Barbie discovered that she used up P500 worth of supplies during July which she purchased for a total of P1,000. She makes the necessary adjusting entry. Transaction : consumption of supplies Analysis : assets decreased. Owner’s equity decreased. Rules : decrease in assets are recorded by credits. decrease in owner’s equity are recorded by debits. Entries : Decrease in owner’s equity is recorded by a debit to supplies expense. Decrease in assets is recorded by a credit to supplies Supplies Expense Supplies 500 500 Depreciation of Property and Equipment Buying long-lived assets like building, vehicles, computers or office furnitures is prepaying for the usefulness of that asset that helps generate income for the business. Depreciation – allocation of the cost of the asset over its estimated useful life. Factors: 1. Asset cost – the amount paid to acquire the depreciable asset 2. Estimated salvage value – the amount that the asset can probably be sold for at the end of its estimated useful life 3. Estimated useful life – the estimated number of periods that an entity can make use of the asset Estimating depreciation through the straight-line method Asset cost xx Less: estimated salvage value xx Depreciable cost xx Divided by : estimated useful life xx Depreciation expense for each time period xx Note: • asset is not directly reduced •Reduction is recorded in the contra account accumulated depreciation •Contra accounts allow the disclosure of the original cost of the asset •Cost of asset less balance of contra account = book value of the property and equipment Vehicle and Equipment… Barbie bought a van for P300,000 and hair steamers for P54,000 last July 1 & 2. She allocates a full month’s depreciation for property and equipment bought on or before the 15th of the month, otherwise, it is half-month’s depreciation. It is estimated that the van will have a useful life of 5 years and a salvage value of P30,000 while the hair steamers, 4 ½ years useful life without salvage value. Compute for depreciation expenses for the van and the hair steamers. Transaction : recording depreciation expense Analysis : assets decreased. Owner’s equity decreased. Rules : decrease in assets are recorded by credits. decrease in owner’s equity are recorded by debits. Entries : Decrease in owner’s equity is recorded by a debit to depreciation expense. Decrease in assets is recorded by a credit a contra asset accounts – accumulated depreciation Depreciation Expense - Vehicle 4,500 Accumulated Depreciation-vehicle Depreciation Expense - Equipment 1,000 Accumulated Depreciation-Equipment 4,500 1,000 Barbie Health and Beauty Specialist Partial Balance Sheet July 31, 2009 Property and Equipment (net): Service Vehicle P 300,000 Less: Accumulated Depreciation 4,500 Office Equipment 54,000 Less: Accumulated Depreciation 1,000 P 295,500 53,000 P 348,500 Allocating Revenues Received in Advance to Revenues Receipt of cash for services or goods even before service is rendered or goods are delivered. It is a liability for the entity and is referred to as unearned revenue. Ex. Magazine subscriptions Unearned Referral Revenues On July 20, Barbie received a P13,500 prepayment for six future home service. Since Barbie completed one of these visits in July, an adjusting entry is made to reflect this. Transaction : recognition of income where cash is received in advance Analysis : liabilities decreased. Owner’s equity increased Rules : decrease in liabilities are recorded by debits. Entries increase in owner’s equity are recorded by credits. : Decrease in liabilities is recorded by a debit to unearned revenue. Increase in owner’s equity is recorded by a credit to Service Revenue Adjusting Entry: Unearned Revenue Service Revenue P _______ P _______ Adjustments for Accruals Accrued Expenses – entity incurs expenses before paying for them. Accrued Salaries Barbie records an expense for the salaries of the part-time employee who earned P1,600 during the four days of July but will not be paid until August 10. Transaction : accrual of unrecorded expenses Analysis : liabilities increased. Owner’s equity decreased Rules : increase in liabilities are recorded by credits. decrease in owner’s equity are recorded by debits Entries : Decrease in owner’s equity is recorded by a debit to Salaries Expense. Increase in liabilities is recorded by a credit to salaries payable. Salaries Expense 1,600 Salaries Payable 1,600 Accrued Interest Barbie’s P100,000 notes payable, which was signed on July 3 carries an 18% interest rate. Barbie uses the formula (for simple interest) below to calculate how much interest expense accrued during the final twenty-eight days of July. Interest = Principal x Interest Rate x Length of Time = P100,000 x 18% per year x 28/360 of a year Transaction = P1,400 : accrual of unrecorded expense Analysis : liabilities increased. Owner’s equity decreased Rules : increase in liabilities are recorded by credits. decrease in owner’s equity are recorded by debits Entries : Decrease in owner’s equity is recorded by a debit to Interest Expense. Increase in liabilities is recorded by a credit to interest payable. Interest Expense Interest Payable P 1,400 P1,400 Note: at the end of July, Barbie owed the bank P1,400 for interest in addition to the P100,000 loan Accrued Revenue – the company may provide services during the period that are neither paid for by the clients nor billed at the end of the period. On July 31, Barbie went to Trixie’s home for a home service. Barbie mailed the bill to Trixie on Aug 2 for P2,500. Barbie made an adjusting entry in accordance with the revenue recognition principle. Transaction : accrual of unrecorded revenue Analysis : assets increased. Owner’s equity increased Rules : increase in assets are recorded by debits Increase in owner’s equity are recorded by credits Entries : increase in asset is recorded by a debit to accounts receivable. Increase in owner’s equity as credit to Service Revenues. Accounts Receivable Service Revenue 2,500 2,500 Accrual for Uncollectible Accounts The company made a credit sales of P1,100,000 in 2008 and prior experience indicate an expected 1% average uncollectible accounts rate based on credit sales. The contra account – Allowance for Uncollectible Accounts has a normal credit balance and is shown in the balance sheet as a deduction from Accounts Receivable. The adjustment will be: Uncollectible Accounts Expense _______ Allowance for Uncollectible Accounts _______ If account is definitely uncollectible: Allowance for Uncollectible Accounts Accounts Receivable _______ _______