Zvi Wiener

advertisement

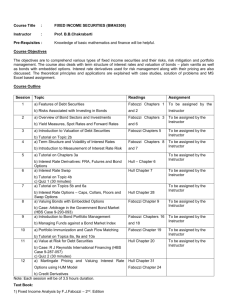

Analysis of Bonds with Embedded Options Zvi Wiener Based on Chapter 14 in Fabozzi Bond Markets, Analysis and Strategies Fall-02 http://pluto.mscc.huji.ac.il/~mswiener/zvi.html EMBAF Static Spread Yield difference is a bad measure of profitability since it does not account for term structure of IR and difference in cashflows. Static spread: create an artificial cashflow using zero-coupon IR, then calculate the difference in yields. See example in Exhibits 14-1, 14-2. Zvi Wiener Fabozzi Ch 14 slide 2 Callable Bond price Negative convexity area non-callable callable yield Callable bond = noncallable – call option price Zvi Wiener Fabozzi Ch 14 slide 3 Option-Free Bond Price = present value of the cash flow discounted at spot rates. Years 1 2 3 YTM 3.5% 4.0% 4.5% Market Value 100 100 100 Years 1 2 3 Spot rate 3.500% 4.010% 4.541% Forward (1y) 3.500% 4.523% 5.580% Zvi Wiener Fabozzi Ch 14 slide 4 Option-Free Bond 5.25% coupon bond with 3 years to maturity: $5.25 $5.25 $105.25 102.075 2 3 1.035 1.0401 1.04541 $5.25 $5.25 $105.25 102.075 1.035 1.035 1.04523 1.035 1.04523 1.05580 Zvi Wiener Fabozzi Ch 14 slide 5 r3,HHH r2,HH r1,H r3,HHL r2,HL r0 r1,L r3,HLL r2,LL r3,LLL Zvi Wiener Fabozzi Ch 14 slide 6 r3e6 r2e4 r1e2 r3e4 r2e2 r0 r1 r3e2 r2 r3 Zvi Wiener Fabozzi Ch 14 slide 7 r2, HH r2, LL e 4 r2, HL r2, LL e 2 Note that Zvi Wiener re 2 r r 2r r r 2 2 Fabozzi Ch 14 slide 8 Zvi Wiener Fabozzi Ch 14 slide 9 Option-Adjusted Spread OAS OAS is the spread over the spot rate curve that is due to the embedded options. Modified duration often assumes fixed cashflow. A better measure is option-adjusted or effective duration. Zvi Wiener Fabozzi Ch 14 slide 10 Effective Duration P P Deffective 2 P0 y P- -price if yield is decreased by y P+ -price if yield is increased by y P0 – initial price of the bond Zvi Wiener Fabozzi Ch 14 slide 11 Effective Convexity P P 2 P0 Ceffective 2 P0 y Zvi Wiener Fabozzi Ch 14 slide 12 Home Assignment Chapter 14 Ch. 14: Questions 2, 7, 13, 20, 22 Zvi Wiener Fabozzi Ch 14 slide 13