Creating Value in a Global Marketplace

advertisement

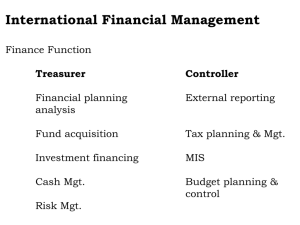

Creating Value in a Globalized World Presentation by Rob Slee, CBA, MA, MBA Robertson & Foley, Investment Bankers, Charlotte rob@robertsonfoley.com CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 1 The Problem / Opportunity Most business owners are not increasing the value of their firms What can be done to improve this? CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 2 Let’s Review What Is Being Taught ● There is one primary capital market in the U.S. ● Corporate finance theory explains behavior of the players ● Every business has one true value ● Capital is efficiently allocated and priced ● Going public is the primary goal of a business owner But none of this is true! CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 3 Upon Further Review ● Capital markets are segmented in the U.S. ● Various finance theories explain behavior of the players ● Every private business has dozens of correct values at one time ● Private capital is not efficiently allocated and priced ● More companies will go private than public in the foreseeable future A new belief system developing? CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 4 What are the Private Capital Markets? ● The venues where private capital is raised and private equity interests are exchanged If you’re sitting here… CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 5 A Tale of Two Markets Public Markets (Wall St.) Private Markets (Main St.) Use of a C corporation Can be any type entity (S, LLC, etc) Value is established by a market Value is established at a point in time Ready access to public capital markets No access to public capital markets Owners have limited liability Owners have unlimited liability Owners are well diversified Owners have one primary asset Professional management Owner management Company has infinite life Typical company life of one generation Liquid securities efficiently traded Illiquid securities inefficiently traded Profit maximization as goal Personal wealth creation as goal CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 6 Capital Markets – An Overview Sales ($millions) 5 Small 150 500 Lower Businesses Middle M I d d l e 5.4MM 1,000 Upper Large M a r k e t Companies 300,000 2-3x 4-7x CREATING ● 2,000 8-9x VALUE ● IN ● 10-11x A ● GLOBALIZED ● >12x WORLD 7 Different Theories for Different Segments Sales ($millions) 5 Small 150 500 Lower Businesses Middle M I d d l e 1,000 Upper Large M a r k e t Companies Small Company Markets Theory Private Capital Markets Theory Corporate Finance Theory CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 8 Dickens Déjà Vu? ● Capitalism may be the most successful export in US history ● It’s the best of times for companies with conceptual business models (how you organize to meet your goals) ● It’s the worst of times for companies with provincial business models ● 70% of private business owners are NOT increasing the value of their firms CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 9 What’s an Owner to Do? I. II. III. Learn to think and act strategically Raise his/her Private Finance IQ Play to win by the New Rules of wealth creation CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 10 I. The Strategy Thing Every so often the rules of business change Industrial Age… Information Age… Conceptual Age CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 11 What Game Are You Playing? The game of business: Information Age Conceptual Age Left brain Tactical MBAs & wonks Checkers Left and right brain Strategic Designers and deliverers Chess CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 12 Who or What is Holding You Back? ● Most owners spend less than 10% of their time on strategic thinking (strategy is what you do to meet your goals) ● In the Conceptual Age, operational effectiveness is the starting point ● What’s the main constraint every business faces? ● Whoever sits behind the owner’s desk! CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 13 Tactical vs. Strategic Thinking Tactical Strategic Sergeant Player Operations Sales General Coach Business model Marketing Does all of this matter to creating wealth? CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 14 II. Private Finance ● The study of how private companies make investment and financing decisions ● Value Relativity: Value is relative to the reason for an appraisal ● The Bizarre Bazaar: Private capital is allocated in a bazaar ● Transfer Spectrum: Business transfer comprises a spectrum of alternatives ● You are lost until you understand the integrated structure of private finance (a story might help) CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 15 On the Lighter Side Investment Banker Man The harmonic mean of the public control premiums derives an implied minority discount that is multiplicatively, not additively, applied to the unadjusted … Slee3 Why it’s so difficult to value a business appraiser’s opinion CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 16 Value Relativity ● ● ● ● Einstein and his theory of relativity Slee’s theory of value relativity The reason for an appraisal leads to a value world Every private company has dozens of correct values at one point in time ● Why? Not because I say so – but because Authorities say it is so CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 17 A Few Value Worlds ● Market Value – what the open market says the business is worth (Asset, Financial, and Synergy Subworlds) ● Fair Market Value – what the IRS/Courts say it is worth ● Owner Value – what you say it is worth ● Investor Value – what an investor says it is worth ● Collateral Value – what the bank says it is worth ● Why is there relativity? Without an active trading market, perspective of the players matters CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 18 The Bizarre Bazaar Success in the private capital bazaar requires: (BTW, why a bazaar and not a supermarket?) ● Understanding the structure and rules of the bazaar ● Being prepared for financial hand-to-hand combat ● Realizing that capital providers constantly move their tents ● Creating capital solutions one deal at a time CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 19 Structure of the Bazaar ● Private capital owner motives include a desire: for few shareholders; to stretch equity; to eliminate personal guarantees; to manage business – not balance sheet ● Capital is allocated based on the credit requirements of the providers (credit box) ● Capital providers have unique return expectations ● Return expectations are all-in rates (not just stated interest rates) CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 20 On the Lighter Side Investment Banker Man Let me get this straight, the all-in cost to factor my client’s receivables is Prime +3% Slee3 Commercial truth-in-lending – when Prime hits 30% CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 21 0 CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD Factoring S Factoring M Angel V/C Factoring L PEG EMC DMC ABL3 Venture Leasing Spec Leasing EWCP ABL2 Bank C/L CAPLine Captive Leasing Bank Leasing 7(a) ABL1 B&I 504 IRBs Expected Returns (%) Private Capital Access Line 60 50 40 30 20 10 Capital Access Points 22 Business Transfer ● Business transfer reflects all possible ways or methods to transfer or exchange a private business interest ● An owner’s transfer motive selects a transfer channel (e.g., Employee channel) ● Each channel contains numerous transfer methods (e.g., ESOP or MBO) ● Transfer methods select value worlds! CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 23 Business Transfer Spectrum TRANSFER TRANSFER Employees Charitable Trusts Family MOTIVES CHANNELS Co-Owners T R A N S F E R ESOPs Management Buyouts/Ins Phantom Stock Stock Appreciation Rights Charitable Remainder Trusts Charitable Lead Trusts Outright Gifts SCINs Annuities GRATs FLPs IDGTs ● VALUE Outside [Retire] [Continue] Public M E T H O D S Negotiated One-Step Private Auctions Two-Step Private Auctions Buy/Sell Russian Roulette Dutch Auction Right of First Refusal INTERNAL TRANSFERS CREATING Outside Consolidate Roll-ups Buy and Build Recapitalizations Initial Public Offerings Direct Public Offerings Reverse Mergers Going Private EXTERNAL TRANSFERS ● IN ● A ● GLOBALIZED ● WORLD 24 Owner Motives Matter Possible values for PrivateCo: Method Value World Value Buy/Sell MBO ESOP Recap Auction IPO Asset Market Value Investment Value Fair Market Value Financial Market Value Synergy Market Value Public Value $ 2.4 MM $ 7.5 MM $ 9.2 MM $12.0 MM $16.6 MM Ask Google Business Owners Choose a Transfer Value! CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 25 III. New Rules of Wealth Creation 1. Every person working in or for a business must create wealth to remain employed 2. Job security is a function of the number of wealthcreating skill sets that are possessed 3. A company can expand its returns via arbitrage if its managers understand how to exploit market opportunities. CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 26 III. New Rules (cont) 4. Companies should adopt conceptual business models to create wealth. 