pankaj f. goel - Resume Excellence

advertisement

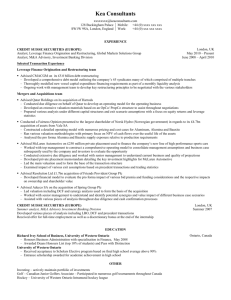

PANKAJ F. GOEL 306, Peace Heaven , Parel, Mumbai – 13; PROFESSIONAL SUMMARY Mobile: +91- 9967643678 email: pankajfg@gmx.com Investment professional with 17 years of transaction experience across Private Equity, Merger & Acquisitions, Structured Investments and Strategic Investments/ JVs with the Ajay Piramal Group having managed and led all aspects of investment life cycle across more than 16 completed transactions; Member of the core Investments/M&A team; reported and worked in collaboration with C-level management, cross-functional business teams, external advisors and consultants on business strategy initiatives, transaction management and fund raising; Participated in the strategy formation and building substantial new businesses for the Piramal Group through (1) an acquisition-led strategy in Pharmaceutical Solutions (CRAMS) and Piramal Diagnostics (business sold by the Group in 2010 for INR 6 bn) (2) a mix of organic and in-organic entry strategy into the financial services sector with a focus on wholesale lending. KEY COMPETENCIES PROFESSIONAL EXPERIENCE Piramal Enterprises Limited (PEL) Investment/acquisition strategy Vice-President – Structured Investments Group (SIG): January 2012 to date Origination & deal strategy Founder member of the Structured Investments Group (SIG) formed in Mar’12 at PEL with a corpus of INR 100 bn; Target evaluation & research SIG investment strategy: (1) Invest in structured credit/mezzanine opportunities across sectors including infrastructure generating high-teens return (2) Acquire yield assets like roads; Business models and valuation Leading transaction due diligence Developing transaction structures and financing plans Forming negotiation strategies and conducting negotiations Preparing/reviewing term sheets/legal documents Presenting Investment recommendations Investment monitoring and exit Obtaining transaction approvals ACADEMIC SUMMARY CAIA Charterholder, 2012 (Chartered Alternative Investment Analyst Association®, USA ) Evaluated over 75 transactions for mezzanine funding and yield assets in the infrastructure space across roads, power, renewables (solar and wind energy), waste management, airports and EPC companies. Key Transactions : Completed structured investment of INR. 5.5 bn in Navayuga Roads Projects Private Limited, Hyderabad; Completed structured investment of INR 5.0 bn in Green Infra Limited, Delhi; Exited investment with a high-teen IRR within two years. Developed a strategy to build a yield asset road portfolio through acquisitions; Identified and evaluated acquisition of over 35 road assets across India with gross equity value of over INR 120 bn; conducted detailed diligence and negotiated documentation on 3 road SPVs. Formulated a framework to provide last mile working capital funding to a South based stressed EPC company against receivables and retention money. Evaluated and conducted diligence for a pre-IPO funding to an infrastructure services company catering to the road sector. Piramal Enterprises Limited (PEL) Vice President - M&A: December 2010 to January 2012 Responsible for M&A and Investments for entry into new business and diversification for PEL, post divestment of its domestic formulations business to Abbott Pharmaceuticals, USA for $3.8 bn. Focused on acquisitions and investments in the Engineering, Industrials, Healthcare and Financial services space. Formulated PEL’s entry strategy into financial services business through establishment of the wholesale lending business. CFA® Charterholder, 2006 ( ® Trademark owned by CFA institute, Charlottesville, Virginia, USA) Masters in Management Studies (MMS) – Finance; Mumbai University, 1998. Bachelors in Engineering – Electronics; Mumbai University, 1996; passed with 1st Class Honors. Evaluated over 25 opportunities in structured investments across infra, retail, industrials etc Conducted industry research and due diligence on five NBFCs in retail and corporate lending. Conducted due diligence and recommended valuation for an EPC company based in Western India. IndiaVenture Advisors Private Limited (IVA), Mumbai Director –Investments: September 2007 to January 2011 Promoted by Mr. Ajay Piramal, IVA (a private equity fund) was established in Sep’07 as a part of the Group’s foray into financial services. IVA raised its first fund, an INR 4,000 mn Healthcare Focused Fund (“Fund”), with a mandate to invest 75% of the corpus in the Indian Healthcare and Life-sciences sector; As Director – Investments, extensively involved in Fund raising and led all aspects of investment life cycle including origination, evaluation, negotiation, closing