Module 25- Banking and the Multiplier

Module 25- Fractional Reserve Banking and the Money Multiplier

J.A.SACCO

Fractional Reserve Banking

Depository institutions are required by the Fed to maintain a specific percentage (reserve requirement) of their customers deposits as reserves

Three types of reserves!

Fractional Reserve Banking

Legal (Total) Reserves-

reserves that depository institutions are allowed by law to claims as reserves (deposits held at Federal Reserve District Bank and/or commercial bank vault cash.

Required Reserves-

the value of reserves that a depository institution must hold in vault cash or with the

Federal District Bank. These reserves are required to back its checkable deposits.

Fractional Reserve Banking

Excess Reserves-

the difference between legal reserves and required reserves. These reserves can be used as new loans and/or purchase government bonds & securities.

Excess Reserves = Legal Reserves- Required Reserves

Fractional Reserve Banking

Example: Total (Legal) Reserves is $20 B. and the

Reserve Requirement is 10%.

What is the required reserves? Excess reserves?

RR is $2B in deposits to be held in Fed District Bank or vault cash.

ER is $18 B. in new loans or to buy gov’t securities.

Reserves and Total Deposits

SACCO KEY POINT- New reserves are not created when checks written on one bank are deposited in another bank.

The bank writing the check will lose reserves, and the bank receiving the check will gain reserves.

Only when the Fed buys/sells securities from banks or the public, or when you put available cash in the bank are reserves increased/decreased and in turn the money supply.

Money Expansion by the Banking System

Why is the reserve requirement and excess reserves important?

How much will the money supply increase after you deposit

$100,000 cash into a commercial bank.

7

How Money is Created?

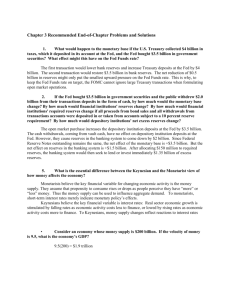

“Multiple Expansion of Checkable Deposits”

Assume a 10% Reserve Requirement

Bank

1

2

3

New Deposits

(new reserves)

$100,000

90,000

81,000

New Required

Reserves

$10,000

9,000

8,100

Maximum

New Loans plus Investments

(excess reserves)

$90,000

81,000

72,900

.

.

.

4 72,900

.

.

.

All other banks 656,100

Totals $1,000,000

7,290

.

.

.

65,610

$100,000

65,610

.

.

.

590,490

$900,000

The Money Multiplier

Money Multiplier

Gives the maximum potential change in the money supply due to a change in reserves

Potential money multiplier

1 required reserve ratio

Initial change in excess reserves x

Actual money multiplier

=

Actual change in the money supply

9

Forces that Reduce the Money Multiplier

Leakages

Currency DrainsPeople hold money in wallet. Don’t put money in bank to allow deposit expansion.

Excess ReservesBanks keep more as excess reserves.

How the Fed Controls the Money Supply

Fed Tools

Reserve Requirement

Increase

Macro. Effects

Contractionary

Money Supply

Interest rate

Investment

Decrease Expansionary

Money Supply

Interest rate

Investment

How the Fed Controls the Money Supply

Fed Tools

Discount/Federal Fund Rate

Increase

Macro. Effects

Contractionary

Money Supply

Interest rate

Investment

Decrease Expansionary

Money Supply

Interest rate

Investment

How the Fed Controls the Money Supply

Fed Tools

Open Market Operations

Sell Securities

“Sell Bonds, Small Bucks”

Macro. Effects

Contractionary

Money Supply

Interest rate

Investment

Buy Securities

“Buy Bonds, Big Bucks”

Most used by the Fed to expand the money supply. Why?

Expansionary

Money Supply

Interest rate

Investment

The Fed and the Money Supply

A.

B.

What has a greater affect on the expansion of the money supply:

$100 deposit of an individual into a commercial bank?

A Fed purchase of a government bond/security from a commercial bank for a $100?

Assume a 20% Reserve Requirement

The Fed and the Money Supply

A.

B.

C.

Money Multiplier?

Individual- RR= $20, ER= $80--- Expansion of Money

Supply is $400.

Fed- RR= $0, ER=$100--- Expansion of Money Supply is

$500.