Ex. 5 Journalizing HST – General Journal

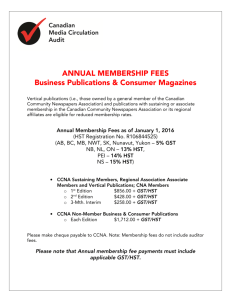

advertisement

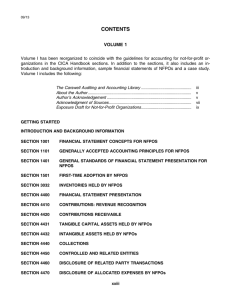

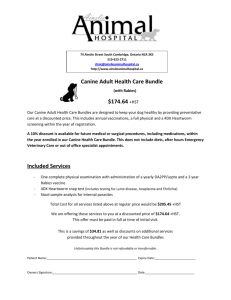

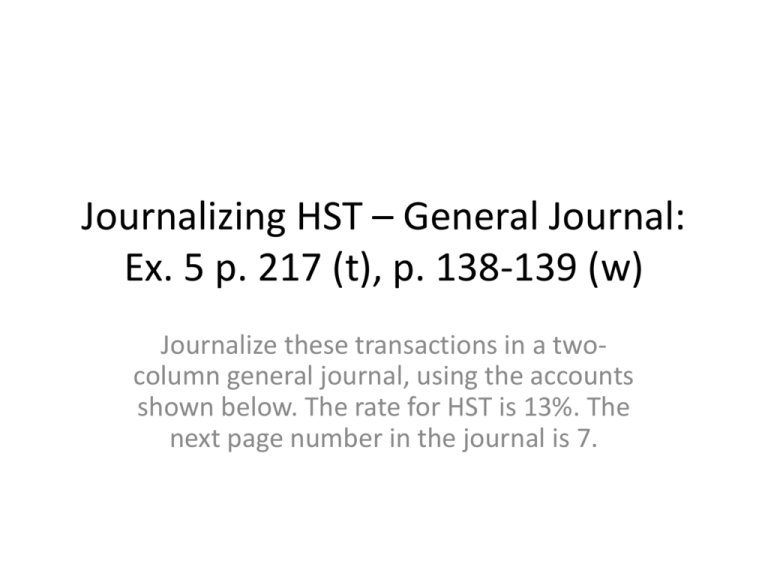

Journalizing HST – General Journal: Ex. 5 p. 217 (t), p. 138-139 (w) Journalize these transactions in a twocolumn general journal, using the accounts shown below. The rate for HST is 13%. The next page number in the journal is 7. Transactions 4 Sales Invoice No. 571, to R. Chevrier for photo services, $275.00 plus HST of $35.75, total $310.75 What accounts are affected? • A/R- R. Chevrier will be debit (asset increase) • Fees Earned will be credit (Revenue increase) • HST Payable will be credit (collected from customer) Page 7 2012 Date Account Title & Explanation Nov 4 A/R- R. Chevrier Fees Earned P R Debit 3 1 0 75 Credit 2 7 5- HST Payable To record sale on account 3 5 75 Debit accounts Listed First 6 Purchase Invoice No. 7943, from Black’s Photo for photo supplies, $265.00 plus HST of 34.45, total $299.45 What accounts will be affected? • Photo Supplies will be debited (assets increase) • HST Recoverable will be debited (paid HST on asset) • A/P- Black’s Photo will be credited (purchased on account) Page 7 2012 Date Account Title & Explanation Nov 4 A/R- R. Chevrier Fees Earned P R Debit 3 1 0 75 2 7 5- HST Payable To record sale on account 6 Photo Supplies HST Recoverable A/P- Black's Photo To record purchase of supplies on account Credit 3 5 75 2653 4 45 2 9 9 45 9 Purchase Invoice No. 2332, from Jack’s Auto for regular maintenance of the company car, $175.00 plus HST of $22.75, total 197.75 What accounts will be affected? • Car Expense will be debited (expense increases) • HST recoverable will be debited (recover tax for business) • A/P- Jack’s Auto will be credited (paid on account) Page 7 2012 Date Account Title & Explanation Nov 4 A/R- R. Chevrier Fees Earned P R Debit 3 1 0 75 Credit 2 7 5- HST Payable To record sale on account 3 5 75 6 Photo Supplies HST Recoverable A/P- Black's Photo To record purchase of supplies on account 2653 4 45 9 Car Expense HST Recoverable A/P- Jack's Auto To record car expense on account 1752 2 75 2 9 9 45 1 9 7 75 10 Cheque Copy No. 652, issued to the owner for his own use, $925.00 What accounts will be affected? • W. Seibert, drawings will be debited (owner’s equity decreases) • Bank will be credited (assets decreases) Page 7 2012 Date Account Title & Explanation 10 W. Siebert, Drawings Bank To record owner withdrawal P R Debit 9 2 5- Credit 9 2 5- 12 Cash Sales Slip No. 214, for photo work performed, $145.00, plus HST of $18.85, total $163.85 What accounts will be affected? • Bank will be debit (asset increases) • Fees earned will be credited (Revenue increases) • HST Payable will be credited (Collected from customer) Page 7 2012 Date Account Title & Explanation 10 W. Siebert, Drawings Bank P R Debit 9 2 5- Credit 9 2 5- To record owner withdrawal 12 Bank Fees Earned HST Payable To record sale for cash 1 6 3 85 1 4 51 8 85 15 Bank Debit Memo From Commercial Bank for bank service charges, $35.50, which are HST exempt What accounts will be affected? • Bank Charges Expense (expense increases) • Bank will be credited (asset decreases) Page 7 2012 Date Account Title & Explanation 10 W. Siebert, Drawings Bank P R Debit 9 2 5- Credit 9 2 5- To record owner withdrawal 12 Bank Fees Earned HST Payable To record sale for cash 15 Bank Charges Expense Bank To record bank service charges 1 6 3 85 1 4 51 8 85 3 5 50 3 5 50 22 Cash Receipt Remittance Slip No. 312, showing