CVP Analysis: Cost-Volume-Profit Formulas & Examples

advertisement

Chapter 3 : Cost-Volume-Profit Analysis

Q1: What is the Cost-Volume-Profit Analysis?

CVP analysis looks at the relationship between cost, Volume and profits to

determine the breakeven point.

Q2: What is the breakeven point?

The breakeven point (BEP) is where: Total revenue = total costs.

Net Income = Zero

Total Contribution Margin = Fixed Cost

Q3: Explain the CVP analysis using graphic form?

Q4: How is CVP Analysis Used?

CVP analysis can determine:

1- Breakeven point both in sales volume and sales dollars.

2- Volume and sales dollars required to achieve target profit.

Break Even Points Formulas

1.

BEP (U) =

2.

BEP ($) =

C.M% =

C.M% =

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔

𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏 𝑷𝒆𝒓 𝑼𝒏𝒊𝒕

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔

𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏 𝑹𝒂𝒕𝒊𝒐

=

=

𝑭.𝑪

𝑪.𝑴/𝑼

𝑭.𝑪

𝑪.𝑴%

= ## units

{C.M/U = SP – V.C/U}

= $##

𝑺𝒆𝒍𝒍𝒊𝒏𝒈 𝑷𝒓𝒊𝒄𝒆 𝑷𝒆𝒓 𝑼𝒏𝒊𝒕 (𝑺𝑷)−𝑽𝒂𝒓𝒊𝒂𝒃𝒍𝒆 𝑪𝒐𝒔𝒕 𝑷𝒆𝒓 𝑼𝒏𝒊𝒕 (𝑽.𝑪/𝑼)

𝑺𝒆𝒍𝒍𝒊𝒏𝒈 𝑷𝒓𝒊𝒄𝒆 𝑷𝒆𝒓 𝑼𝒏𝒊𝒕 (𝑺𝑷)

𝑺𝒂𝒍𝒆𝒔 𝑹𝒆𝒗𝒆𝒏𝒖𝒆 (𝑺𝑹)−𝑽𝒂𝒓𝒊𝒂𝒃𝒍𝒆 𝑪𝒐𝒔𝒕 (𝑽.𝑪)

𝑺𝒂𝒍𝒆𝒔 𝑹𝒆𝒗𝒆𝒏𝒖𝒆 (𝑺𝑹)

Ehab Abdou ( 00965 97672930 )

× 100 = #%

× 100 = #%

www.hca4u.com

Chapter 3 : Cost-Volume-Profit Analysis

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔 + 𝑻𝒂𝒓𝒈𝒆𝒕 𝑷𝒓𝒐𝒇𝒊𝒕

Units Required to Earn Profit =

4.

Sales Required to Earn Profit =

5.

Safety Margin

6.

Safety Margin Ratio =

7.

Safety Margin Ratio =

8.

Operating Leverage =

9.

Percentage Change in Net Income = Percentage Change in Sales × Operating Leverage

𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏 𝑷𝒆𝒓 𝑼𝒏𝒊𝒕

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔 + 𝑻𝒂𝒓𝒈𝒆𝒕 𝑷𝒓𝒐𝒇𝒊𝒕

𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏 𝑹𝒂𝒕𝒊𝒐

=

𝑭.𝑪+𝑷𝒓𝒐𝒇𝒊𝒕

3.

=

𝑪.𝑴/𝑼

𝑭.𝑪+𝑷𝒓𝒐𝒇𝒊𝒕

𝑪.𝑴%

= Sales (U) – BEP (U)

= Sales ($) – BEP ($)

𝑺𝒂𝒍𝒆𝒔 (𝑼) – 𝑩𝑬𝑷 (𝑼)

𝑺𝒂𝒍𝒆𝒔 (𝑼)

𝑺𝒂𝒍𝒆𝒔 ($) – 𝑩𝑬𝑷 ($)

𝑺𝒂𝒍𝒆𝒔 ($)

𝑻𝒐𝒕𝒂𝒍 𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏

𝑵𝒆𝒕 𝑰𝒏𝒄𝒐𝒎𝒆

10. Change in Net Income (Contribution Margin) = Change in Sales × CM%

Contribution Format Income Statement:

Sales Revenue (10,000 units)

(-) Variable Costs

(=) Total Contribution Margin

(-) Fixed Costs

(=) Net Income

Ehab Abdou ( 00965 97672930 )

