Course Objectives - NUS Business School

advertisement

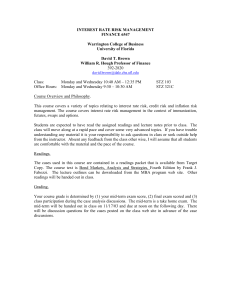

Course Title : FIXED INCOME SECURITIES (BMA5308) Instructor : Prof. B.B.Chakrabarti Pre-Requisites : Knowledge of basic mathematics and finance will be helpful. Course Objectives The objectives are to comprehend various types of fixed income securities and their risks, risk mitigation and portfolio management. The course also deals with term structure of interest rates and valuation of bonds – plain vanilla as well as bonds with embedded options. Interest rate derivatives used for risk management along with their pricing are also discussed. The theoretical principles and applications are explained with case studies, solution of problems and MS Excel based assignment. Course Outline Session Topic Readings Assignment a) Features of Debt Securities Fabozzi Chapters 1 To be assigned by the b) Risks Associated with Investing in Bonds and 2 Instructor a) Overview of Bond Sectors and Investments Fabozzi Chapters 3 b) Yield Measures, Spot Rates and Forward Rates and 6 To be assigned by the Instructor 3 a) Introduction to Valuation of Debt Securities Fabozzi Chapters 5 4 b) Tutorial on Topic 2b a) Term Structure and Volatility of Interest Rates To be assigned by the Instructor Fabozzi Chapters 8 b) Introduction to Measurement of Interest Rate Risk and 7 To be assigned by the Instructor 1 2 5 a) Tutorial on Chapters 3a 6 b) Interest Rate Derivatives: FRA, Futures and Bond Options a) Interest Rate Swap 7 b) Tutorial on Topic 4b c) Quiz 1 (30 minutes) a) Tutorial on Topics 5b and 6a 8 b) Interest Rate Options – Caps, Collars, Floors and Swap Options a) Valuing Bonds with Embedded Options 9 Hull – Chapter 6 Hull Chapter 7 Hull Chapter 28 To be assigned by the Instructor To be assigned by the Instructor To be assigned by the Instructor Fabozzi Chapter 9 b) Case: Arbitrage in the Government Bond Market (HBS Case 9-293-093) a) Introduction to Bond Portfolio Management To be assigned by the Instructor Fabozzi Chapters 16 b) Managing Funds against a Bond Market Index and 18 To be assigned by the Instructor 10 a) Portfolio Immunization and Cash Flow Matching Fabozzi Chapter 19 11 b) Tutorial on Topics 8a, 9a and 10a a) Value at Risk for Debt Securities To be assigned by the Instructor Hull Chapter 20 12 b) Case: R J Reynolds International Financing (HBS Case 9-287-057) c) Quiz 2 (30 minutes) a) Martingale Pricing and Valuing Interest Rate To be assigned by the Instructor Hull Chapter 31 Options using HJM Model Fabozzi Chapter 24 b) Credit Derivatives Note: Each session will be of 3.5 hours duration. Text Book: 1) Fixed Income Analysis by F.J.Fabozzi – 2nd. Edition 2) Options, Futures and Derivatives by John C. Hull – 6th. Edition Assessment Method a) Individual Assignment (Problems): 20% b) Quiz (2 nos.): 20% c) Case Submission (2 cases): 10% d) Class Participation in Case Discussion (2 cases): 10% e) MS Excel Based Assignment: 20% (Walt Disney Company’s Sleeping Beauty Bonds HBS Case nos. 9-294-034 and 9-294-038) f) Group Home Assignment: 20%