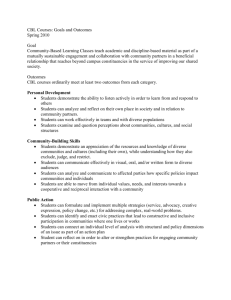

Presentation

advertisement

X Facilities Energy Management Alexis Wong, Kiran Singh, Quan Luu, Sam Hein ITEC 200- ITR 2014 CBL: A Leading Diversified Real Estate Investment Trust Properties Total Malls / Open-Air Outlet Centers Associated Centers Community Centers Offices 3rd Party / Other No. Of Properties 158 83 3 32 10 14 17 Sq. Ft (M) 92.7 72.4 1.0 4.9 2.7 0.8 10.9 The Bottom Line CBL’s Investors require financial and environmental outperformance What strategies should CBL consider to ensure that these goals are complementary? What WegoWise Does Reads your utility bills: electricity, gas, water Simple data visualization tools Identifies usage spikes Benchmarks against peers Projects and measures savings Log onto your WegoWise account Track your energy usage Benchmarking Data Analysis Flushing away excess water usage Shows a typical water retrofit for multi-occupant building in WegoWise database Low flow toilets were installed in 2009 after WegoWise identified a wasteful energy source Transforming data to polar coordinates can illustrate how much excess water usage is now eliminated WegoWise is Extremely Cost-Effective WegoWise Changes the Economics of FEM Product Market Only 5% of the potential market reached by “total” approaches Several barriers to adoption 2011 Empire State Building Retrofit (Johnson Controls) 38% Reduction in energy consumption $13MM Upfront capital commitment $4.2MM Annual energy savings 3.1 Year payback This formula doesn’t work for a lot of firms WegoWise and CBL: An Incremental Approach No hardware = No upfront capital commitment Issue Discovery Data leads to ROI Prioritization Ongoing monitoring and benchmarking WegoWise is cost-effective enough to monitor any FEM installations Why should REITs like CBL pay attention to energy efficiency? ~ 1/3 of typical building operating budgets NOI/NAV effects Occupant comfort 20% of USA’s greenhouse gas emissions Regulatory compliance CSR goals CBL’s Form 10-K 30% of energy in buildings is used inefficiently or unnecessarily 14% Lets Talk Numbers 200,000 Square foot property Pays $2 / square foot + $40,000 10% Reduction in energy consumption At 8% “cap” rate, this can mean an asset value boost of + $500,000 CBL’s net asset value by + $231M CBL’s CSR Program Able to save 500 million gallons per month If the energy efficiency of commercial and industrial buildings improve by 10%, the collected savings would be over $2 billion in 20 years Now Is the Time to Invest