Total

100,000

40,000

60,000

20,000

40,000

Per Unit

SP/U

$10

V.C/U

$4

C.M/U

$6

Percentage

100%

V.C %

40%

C.M%

60%

www.hca4u.com

Chapter 3 : Cost-Volume-Profit Analysis

Breakeven Point For Multi Products

1. BEP (U) =

2. BEP ($) =

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔

𝑶𝒗𝒆𝒓𝒂𝒍𝒍 𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏 𝑷𝒆𝒓 𝑼𝒏𝒊𝒕𝒔

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔

𝑶𝒗𝒆𝒓𝒂𝒍𝒍 𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏 𝑹𝒂𝒕𝒊𝒐

3. Units Required To Earn Profit =

4. Sales Required To Earn Profit =

=

=

𝑭.𝑪

𝑶𝒗𝒆𝒓𝒂𝒍𝒍 𝑪.𝑴/𝑼

𝑭.𝑪

𝑶𝒗𝒆𝒓𝒂𝒍𝒍 𝑪.𝑴%

= ## units

= $ ##

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔+𝑷𝒓𝒐𝒇𝒊𝒕

𝑶𝒗𝒆𝒓𝒂𝒍𝒍 𝑼𝒏𝒊𝒕𝒔 𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏

𝑻𝒐𝒕𝒂𝒍 𝑭𝒊𝒙𝒆𝒅 𝑪𝒐𝒔𝒕𝒔+𝑷𝒓𝒐𝒇𝒊𝒕

𝑶𝒗𝒆𝒓𝒂𝒍𝒍 𝑪𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒊𝒐𝒏 𝑴𝒂𝒓𝒈𝒊𝒏 𝑹𝒂𝒕𝒊𝒐

= ## units

= $ ##

5. Change in Net Income (Contribution Margin) = Change in Sales × Overall CM

Overall Units Contribution Margin

Products

A

B

S.P/U

V.C/U

C.M/U

$10

$4

$6

$20

$12

$8

Overall Contribution Margin

Sales Mix

40%

60%

Overall

$2.4

$4.8

$7.2

Overall Contribution Margin Ratio

Products

A

B

S.P/U

$10

$20

V.C/U

C.M/U

C.M %

$4

$6

60%

$12

$8

40%

Overall Contribution Margin Ration

Sales

(-) Variable Costs

(=) Contribution Margin

(-) Fixed Costs

(=) Net Income

Ehab Abdou ( 00965 97672930 )

A

$400,000

160,000

240,000

B

$600,000

360,000

240,000

Sales Mix

40%

60%

Overall

24%

24%

48%

Total

$1,000,000

520,000

480,000

300,000

180,000

www.hca4u.com

Chapter 3 : Cost-Volume-Profit Analysis

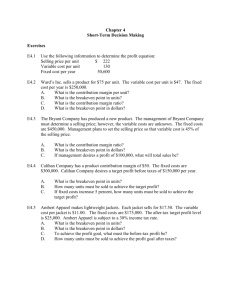

Exercises:

1.

NTQ Corporation produces and sells a single product with a price of $12 per unit and

variable costs of $8 per unit. Total fixed costs per month are $8,000.

a. Calculate NTQ’s contribution margin per unit.

b. How many units must NTQ sell monthly to break even?

c. If fixed costs increase by $500 per month, how many extra units must NTQ sell each

month to continue breaking even?

Solution:

a. Contribution margin per unit

b. Breakeven point in units =

c. Breakeven point in units =

= Selling Price – Variable cost per unit

=

$12

$8

= $4

𝐹𝑖𝑥𝑒𝑑 𝐶𝑜𝑠𝑡

𝐶𝑜𝑛𝑡𝑟𝑖𝑏𝑢𝑡𝑖𝑜𝑛 𝑚𝑎𝑟𝑔𝑖𝑛 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡

𝑁𝑒𝑤 𝐹𝑖𝑥𝑒𝑑 𝐶𝑜𝑠𝑡

𝐶𝑜𝑛𝑡𝑟𝑖𝑏𝑢𝑡𝑖𝑜𝑛 𝑚𝑎𝑟𝑔𝑖𝑛 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡

=

=

$ 8,000

$4

$ 8,500

$4

= 2,000 units

= 2,125 units

Extra Units = 2,125 – 2,000 = 125 units

Another Solution:

Extra Units =

𝐼𝑛𝑐𝑟𝑒𝑎𝑠𝑒 𝑖𝑛 𝐹𝑖𝑥𝑒𝑑 𝐶𝑜𝑠𝑡

𝐶𝑜𝑛𝑡𝑟𝑖𝑏𝑢𝑡𝑖𝑜𝑛 𝑚𝑎𝑟𝑔𝑖𝑛 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡

Ehab Abdou ( 00965 97672930 )

=

$ 500

$4

= $125 units

www.hca4u.com

Chapter 3 : Cost-Volume-Profit Analysis

2.

