Finance1

advertisement

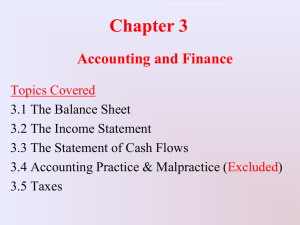

Introduction • • • • Organizing a Business The Role of The Financial Manager Financial Markets Corporate Goals & Incentives Organizing a Business • Types of Business Organizations – – – – Sole Proprietorships Partnerships Corporations Hybrids • • • • Limited Partnerships LLP LLC PC Organizing a Business Sole Proprietorship Partnership Corporation Who owns the business? The Manager Partners Shareholders Are managers and owners separate? What is the owner’s liability? Are owners & the business taxed separately? No No Usually Unlimited Unlimited (exceptions) Limited No No Yes The Role of The Financial Manager (2) (1) Financial managers Firm's operations (4a) (4b) (3) (1) Cash raised from investors (2) Cash invested in firm (3) Cash generated by operations (4a) Cash reinvested (4b) Cash returned to investors Financial markets Financial Markets Company Banks Insurance Cos. Obligations Funds Intermediary Brokerage Firms Obligations Funds Depositors Policyholders Investors Investor The Role of The Financial Manager • Investment Decisions – “Capital Budgeting” – Buy real assets that are worth more than they cost • Financing Decisions —Source of Funds “Capital Markets” —Capital Structure Advantages of Intermediation 1 – Transaction costs/Payments mechanisms. 2 – Matching borrowers and lenders • Borrower may want to borrow for 2 years • May have many lenders that want to lend for a year each. 3 – Pooling of Risk Goals of The Corporation • Shareholders desire wealth maximization • Do managers maximize shareholder wealth? • Managers have many constituencies “stakeholders” • “Agency Problems” represent the conflict of interest between management and owners Goals of The Corporation Agency Problem “Solutions” 1 - Compensation plans 2 - Board of Directors 3 - Takeovers 4 - Specialist Monitoring 5 – Auditors Remark: Problems can still occur because of differences of information. Financial Accounting • • • • • The Balance Sheet The Income Statement The Statement of Cash Flows Accounting for Differences Taxes The Balance Sheet Definition Financial statements that show the value of the firm’s assets and liabilities at a particular point in time (from an accounting perspective). The Balance Sheet The Main Balance Sheet Items Current Assets Cash & Securities Receivables Inventories + Fixed Assets Tangible Assets Intangible Assets The Balance Sheet The Main Balance Sheet Items Current Liabilities Payables Short-term Debt Current Assets Cash & Securities Receivables Inventories + Fixed Assets Tangible Assets Intangible Assets = + Long-term Liabilities + Shareholders’ Equity Market Value vs. Book Value Book Values are determined by GAAP Market Values are determined by current values Equity and Asset “Market Values” are usually higher than their “Book Values” Market Value vs. Book Value Example According to GAAP, your firm has equity worth $6 billion, debt worth $4 billion, assets worth $10 billion. The market values your firm’s 100 million shares at $75 per share and the debt at $4 billion. Q: What is the market value of your assets? Market Value vs. Book Value Example According to GAAP, your firm has equity worth $6 billion, debt worth $4 billion, assets worth $10 billion. The market values your firm’s 100 million shares at $75 per share and the debt at $4 billion. Q: What is the market value of your assets? A: Since (Assets=Liabilities + Equity), your assets must have a market value of $11.5 billion. Market Value vs. Book Value Example (continued) Book Value Balance Sheet Assets = $10 bil Debt = $4 bil Equity = $6 bil Market Value vs. Book Value Example (continued) Book Value Balance Sheet Assets = $10 bil Debt = $4 bil Equity = $6 bil Market Value Balance Sheet Assets = $11.5 bil Debt = $4 bil Equity = $7.5 bil The Income Statement Definition Financial statement that shows the revenues, expenses, and net income of a firm over a period of time (from an accounting perspective). The Income Statement Earnings Before Interest & Taxes (EBIT) EBIT = total revenues minus costs minus depreciation The Income Statement Pepsico Income Statement (year end 1998) Net Sales COGS Other Expenses Selling, G&A expenses Depreciation expense EBIT Net interest expense Taxable Income Income Taxes Net Income 22,348 9,330 291 8,912 1,234 2,581 321 2,260 270 1,990 Profits vs. Cash Flows Differences • “Profits” subtract depreciation (a non-cash expense) • “Profits” ignore cash expenditures on new capital (the expense is capitalized) • “Profits” record income and expenses at the time of sales, not when the cash exchanges actually occur • “Profits” do not consider changes in working capital The Statement of Cash Flows Pepsico Statement of Cash Flows (excerpt - year end 1998) Net Income 1,990 The Statement of Cash Flows Pepsico Statement of Cash Flows (excerpt - year end 1998) Net Income Non-cash expenses Depreciation Other Changes in working capital A/R=(303) A/P=253 Inv=(284) other=(47) Cash Flow from Operations 1,990 1,234 382 (381) 3,212 The Statement of Cash Flows Pepsico Statement of Cash Flows (excerpt - year end 1998) Net Income Non-cash expenses Depreciation Other Changes in working capital A/R=(303) A/P=253 Inv=(284) other=(47) Cash Flow from Operations Cash Flow for New Investments Cash Raised by New Financing Net Change in Cash Position 1,990 1,234 382 (381) 3,212 (5,019) 190 (1,617) Taxes • Taxes have a major impact on financial decisions Marginal Tax Rate is the tax that the individual pays on each extra dollar of income. Average Tax Rate is the total tax bill divided by total income. Taxes Example - Taxes and Cash Flows can be changed by the use of debt. Firm A pays part of its profits as debt interest. Firm B does not. Taxes Example - Taxes and Cash Flows can be changed by the use of debt. Firm A pays part of its profits as debt interest. Firm B does not. EBIT Interest Pretax Income Taxes (35%) Net Income Firm A 100 40 60 21 39 Taxes Example - Taxes and Cash Flows can be changed by the use of debt. Firm A pays part of its profits as debt interest. Firm B does not. EBIT Interest Pretax Income Taxes (35%) Net Income Firm A 100 40 60 21 39 Firm B 100 0 100 35 65 Taxes FOOD FOR THOUGHT - If you were both the debt and equity holders of the firm, which would generate more cash flow to you? (assume Net Income = Cash Flow) Firm A Firm B Net Income 39 65 + Interest 40 0 Net Cash Flow 79 65 Why the difference? Net Income + Interest Net Cash Flow Firm A 39 40 79 Firm B 65 0 65 • Interest is not taxed! • 40*0.35=14 (which is the difference)