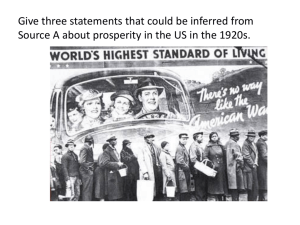

The Economy of the 1920s

advertisement

The Economy of the 1920s EQ: WHAT ECONOMIC P R O B L E M S T H R E A T E NE D THE BOOM OF THE 1920S? Look at the Data The 1920’s was a time of dramatic change in society and the economy Look at the statistics from the 1920’s and notice the economic trends Are these changes positive or negative changes? Why? Is there anything you see that might be a problem in the future? AREA OF THE ECONOMY Industry Advertising Consumer Credit Economic Concentration Workers Agriculture Distribution of Wealth + OR - CHANGE? WHY WAS THIS POSITIVE OR NEGATIVE? The Boom The US became a consumer economy by buying more products. Higher wages, advertising, new products, lower costs, and “credit” made it easier for people to buy more than what they needed Factories make more products Workers want more products because they have more money Workers have more money to buy more products Factories make more money to pay their workers The Boom Bull Market- Stock prices were continually rising People began buying “on margin” Borrowed money to buy stocks Installment Plans became popular because people could buy products on credit or “buy now, pay later.” The Great Bubble: Suppose You had $100 to invest in the Stock Market in July 1926: • July 1926 $100 •July 1927 $112 • July 1928 $148 •January 1929 $193 • September 1929 $216 • December 1929 $147 •December 1930 $102 •July 1932 $34 The Boom New/improved products were created to use with electricity: Refrigerators, washing machines, vacuums, & radios. Toasters, ovens, sewing machines, coffee pots, irons, telephones, & cosmetics. The Boom Advertising helped companies sell their products The Bust Factories were offering vacations and health plans to stop workers from striking = less people joining unions for important conditions. The Bust Many people were not “rich” in the 1920’s Farmers, African Americans, Immigrants, & Unskilled workers suffered and had to pay back debt. Banks were failing because loans were not being paid. The demand for products left factory workers working longer hours for less money (56 hours for $10 a week). The Bust Debt became a problem for many low income families who bought products on installment plans. Many people bought stocks on a “margin”: putting down 10% and paying off the rest when they sold the stock (making it worth less). The Bust Factories were making products too quickly for people to buy them. October 29th, 1929: Black Tuesday—Stock Market Crashes!