Julie’s Jewels sells cubic zirconium (fake diamond) rings for $80 each. The projected

income statement for 2006 follows:

Sales

$4,000,000

Variable costs

(2,200,000)

Contribution Margin

1,800,000

Fixed costs

(1,600,000)

Pretax profit

$ 200,000

a. Compute the contribution margin per ring and the number of rings that must be sold to

break even.

b. Compute the contribution margin ratio and the breakeven point in total revenue.

c. Suppose the total revenues were $200,000 greater than expected. What is the total

pretax profit?

d. What is the margin of safety in number of rings?

e. Assume a tax rate of 25%. How many rings must be sold to earn an after-tax profit of

$300,000?

Solution:

.

a. Contribution margin per ring = $1,800,000 ÷ 50,000 units = $36

Breakeven point = $1,600,000/$36 per ring = 44,445 rings

b. Contribution margin ratio = ($1,800,000÷$4,000,000) × 100 = 45%

Revenue at breakeven = $1,600,000÷0.45 = $3,555,556

c. Increase in Pretax profit = $200,000 x 0.45 = $90,000.

Add this to current profit of $200,000 to calculate new profit of $290,000.

d. Margin of safety in number of rings

= Current number of rings sold – breakeven number of rings

= 50,000 – 44,445 = 5,555 rings

e. Pretax profit = $300,000 ÷ (1- 0.25) = $400,000

Units to meet target profit =

=

Ehab Abdou ( 00965 97672930 )

𝐹𝑖𝑥𝑒𝑑 𝐶𝑜𝑠𝑡+𝑃𝑟𝑜𝑓𝑖𝑡

𝐶𝑜𝑛𝑡𝑟𝑖𝑏𝑢𝑡𝑖𝑜𝑛 𝑚𝑎𝑟𝑔𝑖𝑛𝑔 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡

$1,600,000+$400,000

$36

= 55,556 rings

www.hca4u.com

Chapter 3 : Cost-Volume-Profit Analysis

3.

FTH Corporation produces and sells two products: regular scooters and electric scooters.

Last month, the company produced and sold 500 regular and 300 electric scooters. Last

month’s per-unit financial data for both models is presented below:

Regular

Electric

Selling price

$100

$150

Variable cost

30

40

Product line fixed cost

25

45

Corporate fixed cost

10

10

Product line fixed costs can be avoided if the product is dropped, but corporate fixed costs

can only be avoided if FTH goes out of business entirely. Calculate the following amounts:

a. Total fixed product line costs for each product

b. Total corporate fixed costs

c. Overall corporate breakeven point in sales dollars assuming a constant sales mix

d. Breakeven point in sales dollars for regular scooters, ignoring corporate fixed costs

e. Breakeven point in sales dollars for electric scooters, ignoring corporate fixed costs

Solution

a. Fixed Product line Costs = ($25 x 500) + ($45 x 300) = $26,000

b. Fixed Corporate Costs

c. BEP ($) =

= ($10 x 500) + ($10 x 300) = $8,000

𝐹𝑖𝑥𝑒𝑑 𝐶𝑜𝑠𝑡𝑠

𝑂𝑣𝑒𝑟𝑎𝑙𝑙 𝐶𝑜𝑛𝑡𝑟𝑖𝑏𝑢𝑡𝑖𝑜𝑛 𝑚𝑎𝑟𝑔𝑖𝑛𝑔 𝑅𝑎𝑡𝑖𝑜𝑛

Weighted average CMR

Regular

$50,000

Sales Revenue

500×$100

(-) Variable Costs

Electric

$45,000

300×$150

$15,000

500×$30

$12,000

BEP ($) =

$𝟐𝟔,𝟎𝟎𝟎+$𝟖,𝟎𝟎𝟎

𝟕𝟐%

$ 27,000

300×$40

(=) Contribution Margin

Then : Weighted Average CMR =

Total

$ 95,000

$ 68,000

$ 68,000

$ 95,000

× 100 = 72%

= $47,222

d. Product line fixed cost = $25 x 500 = $12,500

CM Ratio = ($100 - $30) / $100 = 70%

$12,500 / 70% = $17,858 breakeven sales for regular scooters

e. Product line fixed cost = $45 x 300 = $13,500

CM Ratio = ($150 - $40) / $150 = 73% (rounded)

$13,500 / 73% = $18,410 breakeven sales for electric scooters

Ehab Abdou ( 00965 97672930 )

www.hca4u.com