Benefits of Tracking spending habits (pg

advertisement

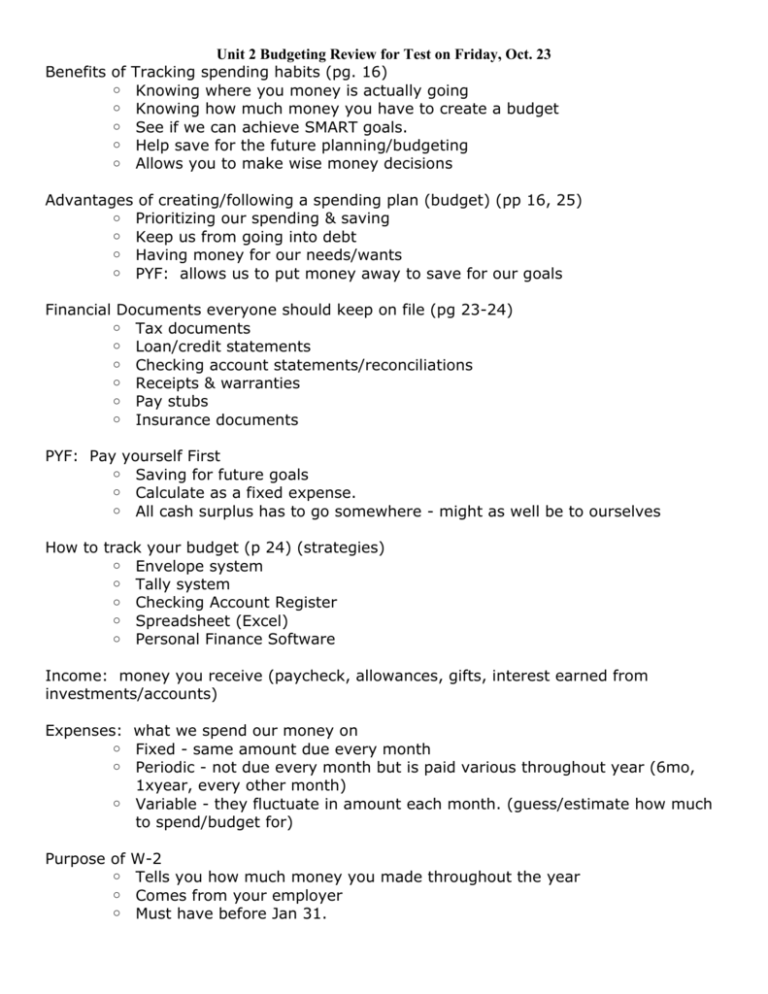

Benefits of o o o o o Unit 2 Budgeting Review for Test on Friday, Oct. 23 Tracking spending habits (pg. 16) Knowing where you money is actually going Knowing how much money you have to create a budget See if we can achieve SMART goals. Help save for the future planning/budgeting Allows you to make wise money decisions Advantages of creating/following a spending plan (budget) (pp 16, 25) o Prioritizing our spending & saving o Keep us from going into debt o Having money for our needs/wants o PYF: allows us to put money away to save for our goals Financial Documents everyone should keep on file (pg 23-24) o Tax documents o Loan/credit statements o Checking account statements/reconciliations o Receipts & warranties o Pay stubs o Insurance documents PYF: Pay yourself First o Saving for future goals o Calculate as a fixed expense. o All cash surplus has to go somewhere - might as well be to ourselves How to track your budget (p 24) (strategies) o Envelope system o Tally system o Checking Account Register o Spreadsheet (Excel) o Personal Finance Software Income: money you receive (paycheck, allowances, gifts, interest earned from investments/accounts) Expenses: what we spend our money on o Fixed - same amount due every month o Periodic - not due every month but is paid various throughout year (6mo, 1xyear, every other month) o Variable - they fluctuate in amount each month. (guess/estimate how much to spend/budget for) Purpose of W-2 o Tells you how much money you made throughout the year o Comes from your employer o Must have before Jan 31. Unit 2 Budgeting Review for Test on Friday, Oct. 23 **Complete a paystub (fill out) Calculate Gross Pay, Net Pay, deductions (pg. 18) o Hours * rate = GP o Deductions include: fed'l tax, state tax, FICA (SS, Medicare), if own business - self-employment tax, child support, advance (loan repayment), fees, retirement fund, insurance SS = .062*GP Med. = .0145*GP o GP - Deductions = NP Net Pay = what is used for? Spending money for BUDGET Purpose of W-4 o Determines how much comes out of your paycheck o Based upon the number of deductions. (usually 0 or 1) Purpose of PayStubs o Provides information on how much you've earned for the year - and pay period o Shows all your deductions - as well as for year-to-date o Employer's information o Current rate o # hours worked o Net pay **calculate for goals Fixed Expense Gross Income (same as gross pay) PYF Payroll Deductions Net Income Spending & Saving Plan = budget o Tracks our cash flow - monitor our money Variable Expenses Organization of personal budget ***you have been keeping track of all the money you spend and all the money you earn. **** You are going to have to create your own personal budget based upon your information Budget relation to Goals (at beginning) Revisions = Will be given a sample budget = you'll have to put together. Will also have to REVISE the budget according to situations. (**STUDY - all the practice budgets we've done in class)