and monitoring of investments; completed 4 investments with a commitment of INR 1,700 mn; Fund formation and raising Participated in formulating Fund investment strategy and preparing investor presentations; PERSONAL SUMMARY Conducted meetings with institutional investors and participated in road-shows for retail investors for fund raising; Date of Birth : 12 Nov 1974 Investment Evaluation Location : Mumbai Status : Married Evaluated over 50 investment opportunities with potential investments of over INR 12 bn across all healthcare verticals viz. hospitals, pharmaceuticals, CRAMs, medical devices, pharmacies, CRO and ITES companies, infrastructure, engineering, education and retail. Languages : English, Hindi Build business model, formulated deal structure, conducted diligence and negotiated key investment terms for a INR 600 mn investment in a south-based tertiary care hospital chain; Conducted industry research, negotiated term-sheet and conducted due diligence on a medical device company for a potential investment of INR 500 mn; Formulated deal structure, conducted valuation analysis and negotiated key terms for a potential investment in a healthcare IT company looking to raise INR 750 mn. Identified, evaluated, negotiated and made investment recommendation for an INR 350 mn investment in a power ancillary company. Investment Experience Led an INR 300 mn investment in a tertiary care hospital with a 400 bed network with strategy to grow through acquisitions; conducted diligence, presented investment case, led negotiations and investment documentation. Completed investment of INR 500 mn in an infrastructure company focused on the road construction with expertise of operating in difficult terrains; negotiated deal structure and investment rights. Investment of INR 300 mn in a mid-cap pharmaceutical company with leadership in niche market segments; conducted industry analysis, constructed business model and made investment recommendation. Investment of INR 600 mn in the second largest organized pharmacy chain in India; originated the transaction and made investment recommendation. Portfolio Monitoring Tertiary care Hospital – Joined the Board of the Company; worked closely with the Promoters to develop strategic & operating plans to increase bed capacity by 2.5x in 3 years and plan geographical expansion, establish financial control & information systems, identified and evaluated over 6 add-on acquisition targets, formulated and executed re-structuring plan for its listed subsidiary and assisted in selection of key senior management. PANKAJ F. GOEL 306, Peace Heaven , Parel, Mumbai – 13; Mobile: +91- 9967643678 Piramal Healthcare (PHL), Mumbai email: pankajfg@gmx.com General Manager – M&A : June 1998 to October 2007 Part of the core M&A team for the Piramal Group reporting to President-M&A ; responsible for entire M&A transaction lifecycle; formulating acquisition strategy, target identification , transaction execution and capital structuring; Formulated acquisition strategy for Group businesses across Pharmaceuticals, Healthcare, Life sciences & Glass; transactions across all sector verticals including ethical formulations, contract manufacturing (CRAMS), R&D, Lab diagnostics & devices and healthcare delivery services; Conducted advanced level evaluation for over 250 potential acquisition targets; completed over 10 transactions including 3 cross-border transactions across Europe, UK & North America which added revenues of $ 250 mn; Completed M&A/Strategic Investment transactions : Created a business proposition based model for valuation and structuring the acquisition of Pfizer’s formulations manufacturing facility located at Morpeth, UK with revenues of $250 mn over five years; Developed the business model, recommended valuation, formulated key terms and conducted due diligence for the acquisition of pharmaceutical fine chemical business of Avecia Limited, UK with revenues of $80 mn; Originated and conducted valuation analysis for the acquisition of select hospital brands in Europe; Developed the business plan and negotiated the structure for establishing a Joint Venture with a Japanese Company in diagnostics; Conducted market research , financial analysis and recommended investment structure for a $7 mn strategic investment in a US based diagnostics company; Performed financial analysis and recommended valuation for the acquisition of a CRO based in Europe; Conducted due diligence and negotiated the key terms for a $5 mn strategic investment in a Canadian biotech company; Negotiated and recommended valuation for the acquisition of the Indian reagents business of a German transnational company; Conducted industry