Harmonisation of Shareholder Rights – A comparative analysis

advertisement

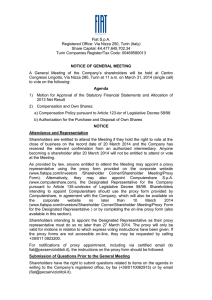

Harmonisation of Shareholder Rights – A comparative analysis Matthias Pannier Research Fellow in European Law Harmonisation of Shareholder Rights on EU level: Implications for the UK BIICL 6 July 2005 Overview 1)EU Level: Existing shareholder rights on European level 2)MS level: current status and reform proposals • Pre general meeting communications • Admission to the general meeting • Right to ask questions, Voting, Proxy voting 3) Summary EU Level: Existing Shareholder Rights on European Level 1) SE Statute • Art 54(1) SE Statute frequency of the AGM • Art 55, 56 SE Statute 10% minority to call in GM and to add additional items to the agenda 2) Company reconstruction • Shareholder approval and information • Principle of equality and minority protection 3) Transparency Directive • Art 17 standards for shareholder information and proxy voting GM Notice Periods: Commission Proposal Annual General Meetings of listed companies shall be convened on a first call with no less than 21 business days notice. Other Shareholders’ Meetings shall be convened on a first call with no less that 10 business days notice. GM Notice: Content and Form Commission proposal Description of participation and voting procedures and requirements Full text of the resolutions and documents available at the latest 15 business days before AGM, and at latest 10 business days before other GM Language customary in the sphere of international finance Information on website GM Notice Periods in some MS EU Dir Austria Finland France Germany Italy The Netherlands Poland Spain Sweden UK 21 days AGM (10 days others) 14 days Between 1 week and 2 months 30 days (prelimiary) 15 days call 30 days 15 days (30 days for plc) 15 days 3 weeks 15 days 6 weeks (2-6 weeks EGM) 21 days AGM (otherwise 14 days) 20 working days Combined Code GM Notice Germany “permanent corporate law reform” KonTraG 1998 (Control and Transparency Act) NaStraG 2002 (Act on Registered Shares and Facilitating the Exercise of Voting Rights) UMAG 16 June 2005 (Act to improve corporate integrity and modernise the regime governing shareholder claims) German Corporate Governance Code (Cromme Code) amended 2005 GM Notice Germany: latest changes 1)UMAG changed period to 30 days (§ 123 Abs. 1 und 4 Akt) 2)Notice and agenda to be announced in the electronic federal bulletin (§§ 121 III S. 1, 124 I S. 1 AktG). In addition companies can use their websites 3)Registered shares: email may be used (§§ 121 IV S. 1, 124 I S. 3 AktG) 4)UMAG special shareholder forum in the electronic federal bulletin GM Notice France: latest changes 1)New Economic Regulation (Nouvelles Régulations Economiques, NRE) 2001 2)Financial Securities Act 2003 • Minority shareholders with 5% of the share capital can now demand a GM (Art L 225-103 CC, Art 122 D) • Notice period 15 days (Art 126 D), listed SA 30 days (Art 130(3) D) • Electronic communication allowed, shareholder consent required GM Notice UK: Latest changes 1) Companies Act 1985 (Electronic Communications) Order 2000 enabled cos to contact shareholders by electronic means Sec 369(4) A-G CA 2) DTI white paper: notice periods for the AGM and EGM equalised to 14 days, companies may set longer periods in order to comply with the combined code. 3) DTI white paper: AGM linked to reporting cycle, held within six months of the end of the financial year 4) DTI white paper: companies allowed to default to electronic communications or communication, subject to shareholder approval. Shareholder right to add proposals to the agenda EU Dir Belgium Denmark France Germany Greece Netherlands Spain UK 5% of share capital or value of €10m At least 20 % of the capital If requisitioned in writing 0.5-5% of the capital 5% of capital or EUR 500.000 Unanimous consent shareholders requisitioned the GM / unanimous consent If approved by members at GM At least 5 % of capital or no less than 100 members holding shares on which an average sum of £100 has been paid up Admission to GM: Commission proposal 1. Provisions making the right to vote in a General Meeting conditional, or allowing the right to vote to be made conditional, on the immobilisation of the corresponding shares for any period prior to the Meeting shall be abolished. 2. The right to vote at the General Meeting of a listed company shall be made conditional upon qualifying as a shareholder of that listed company on a given date prior to the relevant General Meeting. Admission to GM: Latest changes 1) Germany: UMAG removed the reconciliation requirement UMAG will impose a mandatory record date 14 days before the meeting 2) France: articles could provide for a minimum number of shares (Art. L 225-112 I), abolished by NRE of 2001, record date between 5 and 15 days before the meeting 3) No share blocking under English law. Proposals for change in the Myners report (two business days) 4) Polish law still provides for share blocking Right to ask questions: Commission proposal Shareholders shall have the right to ask questions at least in writing ahead of the General Meeting and obtain responses to their questions. Responses to shareholders questions in General Meetings shall be made available to all shareholders. The above principles are without prejudice to the measures which Member States may take, or allow issuers to take, to ensure the good order of General Meetings and the protection of confidentiality and strategic interests of issuers. Right to ask questions: latest changes 1)Germany: UMAG restricts information right : any information published on the corporate website is considered to be given in the shareholder meeting, failure to provide information does not always justify a shareholder suit 2)France: Right to hand in written questions between calling and opening of GM Art L 225-108(3) CC Voting Right Commission Proposal 1. Member States shall ensure that shareholders of listed companies have the possibility to vote by correspondence. 2. Member States shall remove existing requirements, and shall not impose new requirements, on companies which hinder or prohibit voting by electronic means at General Meetings. Voting right: Latest changes 1)Germany: voting right must be exercised in GM. Electronic voting or voting by correspondence is not possible but electronic proxy appointment 2)France: law enables shareholders to vote without participating by correspondence (Art. L 225-107), NRE enables companies to use electronic voting 3)UK: no electronic voting but electronic proxy appointment Voting possibilities Belgium Finland France Germany Italy Poland Netherlands Spain UK By mail X X X By electronic means X X (if articles provide) (X) electr proxy app X X X X (and proxy app) X (X) electr proxy app Source: Norbert Kluge and Michael Stollt `Board-level representation in the EU-25, ETUI 2004 Proxy Voting Commission Proposal 1. Every shareholder shall have the right to appoint any other natural or legal person as a proxy to attend any General Meeting on his behalf. 2. No constraint or limitations shall be imposed other than provisions relating to the legal capacity of the person. In particular, there shall be no limitations on the persons who can be appointed as proxies and on the number of proxies any such person may hold. 3. Shareholders shall not be prevented from appointing their representatives by electronic means. Proxy Voting Commission Proposal 4. Persons appointed as proxies shall enjoy the same rights to speak and ask question in General Meetings as those to which the shareholders they represent are entitled. 5. Issuers shall not themselves collect proxies in advance of General Meetings but shall entrust independent third parties with such collection. 6. All votes cast on each resolution submitted to a General Meeting shall be taken into account, irrespective of the means by which the votes are cast. Proxy Voting: Latest changes 1)Germany: shareholders can be represented by any person, NaStraG introduced an electronic proxy appointment, a proxy can be unlimited in time, special rules for the organized proxy of banks 2)France: only other shareholders and spouses can be proxies, authorization can only be given for one GM, „procuration en blanc“ 3)UK: Proxy can be permanent and in an electronic format, “general proxy“ “two-way-proxy