Budget Assignment

advertisement

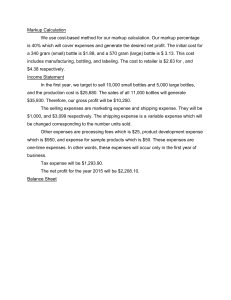

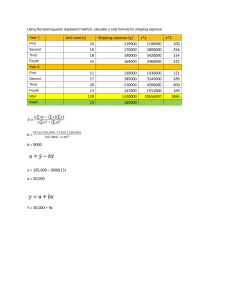

Budget Assignment Personal Finance Summer 2015 1. From June 22 through July 21 (one month), you are to carefully track every penny that you spend. For some of you, this will be the most difficult thing I ask you to do in this entire course because it means you must record your spending ALL THE TIME. I strongly caution you against trying to remember until the end of the week or even the end of the day. Write every expense down as soon as it happens. It doesn’t matter how you pay for something (cash, credit card, or debit card), record it as soon as it happens – before you walk away from wherever you are. 2. Categorize each expense. The choice of what categories to use is up to you, but let me recommend that it is best to be as specific as possible with the categories. Here are some suggestions (this is definitely not meant to be a comprehensive list!): a. Food eaten at home b. Food eaten out c. Rent d. Utilities (electricity, water, etc.) e. Gas f. School supplies g. Entertainment h. Toiletries i. Clothes j. Recreation k. Gifts and contributions l. Auto maintenance m. Phone n. Cable TV 3. Think carefully about expenses that didn’t come up this month, but will arise at other times during the year (i.e. vacation, insurance premiums, appliance repairs). Write down when they will likely occur and how much you expect them to be. Figure out how much (per month) you need to set aside to make sure that there is money to pay for each of them. 4. Determine how much your monthly expenses are. Be sure to include the monthly cost of everything in #3 above. 5. Figure out how much your monthly “income” is. As a student, this may or may not be from employment – but it is from wherever you get money to spend on the items above. 6. Make any adjustments you think are necessary to each expense category so that your monthly total is approximately 1/12 of what you expect to spend over the course of a year. 7. Make further adjustments to the expense categories so that the monthly total for your expenses is less than or equal to your monthly income. If possible, include a “savings” category. 8. Write a couple of paragraphs of what you have learned from this exercise and what challenges you think that keeping a budget in the future might hold.