C38FM_C4 - Heriot

advertisement

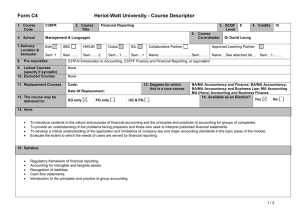

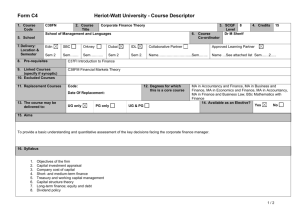

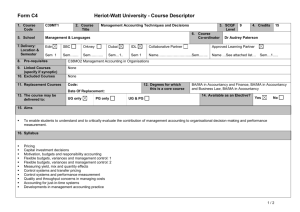

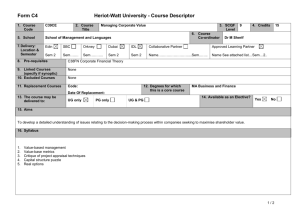

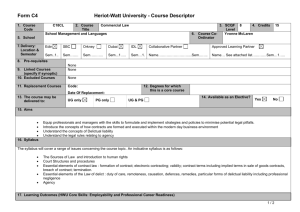

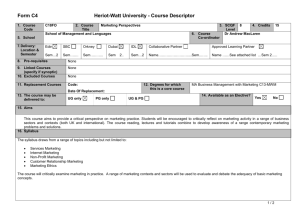

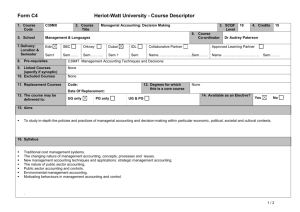

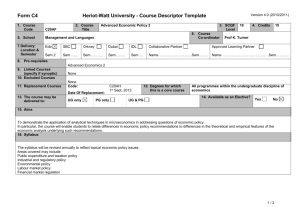

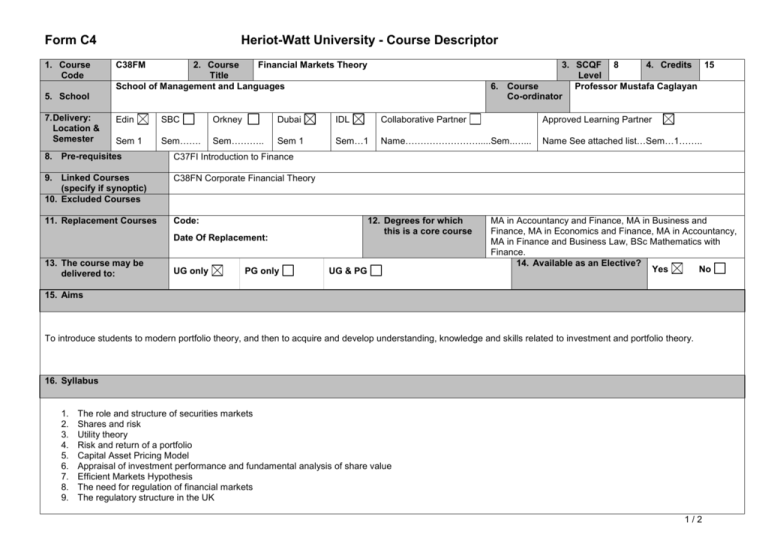

Form C4 1. Course Code Heriot-Watt University - Course Descriptor C38FM 2. Course Financial Markets Theory Title School of Management and Languages 3. SCQF 8 4. Credits 15 Level 6. Course Professor Mustafa Caglayan Co-ordinator 5. School 7. Delivery: Location & Semester Edin SBC Orkney Dubai IDL Collaborative Partner Approved Learning Partner Sem 1 Sem……. Sem……….. Sem 1 Sem…1 Name…………………….....Sem..…... Name See attached list…Sem…1…….. 8. Pre-requisites C37FI Introduction to Finance 9. Linked Courses (specify if synoptic) 10. Excluded Courses C38FN Corporate Financial Theory 11. Replacement Courses Code: 12. Degrees for which this is a core course Date Of Replacement: 13. The course may be delivered to: UG only PG only UG & PG MA in Accountancy and Finance, MA in Business and Finance, MA in Economics and Finance, MA in Accountancy, MA in Finance and Business Law, BSc Mathematics with Finance. 14. Available as an Elective? Yes No 15. Aims To introduce students to modern portfolio theory, and then to acquire and develop understanding, knowledge and skills related to investment and portfolio theory. 16. Syllabus 1. 2. 3. 4. 5. 6. 7. 8. 9. The role and structure of securities markets Shares and risk Utility theory Risk and return of a portfolio Capital Asset Pricing Model Appraisal of investment performance and fundamental analysis of share value Efficient Markets Hypothesis The need for regulation of financial markets The regulatory structure in the UK 1/2 Form C4 Heriot-Watt University - Course Descriptor 17. Learning Outcomes (HWU Core Skills: Employability and Professional Career Readiness) Subject Mastery Understanding, Knowledge and Cognitive Skills Scholarship, Enquiry and Research (Research-Informed Learning) After completing this course, students should be able to o o o o Personal Abilities critically evaluate the role of financial markets, in particular the equity market, in economic systems, explain the main principles involved in investment analysis and the management of equity portfolios, understand and explain the main components and functioning of a developed financial system, understand the need for, and principles of, regulation and the regulatory structure in the UK. Industrial, Commercial & Professional Practice Autonomy, Accountability & Working with Others Communication, Numeracy & ICT After completing this course, students should be able to o o o carry out the calculations required to apply the principles of investment analysis to simple numerical examples, communicate, and justify, these calculations in an effective way in written format, understand the operations and responsibilities of the various professional and regulatory bodies responsible for the operations and stability of the financial system and their role in career paths. 18. Assessment Methods Method 19. Re-assessment Methods Duration of Exam Weighting (%) Synoptic courses? Method (if applicable) Coursework Examination ALPs only: Examination 2 Hours 2 Hours Duration of Exam Diet(s) (if applicable) 30% 70% 100% None None Examination 2 hours Resit Examination 2 hours Resit 20. Date and Version Date of Proposal April 2011 Date of Approval by School Committee Date of Implementation September 2011 Version Number 2/2 1.0