research, formulated a unique business-transfer based acquisition structure and conducted financial analysis for the acquisition of the global Inhalation Anaesthetics business of Rhodia, Paris; Performed market research, valuation analysis, negotiated and conducted due diligence for the acquisition of ethical brands; Created merger structure and earnings impact modeling for the merger of Global Bulk Drugs, an Indian API company. Acquired 6 pathology diagnostic laboratories with cumulative revenues of INR 250 mn as a part of the roll-up acquisition strategy for the business; identified, conducted business modeling, valuation, negotiated and reviewed transaction documentation; Other Significant M&A/ strategic investment transactions : Worked on industry research, business modeling and developing an innovative carve-out deal structure for the acquisition of a INR 3,500 mn domestic branded generics portfolio of a MNC pharmaceutical company; Evaluated and negotiated the potential merger of the flaconnage business with a major European player in the sector; Conducted site visits, business evaluation , valuation analysis and due diligence as a part of an accelerated deal process for the potential acquisition of a formulation development company with revenues of over $35 mn based in UK; Performed business valuation and formulated key terms for the acquisition of Clinical Research Organization (CRO) companies based in Europe & North America. Conducted due diligence and business valuation for the acquisition of a novel drug delivery formulations company based in Europe with revenues of $150 mn; Extensively analyzed, conducted site visits, performed due diligence and participated in the sale process of the global leader in formulation contract manufacturing based in North America with revenues of more than $ 500 mn; Created business model and conducted due diligence of a branded formulations business of a prominent domestic company with revenues of over INR 900 mn; Performed business evaluation and recommended valuation for the acquisition of a CMO in N. America with revenues $70 mn; Developed a multiple plant carve-out and business transfer structure and recommended valuation for the acquisition of Pharma Fine chemicals business of a Swiss chemical major having revenues of $ 170 mn; Conducted market research and financial modeling for the acquisition of a Philippines & Australia based hospital products business of a global major with revenues of $35 mn. Strategic Planning for acquisitions : Custom Manufacturing (CMO) /API business: Identification of target companies universe and preliminary evaluation of over 30 potential acquisitions targets as an entry strategy for the global expansion of the business; completed 2 cross-border acquisitions with annualized revenues of $ 200 mn establishing PHL among the top 10 CMOs globally. Pharmaceutical development services: Identified target companies universe in North America and Europe and conducted preliminary evaluation of over 20 potential targets to serve as an entry vehicle into this vertical; led to advanced negotiations with 2 targets. International formulations: Market research for identification of attractive geographies for expansion and short listing and evaluation of over 20 potential targets; resulted in first international acquisition for the company in 2005 and a follow-up acquisition in 2009; Domestic formulations: Researched industry trends & analyzed company financials for over 25 domestic companies / brand portfolios to grow PHL’s domestic formulations business. Identified and explored potential transactions with over 10 targets; Allied Business: Involved in formulation and implementation of the startup strategy for a national pathology diagnostics lab network through a mix of 6 acquisitions and organic expansion to establish a pan-India footprint; Select Corporate finance activities : Developed and executed business re-structuring/divestment plan for the healthcare services business and OTC/Herbal JVs; Analyzed various capital raising options and built financial models for assessing financial impact of various instruments/options; formulated conversion structure and investment documentation for a foreign currency convertible. Financial Control and Management : Prepared and presented monthly performance of the Joint Venture (JV) companies to senior management; Financial controller of Piramal Diagnostics during the business startup phase: Established monthly information & streamlined financial control systems; developed framework for operations integration across locations; analyzed business performance and management reviews; evaluated capital expansion projects and handled statutory audits.