Zvi Wiener

advertisement

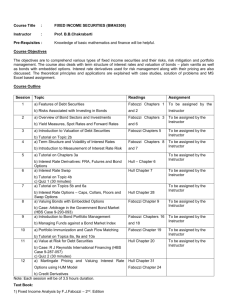

Corporate Debt Instruments Zvi Wiener Based on Chapter 7 in Fabozzi Bond Markets, Analysis and Strategies Fall-02 http://pluto.mscc.huji.ac.il/~mswiener/zvi.html EMBAF Corporate Debt Financial obligations of a corporation that have priority over its common stock and preferred stock in the case of bankruptcy. A. B. C. D. Zvi Wiener Corporate bonds Medium-term notes Commercial papers Asset-backed securities Fabozzi Ch 7 slide 2 Major groups of issuers A. B. C. D. E. Zvi Wiener Utilities Transportation Industrials Banks and finance companies ~communication Fabozzi Ch 7 slide 3 Features of Corporate Bonds (indentures) Corporate trustee – represents bondholders Term bonds – maturity Under 10 years – notes Some bonds have specific collateral Others are debentures Guaranteed bonds (third party’s guarantees) Zvi Wiener Fabozzi Ch 7 slide 4 Call provision Company can retire the debt before maturity. This is an option and makes the debt more expensive. Sinking fund provision – predetermined. Zvi Wiener Fabozzi Ch 7 slide 5 Bond Provisions Sinking fund provision sometimes the issuer is required to retire a portion of an issue each year. either by cash payment to bondholders (lottery) or by buyback bonds Zvi Wiener Fabozzi Ch 7 slide 6 Bond Rating Standard and Poors Moody’s Investor Service Fitch Duff and Phelps מעלות Zvi Wiener Fabozzi Ch 7 slide 7 Investment Grade Moody’s Aaa Aa1 Aa2 Aa3 A1 A2 A3 Baa1 Baa2 Baa3 Zvi Wiener S&P=F=D&P AAA AA+ AA AAA+ A ABBB+ BBB BBBFabozzi Ch 7 slide 8 Speculative Grade Moody’s Ba1 Ba2 Ba3 B1 B2 B3 Caa Ca C Zvi Wiener S&P=F=D&P BB+ BB BBB+ B BCCC+ CCC CCCCC C Fabozzi Ch 7 slide 9 High Yield Bonds LBO, downgrading, refinancing fallen angels deferred interest bonds Step-up bonds pay initially low interest which increases with time Spreads as a measure of risk and premium. Zvi Wiener Fabozzi Ch 7 slide 10 Transition Matrix One year transition matrix (very old) Start\end Aaa Aa Aaa 91.9 7.38 0.72 0.00 0.00 0.00 0.00 Aa 1.13 91.26 7.09 0.31 0.21 0.00 0.00 A 0.10 2.56 91.20 5.33 0.61 0.20 0.00 Baa 0.00 0.21 5.36 87.94 5.46 0.82 0.21 Zvi Wiener A Baa Fabozzi Ch 7 Ba B C&D slide 11 Default Rates ?????? Zvi Wiener Fabozzi Ch 7 slide 12 Loss Given Default ?????? Zvi Wiener Fabozzi Ch 7 slide 13 SEC rule 144A Allows to trade private placements among qualified institutions. Zvi Wiener Fabozzi Ch 7 slide 14 Medium Term Notes (MTN) Notes are registered with the SEC under Rule 415 (the shelf registration) and are offered continuously to investors by an agent of the issuer. Maturities vary from 9 months to 30 years. Can be either fixed or floating. Very flexible way to raise debt! Zvi Wiener Fabozzi Ch 7 slide 15 Primary Market (MTN) Issuer posts spreads over Treasuries for a variety of maturities. Then an agent tries to find an investor. Minimal size is between $1M and $25M. The schedule can be changed at any time! Often structured MTNs are used (caps, floors, etc.) = structured notes. Zvi Wiener Fabozzi Ch 7 slide 16 Structured Notes Many institutional investors can use swaps and structured notes to participate in markets that were prohibited. Another use of structured notes is in risk management. Financial Engineering is used to create securities satisfying the needs of investors. Zvi Wiener Fabozzi Ch 7 slide 17 Commercial Papers Short term debt issued with less documentation typically by large and stable corporations for up to 270 days. Much cheaper borrowing than banks. Bridge financing. Rollover Risk An alternative to CD. Zvi Wiener Fabozzi Ch 7 slide 18 Commercial Papers Short term unsecured promissory note An alternative to short term bank borrowing A typical round-lot transaction is $100,000 In the USA maturity is up to 270 days Requires less paperwork Those with maturity up to 90 days can be used as collateral for FED discount window. Zvi Wiener Fabozzi Ch 7 slide 19 Commercial Papers Typically rolled over Rollover risk is backed by an unused bank credit line In order to issue CP one need either a high rating or good collateral Sometimes credit enhancement is used (LOC) CP issued in the USA by foreigners are called Yankee CP Zvi Wiener Fabozzi Ch 7 slide 20 Commercial Papers Between 71 an 89 there was one default on CP. 3 defaults occurred in 89 and 4 in 90 Direct paper is sold without an agent Secondary market is thin There is a special rating for CP, P-1,3, A-1,3 discount instruments, used by money market Zvi Wiener Fabozzi Ch 7 slide 21 Bankruptcy and Creditor rights Liquidation (Chapter 7) Reorganization (Chapter 11) Zvi Wiener Fabozzi Ch 7 slide 22 Bankruptcy and Credit Rights liquidation - all assets will be distributed reorganization - a new corporate entity will result a company that files for protection becomes a debtor in possession and continues to operate under the supervision of the court Zvi Wiener Fabozzi Ch 7 slide 23 Bankruptcy and Credit Rights Absolute priority rule - senior creditors are paid in full before junior creditors are paid anything. Works in liquidation but often does not work in reorganization. Zvi Wiener Fabozzi Ch 7 slide 24 Merton’s model $ firm equity debt D Zvi Wiener V Fabozzi Ch 7 slide 25 Home Assignment Chapter 7 Questions 10, 21, 25 Zvi Wiener Fabozzi Ch 7 slide 26