THE BUST

advertisement

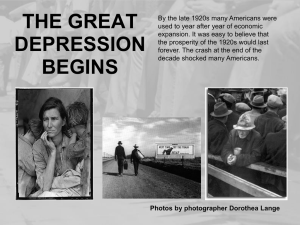

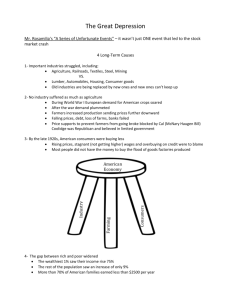

LANE “BUST” 1 THE BUST On Thursday, October 24, 1929, an unprecedented wave of sell orders shook the New York Stock Exchange. Stock priced tumbled, falling $2, $5, and even $10 between trades. As prices fell, brokers required investors who had bought stock on margin 1to put up money to cover their loans. To raise money, many investors dumped stocks for whatever price they could fetch. At noon, a group of prominent bankers met at the offices of J.P. Morgan and Co. to stop the hemorrhaging (losing a large amount) of stock prices. The bankers' pool agreed to buy stocks well above the market. At 1:30 p.m., they put their plan into action. Within an hour, U.S. Steel was up $15 a share; AT&T up $22; General Electric up $21; Montgomery Ward up $23. Even though the market recovered its morning losses, public confidence was badly shaken. Rumors spread that eleven stock speculators had killed themselves and that government troops were surrounding the exchange to protect traders from an angry mob. President Hoover sought to reassure the public by declaring that the "fundamental business of the country...is on a sound and prosperous basis." Prices held steady on Friday, and then slipped on Saturday. Monday, however, brought fresh disaster. Kodak plunged $41 a share; AT&T plunged $24; New York Central Railroad plunged $22. The worst was yet to come. It occurred on Black Tuesday, October 29, the day the stock market experienced the greatest crash in its history. As soon as the stock exchange's gong sounded, a mad rush to sell began. Trading volume soared to an unprecedented amount on average price of a share fell 12 percent. Stocks were sold for whatever price they would bring. One purchaser--reportedly a messenger boy--bought a block of the stock for $1 a share. The bull market (growth of the stock market prices) of the late 1920s was over. By 1932, the index of stock prices had fallen from a 1929 high of 210 to a low of 30. Stocks were valued at just 12 percent of what they had been worth in 1929. Altogether, between 1929 and 1932, the nation's stock exchanges lost $179 billion in value. 1 Buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to buy more stock than you'd be able to normally. To trade on margin, you need a margin account. This is different from a regular cash account, in which you trade using the money in the account. Example: Maintenance margin refers to the minimum amount of money that must exist in the account before the broker forces the investor to deposit more money. Let's say an investor deposits $10,000 and the maintenance margin is 50% ($5,000). As soon as the investor's money vaule dips so much as a dollar below $5000, the broker may call the investor and demand that he/she deposit additional money to bring the balance back to maintenance margin level. LANE “BUST” 2 The great stock market crash of October 1929 brought the economic prosperity of the 1920s to a symbolic end, however we must understand that there were multiple causes for the stock market crash in 1929. For example: The prosperity of the 1920s was unevenly distributed among the various parts of the American economy. The result that the nation was producing more goods than what the people could consume. Tariffs (taxes) and war-debt policies of the gov’t of the 1920s had cut down the foreign market for American goods. Finally, easy-money lending policies led to an excessive expansion of credit and installment buying and extreme decline of the stock market put Americans banks into gigantic trouble. For the next ten years, the United States was stuck in a deep economic depression. By 1933, unemployment had soared to 25 percent, up from just 3.2 percent in 1929. Industrial production declined by 50 percent. In 1929 before the crash, investment in the U.S. economy totaled $16 billion. By 1933, the figure had fallen to $340 million--a decrease of 98 percent.