Risk Management and Derivatives - Heriot

advertisement

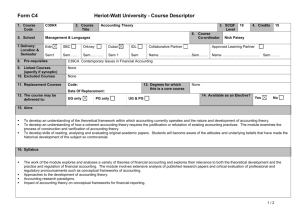

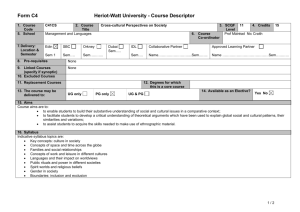

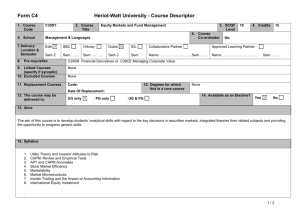

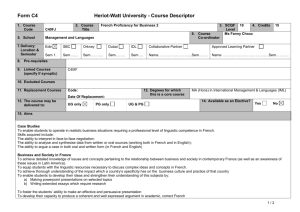

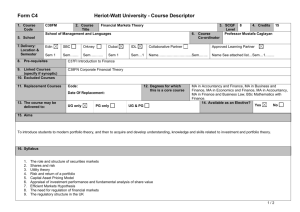

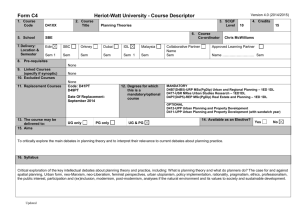

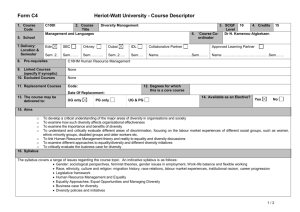

Form C4 Heriot-Watt University - Course Descriptor 1. Course Code C30SX 2. Course Title Risk Management & Derivatives 5. School Management & Languages 7. Delivery: Location & Semester Edin SBC Orkney Dubai IDL Collaborative Partner Approved Learning Partner Sem 1 Sem……. Sem……….. Sem…… Sem Name…………………….....Sem..…... Name ……………………….… 6. Course Co-ordinator 8. Pre-requisites C39SN Financial Derivatives or C39CE Managing Corporate Value 9. Linked Courses (specify if synoptic) 10. Excluded Courses None 11. Replacement Courses Code: 10 4. Credits 15 Dr Boulis Ibrahim Sem…….. None 12. Degrees for which this is a core course Date Of Replacement: 13. The course may be delivered to: 3. SCQF Level UG only PG only UG & PG BSc (Hons) in Mathematics with Finance 14. Available as an Elective? Yes No 15. Aims The aim of this course is to develop an in-depth understanding of security analysis and derivatives applications in portfolio and risk management 16. Syllabus Based on a collection of articles from both academic and practitioner orientated journals covering the areas mentioned in ‘subject mastery’ below. . 17. Learning Outcomes (HWU Core Skills: Employability and Professional Career Readiness) 1/2 Form C4 Heriot-Watt University - Course Descriptor Subject Mastery Understanding, Knowledge and Cognitive Skills Scholarship, Enquiry and Research (Research-Informed Learning) Personal Abilities understand and explain the various types of risk faced by various critically evaluate relevant information gathered from a variety of financial institutions; sources. understand and critically appraise the various strategies involved in risk management practices (financial engineering); appraise the shortcomings of Black-Scholes option pricing model and master knowledge of methods of using these shortcomings; understand derivatives of options (the Greeks) and their uses. assess the effect of changing volatility in creating ‘smiles’ in B/S implied volatility estimates; describe the various uses of derivatives in dynamic asset allocation, portfolio insurance, hedging, executive compensation and banking. Industrial, Commercial & Professional Practice Autonomy, Accountability & Working with Others Communication, Numeracy & ICT discuss real options (e.g., corporate capital define, explain, discuss and critically appraise write well-constructed essays investment projects) and their evaluations. relevant subject issues in individual and group using well-balanced arguments; discuss the determinants of portfolio efforts. performance. understand bond portfolio management and the determinants of bond prices. critically appraise security analyses (fundamental v. technical) versus asset allocation. 18. Assessment Methods Method 19. Re-assessment Methods Duration of Exam Weighting (%) Synoptic courses? (if applicable) Coursework Examination 2 hours Method Duration of Exam (if applicable) 30% 70% 20. Date and Version Date of Proposal 02 February 2013 Date of Approval by School Committee Date of Implementation Version Number 2/2 Diet(s)