5. Owners need to raise their Private Finance IQ’s to make better investment and financing decisions (and thereby create wealth). CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 27 The Midas Touch ● Most owners know the game has changed, but they don’t know how to win going forward ● Midas Managers have figured it out ● Midas Managers have always existed and have always created wealth ● Let’s review the essence of Midas CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 28 Essence of Midas Midas Managers are: ● ● ● ● ● Control freaks in pursuit of a goal Contrarians Strategists who delegate Able to “look just over the horizon” Capable of understanding and exploiting the motives of others ● Driven to create wealth CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 29 The Wealth Matrix Income Market Position Risk Arbitrage M Business Models S Private Finance CREATING ● VALUE ● T IN ● R A I A ● D A T E GLOBALIZED ● S G WORLD I E S 30 Let’s Play Some Wealth Creation Games 1. 2. 3. 4. 5. The Valuable View Game The Consolidation Math Game The Create a Niche Conglomerate Game The Productize Your Business Game The Design and Deliver Game CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 31 1. The Valuable View Game Small Middle Expected Returns 50% 40% 30% 20% Large 10% 0% Debt CREATING ● VALUE ● Mezzanine IN ● A ● GLOBALIZED Equity ● WORLD 32 1. How to Get Viewed on a Better Line 1. 2. 3. 4. 5. Simplify the business model Develop a recurring revenue/income stream Institutionalize the business (mgmt, systems, etc.) Create transparency on all fronts Rationalize the process chain End Result: Better/cheaper access to capital plus a higher acquisition multiple CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 33 2. Consolidation Math Game Sales ($millions) 5 Small 150 500 Lower Businesses Middle M I d d l e 2-3x 4-7x CREATING ● Upper ● IN Large M a r k e t 8-9x VALUE 1,000 ● Companies 10-11x A ● GLOBALIZED ● >12x WORLD 34 2. The Rules of this Game ● ● ● ● ● ● ● Identify your market segment You need a platform company Determine which competitors are not adding value Go after all of them at once Use the Head-’n-Shoulders approach The toughest part is integrating the operations Don’t fall in love with the result CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 35 3. Create a Niche Conglomerate ● Take what globalization will give you – become a niche-aholic ● Successful middle market firms are amalgams of niches ● Hang your niches off an intellectual capital tree ● Spend 50% of your time developing the next niche ● Ideal company: $15 MM in sales, comprised of 5-6 niches, EBITDA of $4-5 MM CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 36 3. Niche Building (Rob’s Intellectual Capital Tree) Seminars Preach Advise Write Create Books CREATING ● Own Stuff Engr. VALUE ● IN ● A ● GLOBALIZED ● WORLD 37 4. Productize Your Business Game ● Cimtec Automation is a Charlotte value-added distributor of factory automation ● The managers and I bought it from Unifi in 2002 ● Project engineering equates to no value creation because the market wants/values recurring revenue/income streams ● We are currently productizing our offerings ● This is the Head-’n-Shoulders approach again CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 38 5. Design and Deliver Game ● The new global business model calls for controlling rather than owning your process chain (own only your intellectual capital) ● This strategy works even in depressed industries ● Take the Textiles industry for example. We have clients with annual sales of more than $50MM; EBITDA of more than $10MM; fewer than 15 employees. CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 39 5. Design and Deliver (Example) Robertson & Foley’s Process Chain The Old Chain: OWN EVERY STEP OF THE PROCESS (INCLUDING EMPLOYEES/OTHER) The New Chain: MARKET ENGINEER OUTSOURCE DELIVER The hardest part is letting go of what worked 10-20 years ago CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 40 What’s Stopping You? ● Creating wealth is a choice ● Most owners seek only a lifestyle – not wealth ● The Conceptual Age threatens to destroy many lifestyle businesses ● Owners need to reconceptualize themselves and their business models CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 41 Where Do You Go from Here? ● Answer the following question: - If we were meeting 3 years from now, what would have to happen for you to feel like you’ve been successful? ● Write down the answers and post them ● Choose strategies that will get you there ● By all means, delegate the stuff you hate, and enjoy meeting your goals! CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 42 Après Wealth Creation Once you create wealth, you need to realize it… CREATING ● VALUE ● IN ● A ● GLOBALIZED ● WORLD 43