Beginning a New Job - Missouri Valley Schools

advertisement

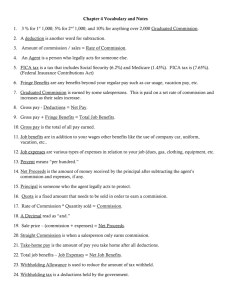

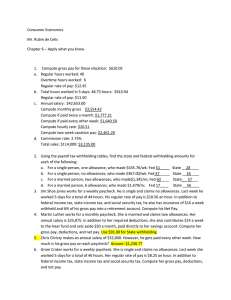

Beginning a New Job Business Issues Mrs. Kohl PART 1 FIRST DAY ON THE JOB A. Having a good first day A. Orientation – introduction to the company 1. Complete required and necessary paperwork; bring a. Driver’s license b. Social security card 2. Introduction to coworkers 3. Tour 4. 5. Company policies – specific rules, expectations, pay/salary, vacation/sick days, evaluations; dress code May be assigned a mentor which is a coworker(s) who help new employees on the job; informal teachers B. Exposure to company culture 1. 2. What is company culture? Behavior, attitudes, habits, and values of the company Examples a. Strict – business suits, always working b. Laid back – open environment, casual dress, easy going C. Dressing for the job 1. 2. 3. 4. 5. Want to match the company’s image See what other employees dress is Ask if you aren’t sure what to wear Check out dress code policies What is casual? Varies from company to company – ask if you aren’t sure PART 2 WHAT TO EXPECT FROM YOUR EMPLOYER A. Pay 1. Hourly wages – paid a wage for each hour worked a. Known as nonexempt employees – are covered by a law who must be paid overtime b. Overtime – paid for hours over the standard 40 hour week; usually time and a half c. Examples: secretaries, waitresses, bank tellers 2. Salaried wages – paid a set amount no matter how many hours are worked a. Known as exempt employees – not covered by the law to be paid overtime b. Examples: management positions, teachers, doctors, judges 3. 4. Commission – paid by how much one sells or makes a. Examples: car salesman, real estate, telemarketers Incentive plans – reward workers for achievement a. Profit sharing – workers receive a share of company’s profits b. Bonuses – reward for high levels of performance B. Fringe benefits 1. What are fringe benefits? Extras for employees in addition to the paycheck; these vary from company to company 2. Examples a. Health plans – health insurance (most costly to employers), dental plans, vision plans, life insurance, disability insurance b. Retirement plans – saving money for retirement (401K, pension plans, stocks, c. d. Convenience benefits – services that make employee lives easier (flexible work hours, onsite oil changes, gym memberships, on site fitness area, daycare, counseling, season tickets to athletic events) Cafeteria plan – able to pick and choose what benefits the company has to offer that best suit the employee C. Honesty and fair treatment 1. 2. 3. Honesty: promised pay, benefits, hours, vacation days Fair treatment from employer, supervisors, coworkers Workplace laws cover certain situations D. Evaluations 1. 2. Performance reviews – scheduled formal evaluations used to determine raises, promotions, etc a. Terms: 30 days, 60 days, 90 days, 1 year Probation – when first hired, you are put “on trial” to see how you do; used to determine whether you are suited for the job E. Standard separation procedures 1. 2. Termination – nicer way of saying “fired”, usually because of poor performance, broken rules, etc. by the employee Laid off – when a company can no longer keep employees because business is slow, business is closing, etc. PART 3 PAYCHECK DETAILS A. Gross pay vs net pay Gross pay – pay before deductions Net pay – pay after deductions B. Required deductions 1. Federal income tax (FIT) – income tax for the federal government a. b. c. Marital status Number of allowances Amount of income (gross pay) 2. State income tax (SIT) – income tax for the state government a. b. c. 3. Marital status Number of allowances Amount of income (gross pay) FICA taxes Social security 6.2% of gross pay Medicare 1.45% of gross pay C. Other deductions (optional) Lunches Child support Savings/investments Uniforms Insurance Miscellaneous expenses