the receipt of $412.00 from H Walker on account. What accounts will be affected? • Bank will be debited (asset increases) • A/R- H. Walker will be credit (asset decreases) Page 8 2012 Date Account Title & Explanation Nov 22 Bank A/R- H. Walker P R To record payment received from H. Walker Debit 4 1 2- Credit 4 1 2- 23 Memorandum From the owner stating that he had taken $75.00 of photo supplies for his personal work at home What accounts will be affected? • W. Siebert, Drawings will be debited (Drawings increases) • Photo Supplies will be credited (assets decrease) Page 8 2012 Date Account Title & Explanation Nov 22 Bank A/R- H. Walker P R Debit 4 1 2- Credit 4 1 2- To record payment received from H. Walker 23 W. Siebert, Drawings Photo supplies To record photo supplies taken by owner 757 5- 25 Cheque Copy No. 653, paying for the supplies purchased above on November 6. What accounts will be affected? • A/P- Black’s Photo will be debited (liabilities decreases) • Bank will be credited (assets decrease) Page 8 2012 Date Account Title & Explanation Nov 22 Bank A/R- H. Walker P R Debit 4 1 2- Credit 4 1 2- To record payment received from H. Walker 23 W. Siebert, Drawings Photo supplies To record photo supplies taken by owner 75- 25 A/P- Black's Photo Bank To record payment to A/P- Black's Photo 2 9 9 45 7 5- 2 9 9 45 28 Purchase Invoice No. 55521, received from Oakley Motors for body repairs on the business automobile, $750.00 plus HST of $97.50, total $847.50 What accounts will be affected? • Car expense will be debited (expenses increase) • HST Recoverable will be debited (pay HST) • A/P- Oakley Motors will be credited (liabilities increase) Page 8 2012 Date Account Title & Explanation Nov 22 Bank A/R- H. Walker P R Debit 4 1 2- Credit 4 1 2- To record payment received from H. Walker 23 W. Siebert, Drawings Photo supplies To record photo supplies taken by owner 75- 25 A/P- Black's Photo Bank To record payment to A/P- Black's Photo 2 9 9 45 28 Car Expense HST Recoverable A/P- Oakley Motors 7509 7 50 7 5- 2 9 9 45 8 4 7 50 Remittance • Now we must prepare to remit November’s HST to Canada Revenue Agency (CRA) • Calculate Wayne Siebert’s total HST Payable & HST Recoverable HST Payable DR CR 35.75 (1) 18.85 (5) 54.60 HST Recoverable DR (2 ) 34.45 (3 ) 22.75 ( 10) 97.50 154.70 CR Clearing an account balance • This means to bring the account to zero. HST Payable DR 54.60 CR 35.75 ( 18.85 ( 54.60 0 Bank HST Recoverable DR ( ) 34.45 ( ) 22.75 ( ) 97.50 CR 154.70 154.70 0 DR 154.70 100.10 CR 54.60 A typical HST remittance journal entry Date Account Title & Explanation Dec 31 HST Payable Bank HST Recoverable To record HST refund P R Debit 5 4 60 1 0 0 10 Credit 1 5 4 70 Wayne Siebert Photography Balance Sheet December 31, 2012 (pay the next month) Liabilities (SECTION ONLY) Bank Loan Accounts Payable HST Payable $54.60 Less: HST Recoverable 154.70 Refund Total Liabilities XXXXX XXXXX 100.10 XXXXX If HST Payable is greater than HST Recoverable Wayne Siebert Photography Balance Sheet December 31, 2012 (pay the next month) Liabilities (SECTION ONLY) Bank Loan Accounts Payable HST Payable $154.60 Less: HST Recoverable 54.50 Remittance Total Liabilities XXXXX XXXXX 100.10 XXXXX Start Exercise #6A p. 218-219 (t), p. 140-141 (w) • Complete Ex. 6A p. 218-219 (t), p. 140-141 (w) • Switch with a classmate when done & correct – Use a pen for errors – Put both names on it (identify who did what) – Give a mark out of 10 & hand in • Read 7.1 – Posting p. 228-232 (t) & define the following terms: Posting, Crossreferencing & Forwarding