Chapter 8

advertisement

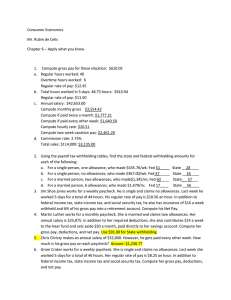

Chapter 8 Income and Taxes 1 Section 8.1 Examining Pay and Benefits Objectives •Distinguish between types of income •Explain regulations affecting pay •Give examples of benefits •Describe employment classifications and their effect on pay and benefits 2 Types of Pay •Salary – is a set amount of money earned by an employee per year or other fixed length of time •Wages – are employee earnings that are paid by the hour, day, or item •Piecework – work for which wages are based on the number of items or pieces produced •Commission – is a fixed percentage or amount of profit given to an employee in exchange in addition to regular pay •Bonus – is a sum of money paid to an employee in addition to regular pay •Tip – is money given to an employee by customers in exchange for a service 3 Regulation Affecting Pay Fair Labor Standard Act (FLSA) – federal government developed standards governing employee payment and compensation 4 Equal Pay – forbids employers from paying one person less than another person for the same work •Discrimination against women, minorities, and older workers Minimum Wage – this is the lowest hourly rate an employer may legally pay most workers •This is raised periodically to help workers keep up with inflation 5 Subminimum Wage – is set lower than the standard minimum wage •Full-time students, employees who are younger than 20, and employees who are developmentally disabled Overtime – employees that work in excess of 40 hours per week •Most cases must be at least 1.5 time the employee’s regular rate of pay •Salaried employees are not paid overtime 6 Types of Benefits •Insurance •Savings & Retirement •Other •Holidays •Vacation •Sick leave •Job training •Maternity leave 7 Employment Classifications Full-time – hold wages or salary jobs of at least 35 hours per week Part-time – work fewer than 35 hours per week Temporary – short-term assignments at various companies Contract – are hired for a specified period of time to complete a particular project for an employer 8 By Using Temporary or Contract Employees, Employers Gain Several Advantages: •Can easily increase or decrease staffing as their needs change •Cost may be less if benefits are not paid •Avoid costly hiring and training procedures 9 Chapter 8.2 Understanding Your Paycheck Objectives •Explain variations in how workers receive pay •Describe the information found on a pay stub •Identify paycheck deductions and their purposes 10 How Employees Are Paid •Weekly •Every two weeks •Monthly •Twice a month Direct Deposit – pay is electronically transferred directly into the recipient’s bank account by completing and signing a form 11 Earnings •Number of hours (regular and overtime) – very important to someone who gets hourly pay •Gross Pay – is the total amount of money earned for working during a pay period. Salary – usually does not change Hourly – Multiply the number of hours worked by the hourly rate 12 Deductions – is anything that is subtracted from gross pay Types •Tax Withholding Federal, State, and Local Income Taxes. Social Security, Medicare deductions (FICA – Federal Insurance Contribution Act) •Benefits Medical, Dental, & Vision •Other Deductions Savings & Retirement Plan 13 Totals and Net Pay •Net Pay – is the amount of pay an employee is left with after taxes and other deductions are subtracted from the gross pay. (Take-homepay) •Multiply the figures for gross and net pay by the number of pay periods during the year 14 Chapter 8.3 Paying Income Taxes Objectives •Identify responsibilities related to income taxes •Describe the purpose of various income tax forms •Explain the types of information included on a tax return •Discuss the benefits of tax planning 15 Income Tax Responsibilities – 2 main tasks •Complete a form that allows your employer to withhold income taxes from your pay •File a tax return at least once a year, and pay any additional tax owed 16 Income Tax Withholding •Form W-4 – Employee’s Withholding Allowance Certificate Personal Information Name, address, social security number, & single or married Exempt Status •Allowances – are factors that affect the amount of income tax withholding The more allowances you claim, the less tax your employer will take out 17 Getting Ready for Tax Time •April 15th – “Income Tax Day” – deadline by which most people need to file a tax return •If you withhold more than you need to pay, then you will receive a “Refund” •If you have less withheld, then you will need to pay the difference 18 Internal Revenue Service (IRS) – government agency in charge of collecting federal income tax Do You Need to File? •People Who Need Not to File a Tax Return •Some incomes that falls below a certain amount •Self-employed, over the age of 65, single adult, a child, or a married person with children 19 What Materials Do You need? Form W-2 – Employer will send to you total earnings for the year by January 31st (You check for errors) Form 1099 – Interest earned on savings during the year, sent by the bank IRS Instruction booklets and forms – Form 1040, 1040A, or 1040EZ (Teens or people who make small amounts of incomes) Personal Records 20 Completing Your Tax Return •Filing Status – Married or Single •Exemptions – Number of people in the household Dependent – is someone who is supported by a taxpayer’s income. 21 •Income – all sources •Deductions Tax deductions – reduces the amount of income that is taxed Itemized deduction – amounts actually spent on tax-deductible expenses during the year Standard deduction – a set amount that the IRS allows without listing any actual expenses 22 •Taxable Income – The portion of your income that is actually subject to income tax •Tax owed •Tax Credit – is subtracted directly from the amount of tax owed •Final Calculations 23 Electronic Filing – on the IRS website. The Benefits of Tax Planning •Investing money •Charities 24